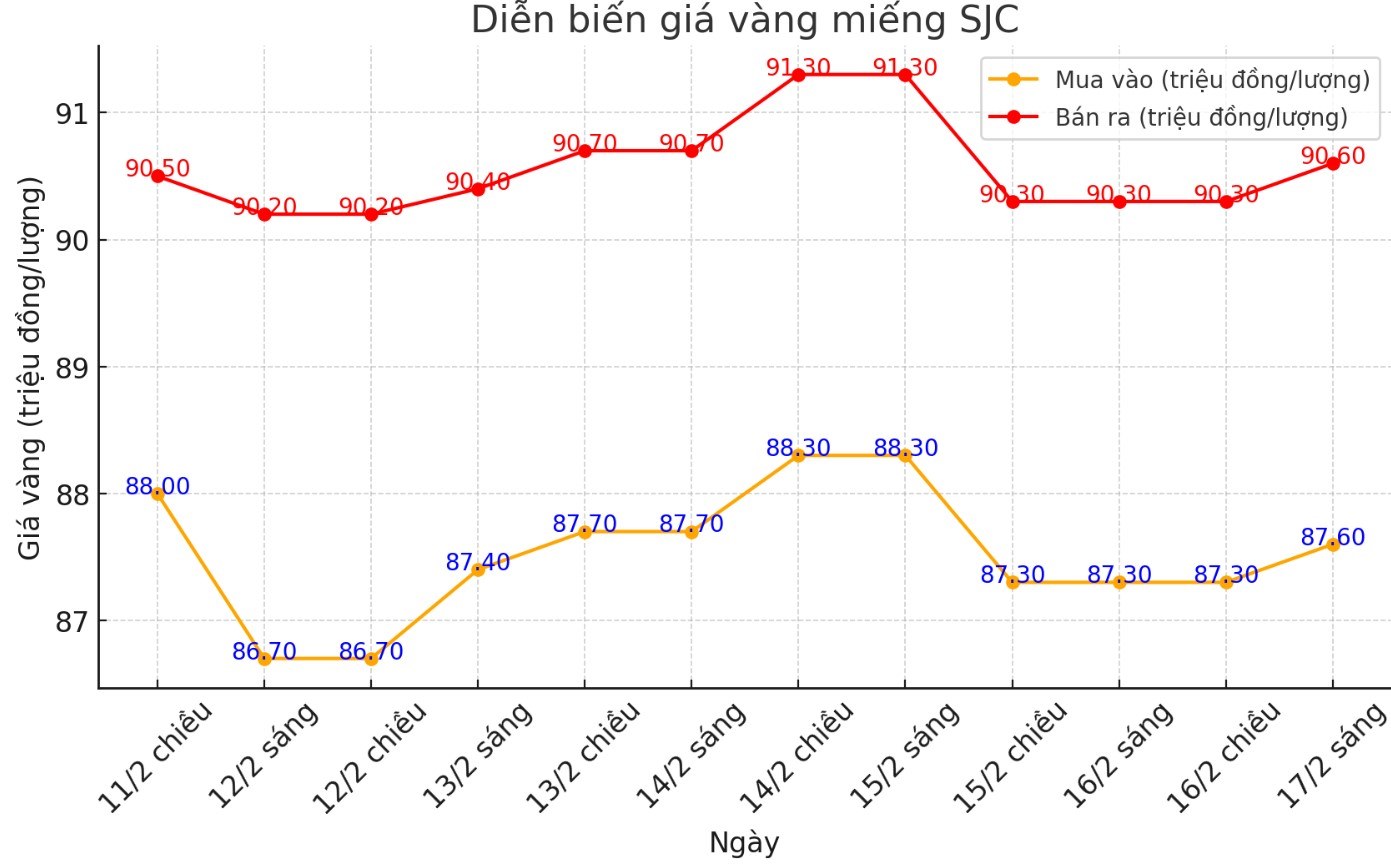

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 87.6-90.6 million VND/tael (buy in - sell out); increased by 300,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 3 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 87.6-90.6 million VND/tael (buy - sell); increased by 300,000 VND/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at DOJI Group is at 3 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 87.6-90.6 million VND/tael (buy - sell); increased by 300,000 VND/tael for both buying and selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 3 million VND/tael.

