According to Kitco, China imported the highest amount of gold last month in nearly a year, despite gold prices reaching a record of 3,500 USD/ounce.

Total imported gold volumes reached 127.5 tons, the highest level in 11 months, up 73% compared to March, although gold prices were at a very high level at that time.

The import increase is partly due to the People's Bank of China (PBoC) granting additional import quotas to a number of commercial banks in April, in order to meet strong demand from institutional and individual investors in the context of peak US - China trade tensions.

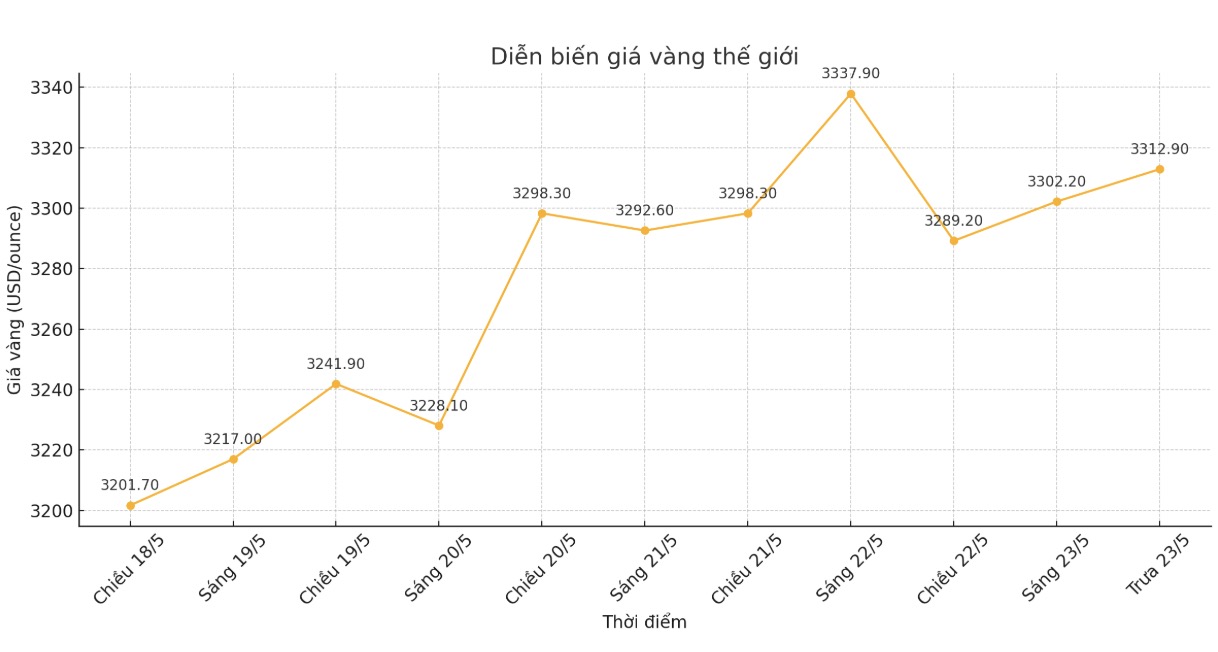

The buying momentum shows no signs of slowing down. The Chinese gold market continued to support gold prices this month. After a few weeks of unusual weakness, it was Chinese investors who stood up to hoard gold when prices fell, pulling gold back to above 3,300 USD/ounce.

Stephen Innes - Head of Trading and Market Strategy at SPI Asset Management - said: "oldman's cash flow monitoring shows that the Shanghai night-time trading session has become bustling again, triggering a simultaneous purchase on COMEX".

Mr. Innes also emphasized that the number of open positions on the Shanghai exchange has reached a historical peak, with gold and silver prices both increasing sharply, respectively +3% and +4%. This shows a clear and strong consensus in the market.

He also commented on the steadfastness of domestic Chinese traders: Although gold prices have fallen 8% compared to the recent peak, they are still not selling off. This is not a trend but a solid trust. As the physical price difference between the Shanghai Gold Exchange (SGE) and the LBMA surges, global demand is activated again."

Mr. Innes also noted the highest import price in a year, proving that "physical price differences on the Shanghai Gold Exchange are not only maintained but also overcome resistance".

Charles-Henry Monchau - Investment Director at Syz Group commented: "As the world changes power, China is conducting a long-term financial strategy to reshape the international monetary order. The focus is on moving away from the US dollar, the currency that has dominated global trade, reserves and finance for nearly a century. Instead, China is betting on a combination of gold and the yuan."

Monchau assessed China's gold strategy as practically sound. Holding trillions of dollars in US dollar assets makes China vulnerable to financial pressure, sanctions and market fluctuations from the US. By hoarding large amounts of gold and internationalising the yuan through initiatives such as the Shanghai Gold Exchange, Beijing is building a parallel financial system, helping to increase autonomy and reduce the risk of dependence on the US dollar-based system."

He said many experts believe that the actual amount of gold held by China is greater than the published data. There is news that the PBoC is buying gold five times more than it reported to the IMF, with real reserves could exceed 5,000 tons. This lack of transparency is intentional - China is quietly converting its reserves from USD to gold, avoiding market panics while gradually increasing financial strength".

The effectiveness of this strategy is sophistication. Unlike selling US government bonds that can cause panic and counterproduction, buying gold is a quiet and accumulation way. This creates pressure for the USD to decline over time, especially if other countries follow. Converting a part of the surplus of US dollar to gold helps China reduce global demand for the dollar while building a currency buffer based on real value," he said.

He concluded: Through calculated gold accumulation and raising the level of the yuan in global trade, Beijing builds leverage, not destroys it. The goal is not to flip the dollar overnight but to reduce risks, fight financial enforcement and create an alternative to the world.

The world may not be ready to give up the USD, but is getting ready to consider other options. As inflation, sanctions and public debt change the face of global finance, China's gold-yuan strategy not only makes the country a competitor to the US economic power, but also the architect of a new monetary era, a system that is less dependent on trust and more based on real value".