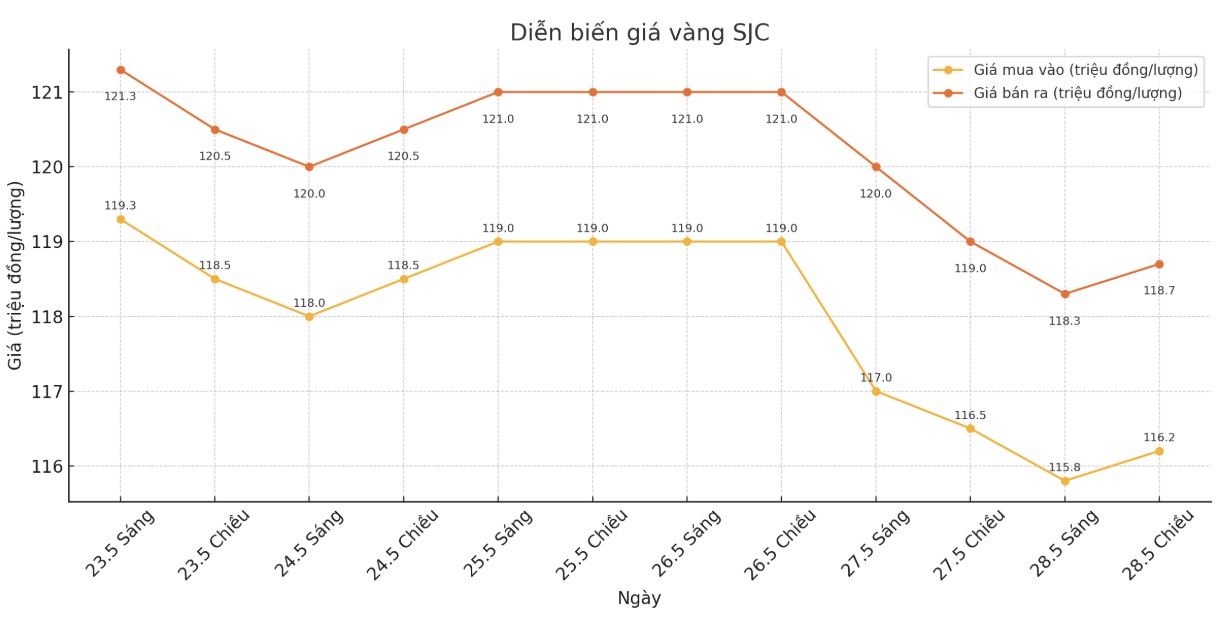

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116.2 - 118.7 million/tael (buy - sell), an increase of VND400,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116.2 - 118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.2 - 118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 115.7 - 118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

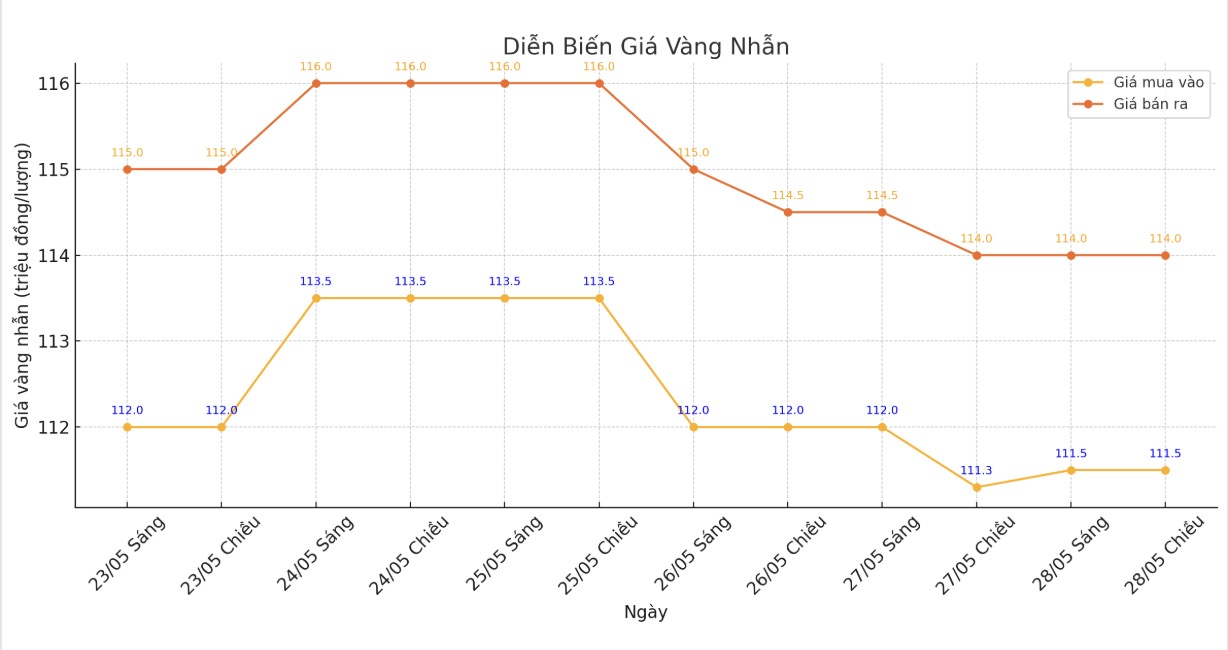

9999 round gold ring price

As of 6:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5 - 114 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.8 - 116.8 million VND/tael (buy - sell), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5 - 114.5 million VND/tael (buy - sell), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