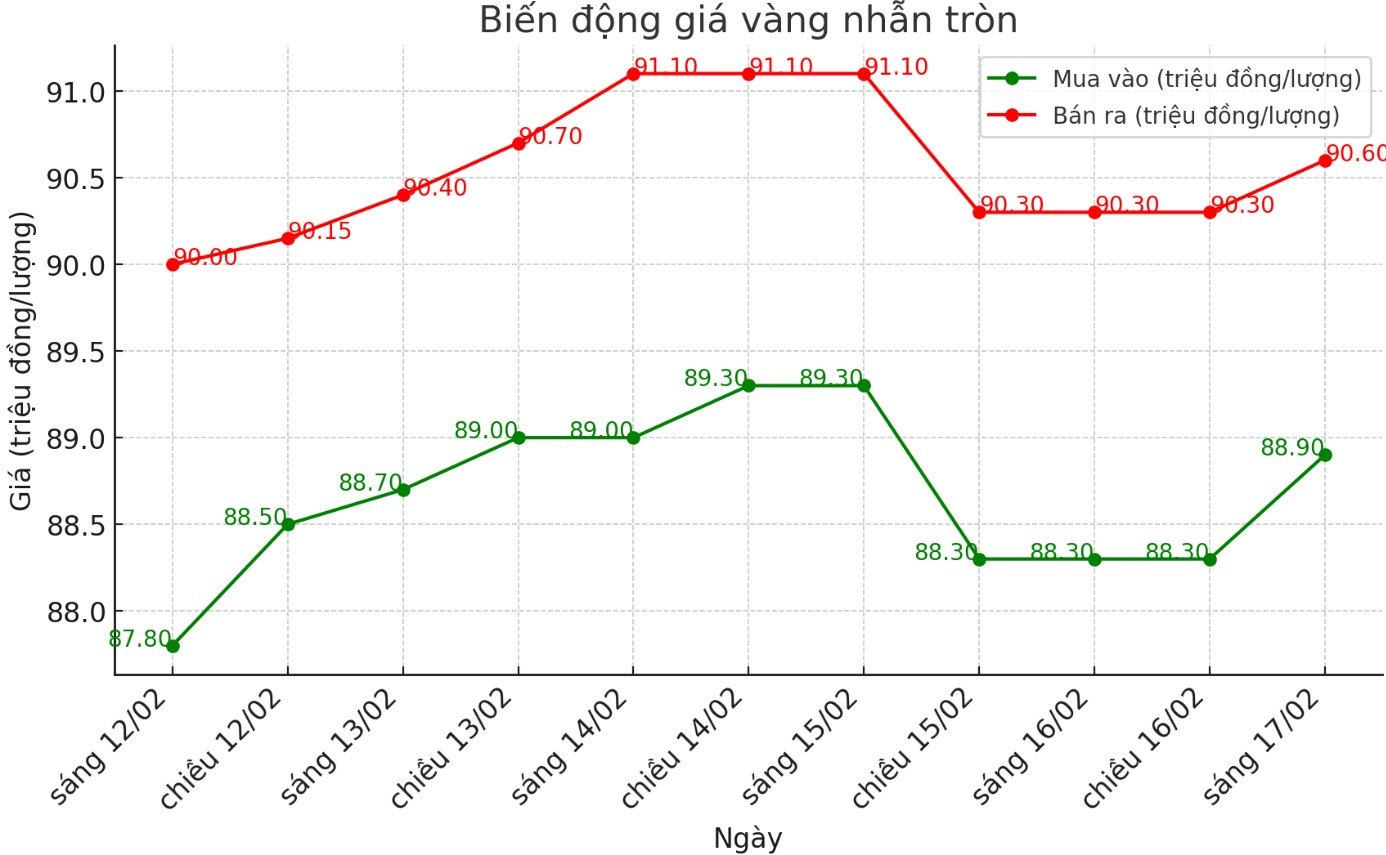

9999 round gold ring price

As of 9:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 88.9-90.6 million VND/tael (buy - sell); an increase of 600,000 VND/tael for buying and an increase of 300,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 88.95-90.60 million VND/tael (buy - sell), an increase of 600,000 VND/tael for buying and an increase of 300,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 1.65 million VND/tael.

