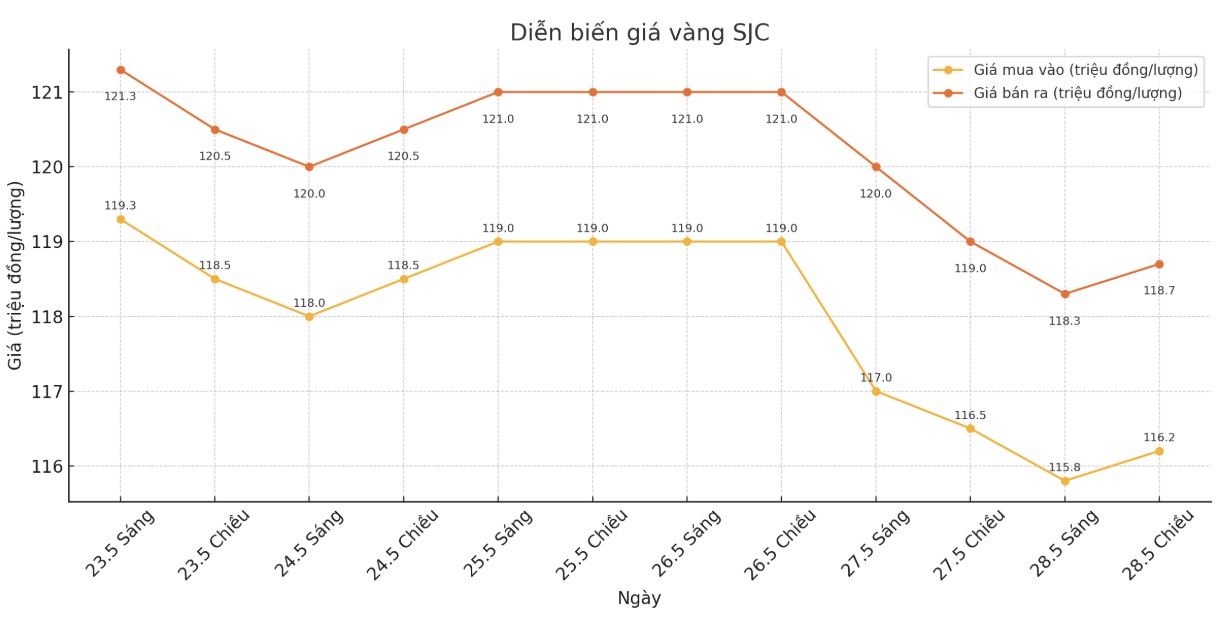

Updated SJC gold price

As of 5:30 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND116.2-118.7 million/tael (buy in - sell out), an increase of VND400,000/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 116.2-118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 116.2-118.7 million VND/tael (buy - sell), an increase of 400,000 VND/tael for both buying and selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 115.7/18.7 million/tael (buy in - sell out), an increase of VND 400,000/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

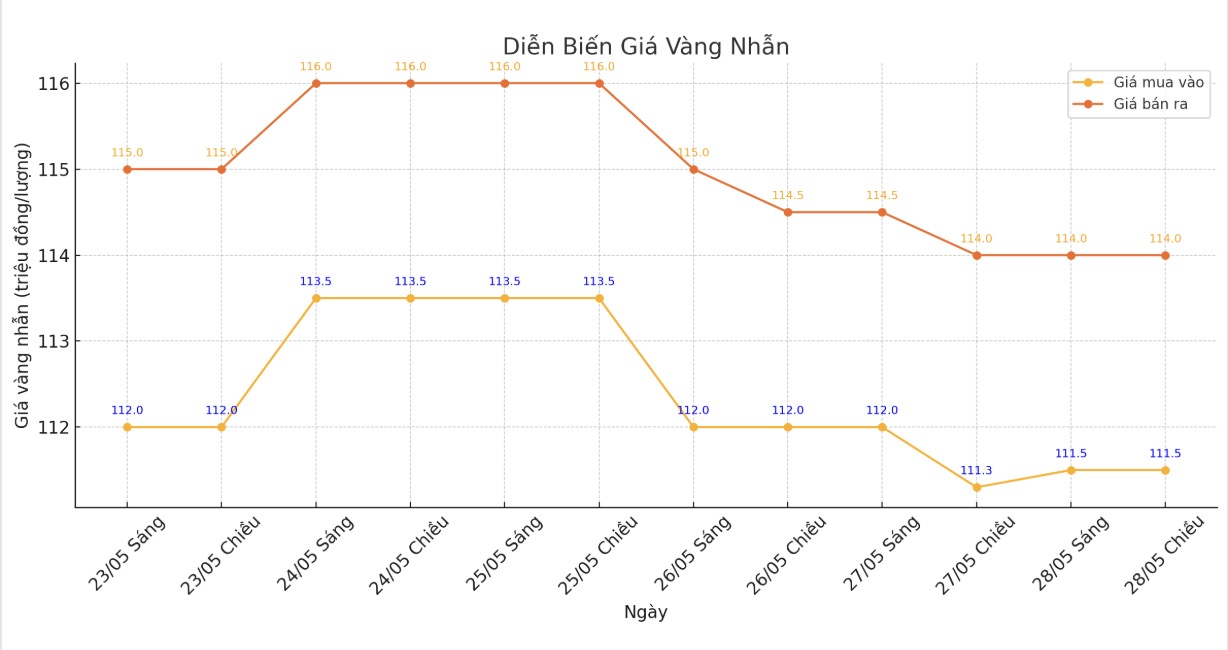

9999 round gold ring price

As of 5:15 p.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 111.5-114 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and kept the same for selling. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 113.8-116.8 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 111.5-114.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