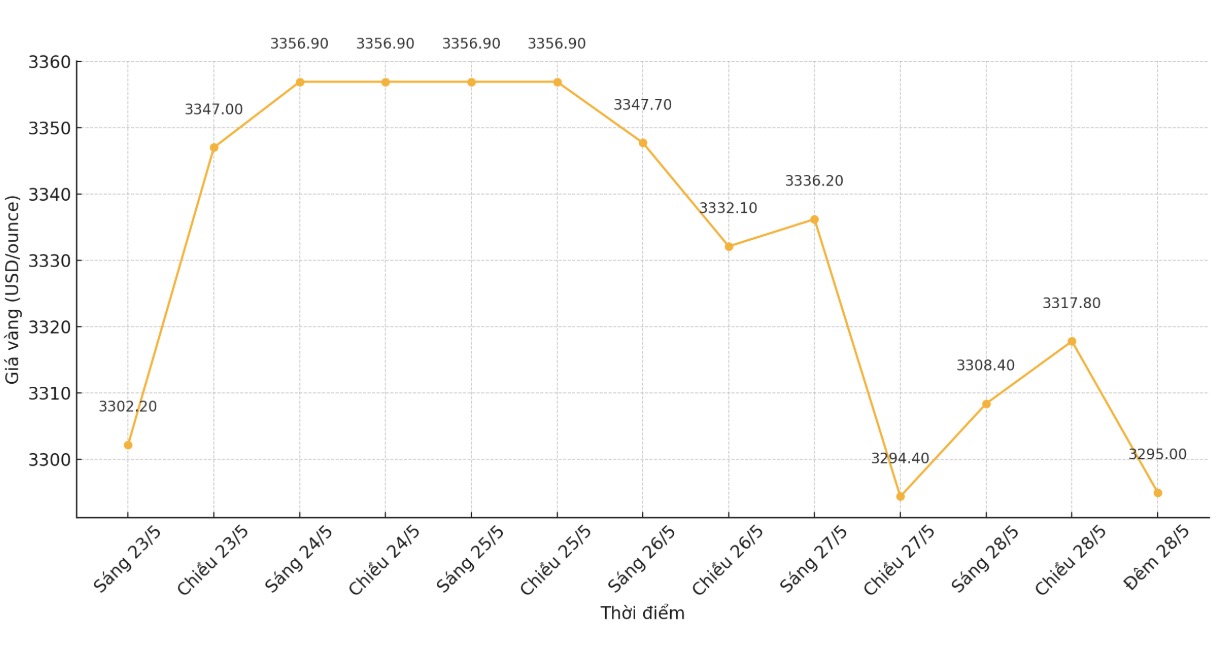

World gold price

At 11:00 p.m. on May 28, the world gold price listed on Kitco was around 3,295 USD/ounce, down 3.6 USD.

Gold price forecast

Technically, June gold bulls have a short-term advantage. The next upside price target is to close above $3,400/ounce. The next short-term downside target for the bulls is to push gold prices below $3,123.30/ounce.

The first resistance level was seen at $3,324.5 an ounce and then $3,350 an ounce. The first support level was seen at an overnight low of $3,289.9/ounce and then $3,275/ounce.

The US stock index fell slightly after recording a strong increase on Tuesday. The risk-taking willingness of traders and investors has improved recently, as the US has changed its tone to be more harmonious in trade relations with other major economies. This has limited the price increase of safe-haven metals.

Although gold prices are fluctuating around $3,300/ounce, experts predict that this precious metal could still reach a record peak in the near future. Citigroup (Citi) has raised its gold price forecast for the next three months to $3,100 to $3,500/ounce, after US President Donald Trump warned of imposing a 50% tax on imports from Europe, but later withdrew this statement.

Although concerns about an escalating trade war have eased, Citi has maintained a positive view on gold in the short term, but is more cautious about the long term. Citi experts say gold could struggle in late 2025 and 2026 as the economy recovers and the Federal Reserve begins to cut interest rates. They also believe that the US midterm election could reduce the appeal of gold as a safe-haven asset.

Citi also warned that the gold market may be approaching saturatation, although demand remains strong. According to Citi, about 0.5% of global GDP is spent on gold - the highest level in the past 50 years. Citi's forecast is lower than other financial institutions, such as Bank of America, Goldman Sachs and Natixis, which predict gold prices could reach $4,000/ounce this year or early 2026.

Overseas markets today saw the USD strengthen. Nymex crude oil prices increased and are trading around $61.75/barrel. The yield on the 10-year US Treasury note is currently at 4.489%.

Notable economic data this week

Thursday:Weekly jobless claims, preliminary Q1/2025 GDP, US pending home sales.

Friday: US PCE core inflation index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...