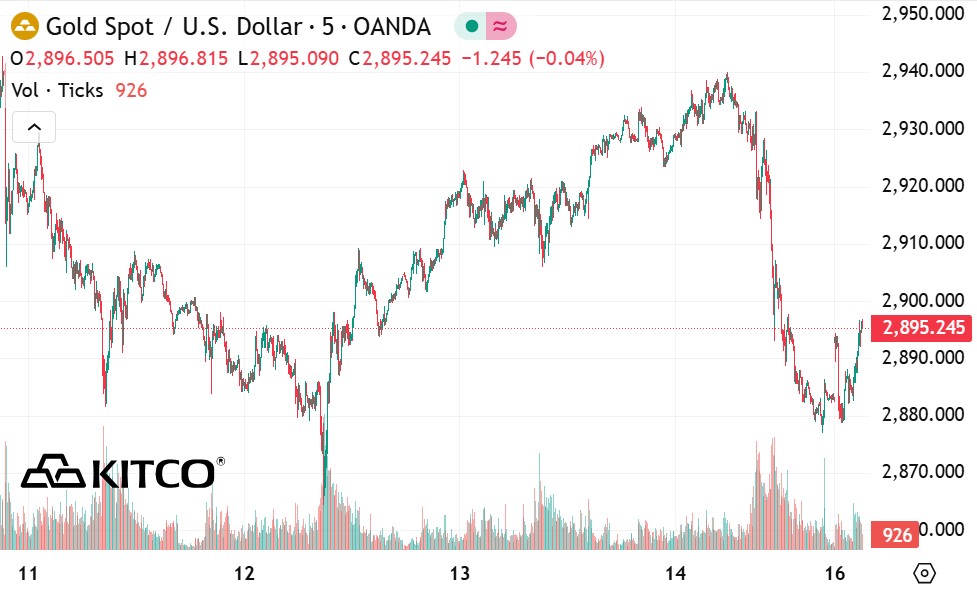

World gold price

As of 8:55 a.m., the world gold price listed on Kitco was at 2,895.2 USD/ounce, up 12.8 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices recovered in the context of the USD decreasing. Recorded at 9:00 a.m. on February 17, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.530 points (down 0.05%).

"Gold prices will increase" - Darin Newsom, senior market analyst at Barchart.com commented.

Why not? Because all factors are in favor of gold. The market is being deliberately manipulated, while geopolitical tensions continue to escalate. In this context, what other choice do long-term investors have besides gold?" - Darin Newsom said.

Carsten Fritsch, commodity analyst at Commerzbank, remains bullish on gold next week but recommends caution: It seems that the recent record high is not the last peak. The price approaching the $3,000/ounce mark will support the increase, but at the same time increase the risk of correction" - he commented.

Bob Haberkorn - senior commodity broker at RJO Futures, said that although the US retail sales report released last Friday morning caused gold prices to fall, in fact gold has weakened before due to geopolitical factors.

Even before the release of US retail sales data, information about the likelihood of a peace deal in Ukraine had weakened gold since last night. After that, as retail sales fell sharply, the market became more confident that the Fed would not cut interest rates in March, leading to a slight adjustment.

However, it is worth noting that from what I hear and observe in the market, investors are still waiting patiently to buy. There was almost no selling pressure. I don't even see where traders sell them," he said.

Notable economic data this week

Tuesday: Empire State Production Index (economic index measuring the business conditions of the manufacturing sector in New York state, USA. This index is published monthly by the US Federal Reserve (FED) New York branch, based on a survey of manufacturers in the region).

Wednesday: US housing data (New builds and Construction Permits), FED meeting minutes.

Thursday: USWeeks Unemployment Insurance Application, FED Philadelphia Production Survey.

Friday: S&P Flash PMI, Current home sales in the US

See more news related to gold prices HERE...