Update SJC gold price

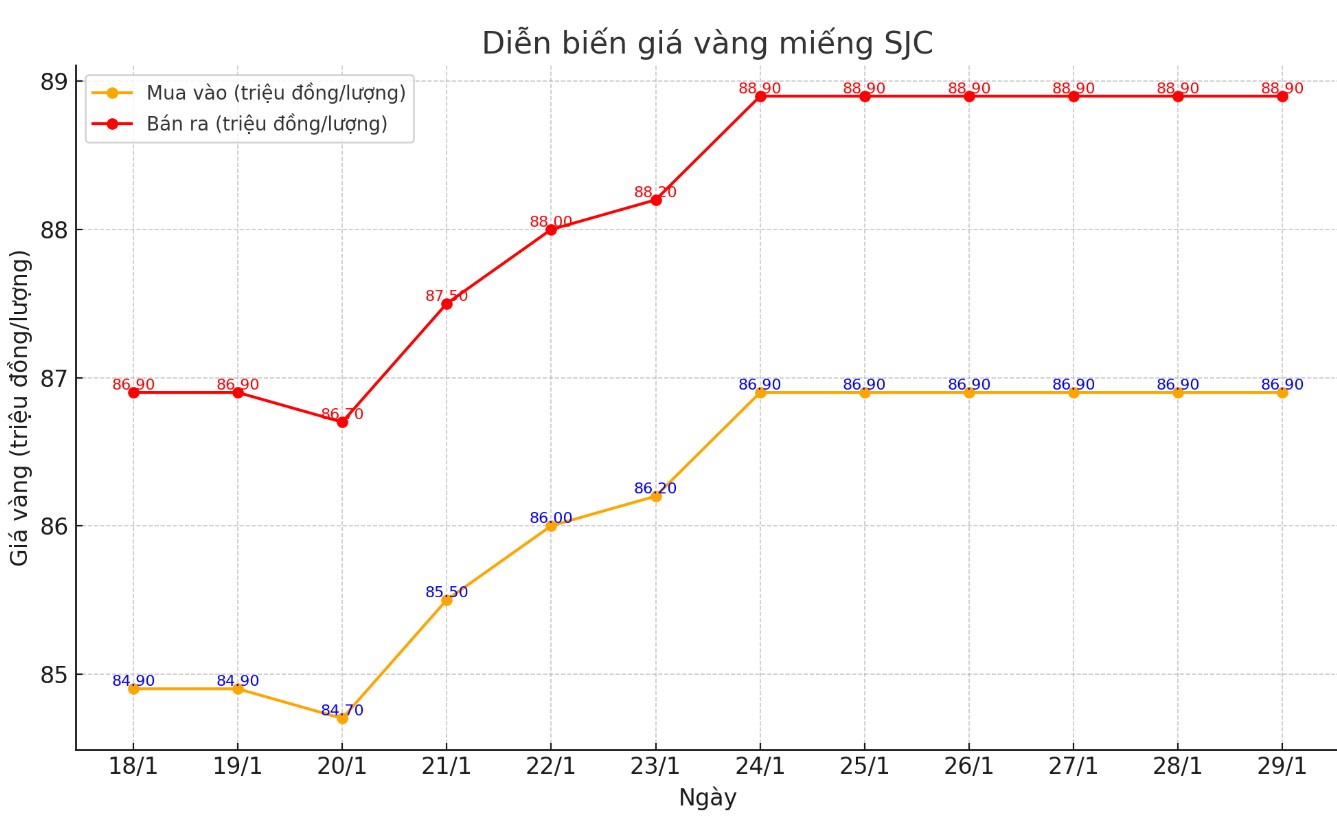

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); increased by 100,000 VND/tael for both buying and selling compared to the beginning of the previous trading session.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