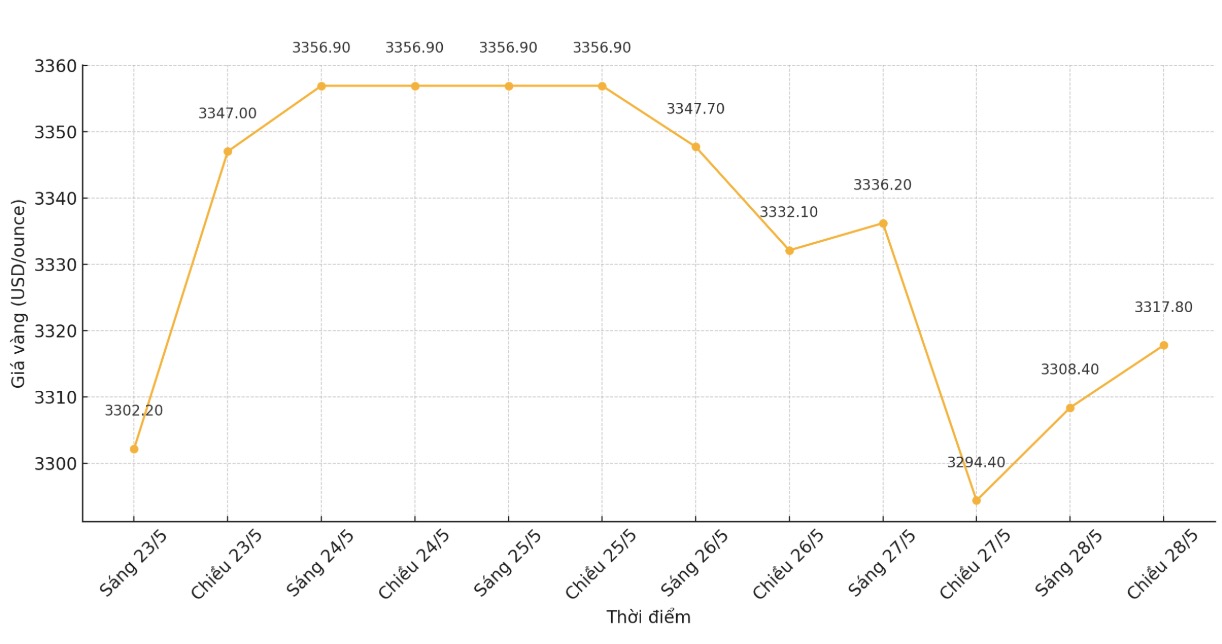

World gold price

At 5:35 p.m., the world gold price listed on Kitco was around 3,317.8 USD/ounce, up 23.4 USD/ounce.

Gold price forecast

According to Reuters, investors are taking advantage of buying when prices fall. However, the increase was partly limited because trade tensions between the US and the European Union (EU) had eased.

Francisco Blanch - head of global commodity and derivatives research at Bank of America Securities said that the current adjustment of gold prices is the result of reducing geopolitical instability in the short term. However, this expert believes that gold and silver will continue to record an increase in the second half of 2025.

We have forecast gold prices to reach $3,500/ounce in the first half of this year. We have achieved that goal, and we now think the market is going through an adjustment that could last for several months.

However, we are still optimistic in the long term. We think that in the long term, it could be in the second half of 2025 or by 2026, gold prices will surpass $4,000/ounce, but we are currently going through a correction because some of the extreme uncertainty we have seen in recent months seems to be easing.

In another development, despite gold prices peaking above $3,500/ounce in April, China has stepped up imports of the precious metal. According to data from the Hong Kong Population Statistics and Investigation Office (China), the net import of gold through Hong Kong to China reached 43.462 tons - nearly 9 times higher than in March and the highest level since March 2024.

Total gold imports through Hong Kong (China) reached 58.61 tons, up more than 178%. Soni Kumari - commodity strategist at ANZ - said that the increased difference between domestic and international prices has boosted imports, while demand from central banks is also a notable factor.

Customs data from other regions also showed that China's total gold imports in April reached 127.5 tons - the highest level in 11 months.

The People's Bank of China's granting of additional import quotas to commercial banks also contributes to meeting the growing demand for shelter amid concerns about the US-China trade war.

The market is now waiting for the US core consumer inflation (PCE) report. This report will be published later in the week and could provide further cluees on the direction of interest rates.

Notable economic data this week

Wednesday: FOMC meeting minutes for May.

Thursday:Weekly jobless claims, preliminary Q1/2025 GDP, US pending home sales.

Friday: US PCE core inflation index.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...