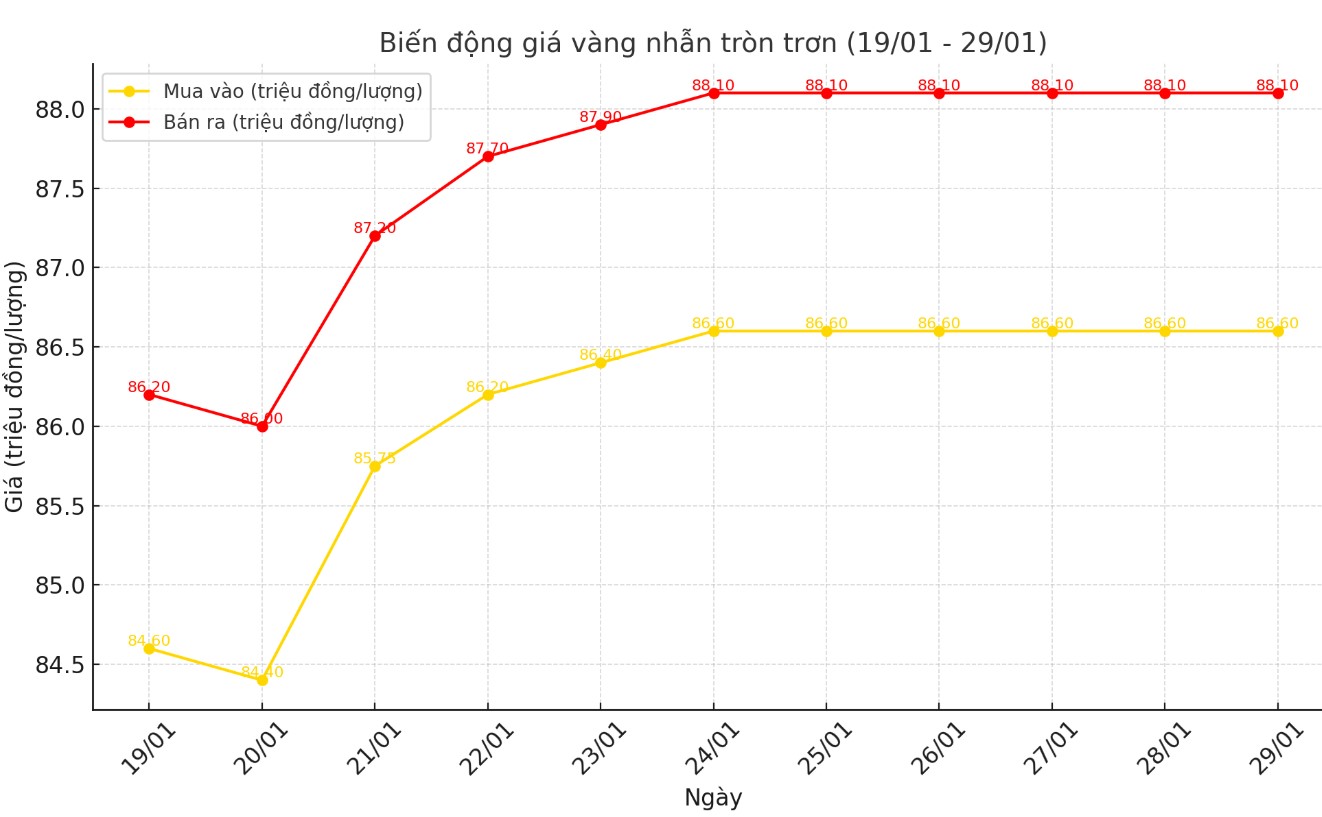

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both buying and selling prices remain the same compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping both buying and selling prices unchanged compared to early this morning.

World gold price

As of 3:45 a.m. on January 30, the world gold price listed on Kitco was at 2,755.3 USD/ounce, down 9.4 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices fell amid a high USD index. Recorded at 3:45 a.m. on January 30, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.720 points (up 0.19%).

According to Kitco, gold prices fell slightly, showing no significant reaction immediately after the US Federal Reserve (FED) kept its monetary policy unchanged, as expected by the market.

The Federal Open Market Committee (FOMC) statement said that the US unemployment rate has stabilized at a low level and that labor conditions remain “solid”. However, the statement also stressed that inflation remains “somewhat elevated”.

Traders are now awaiting a press conference from Fed Chairman Jerome Powell. In addition, the market will also closely monitor any remarks from President Donald Trump immediately after the Fed meeting.

Traders expect the European Central Bank to cut its key interest rate at its monetary policy meeting on Thursday.

In the outside markets, Nymex crude oil futures fell, trading around $73 a barrel. The yield on the 10-year US Treasury note is currently at 4.585% - up slightly after the FOMC statement.

Gold for February delivery remains bullish and holds the advantage in the short term. Currently, buyers are aiming to push prices above the strongest resistance level at $2,826.30 an ounce. On the other hand, sellers want to push prices below the important support level at $2,700 an ounce.

In the short term, gold prices may face resistance at the weekly high of $2,778.10/ounce, followed by $2,800. Meanwhile, the nearest support zone is $2,750/ounce, and if it falls further, it could fall to the weekly low of $2,732/ounce.

See more news related to gold prices HERE...