Update SJC gold price

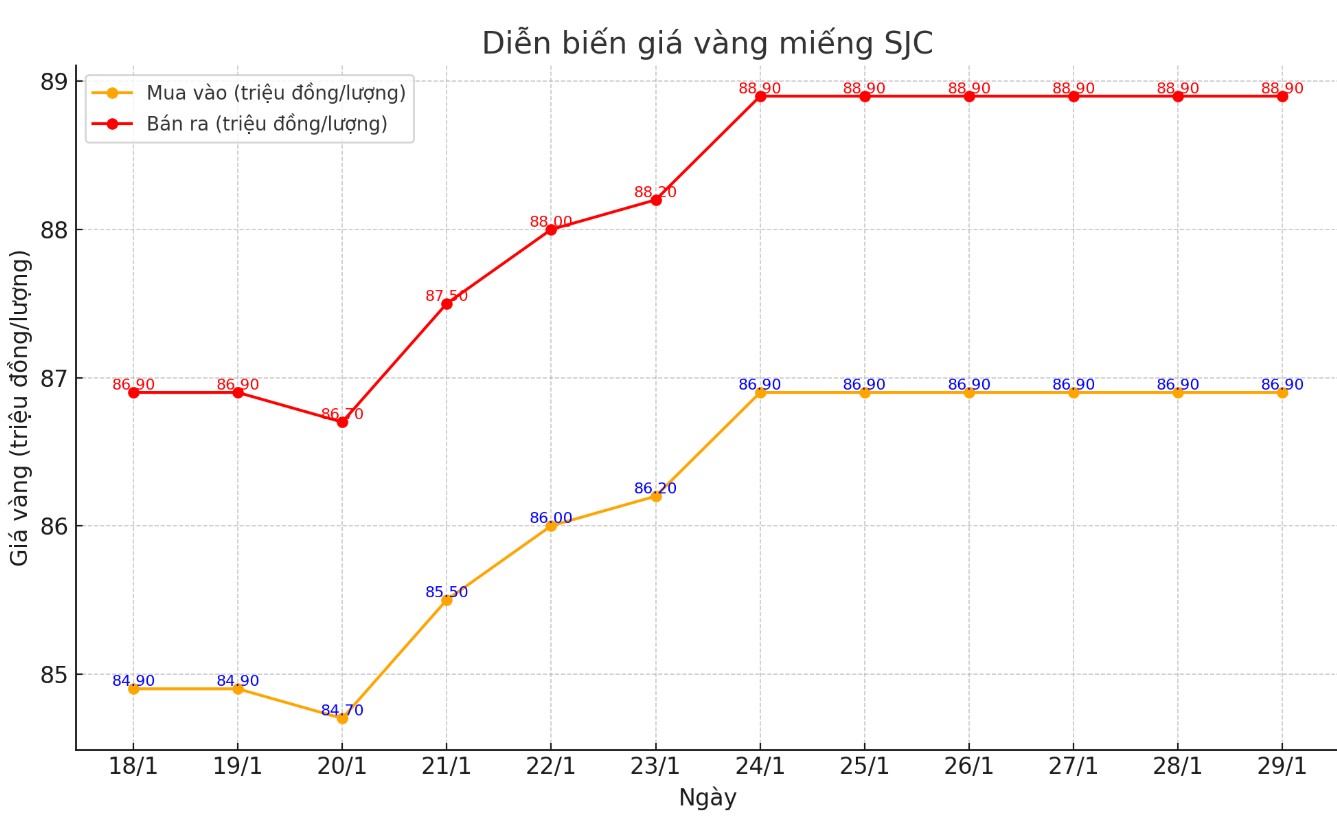

As of 10:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND86.8-88.8 million/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 86.9-88.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 86.9-88.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

Price of round gold ring 9999

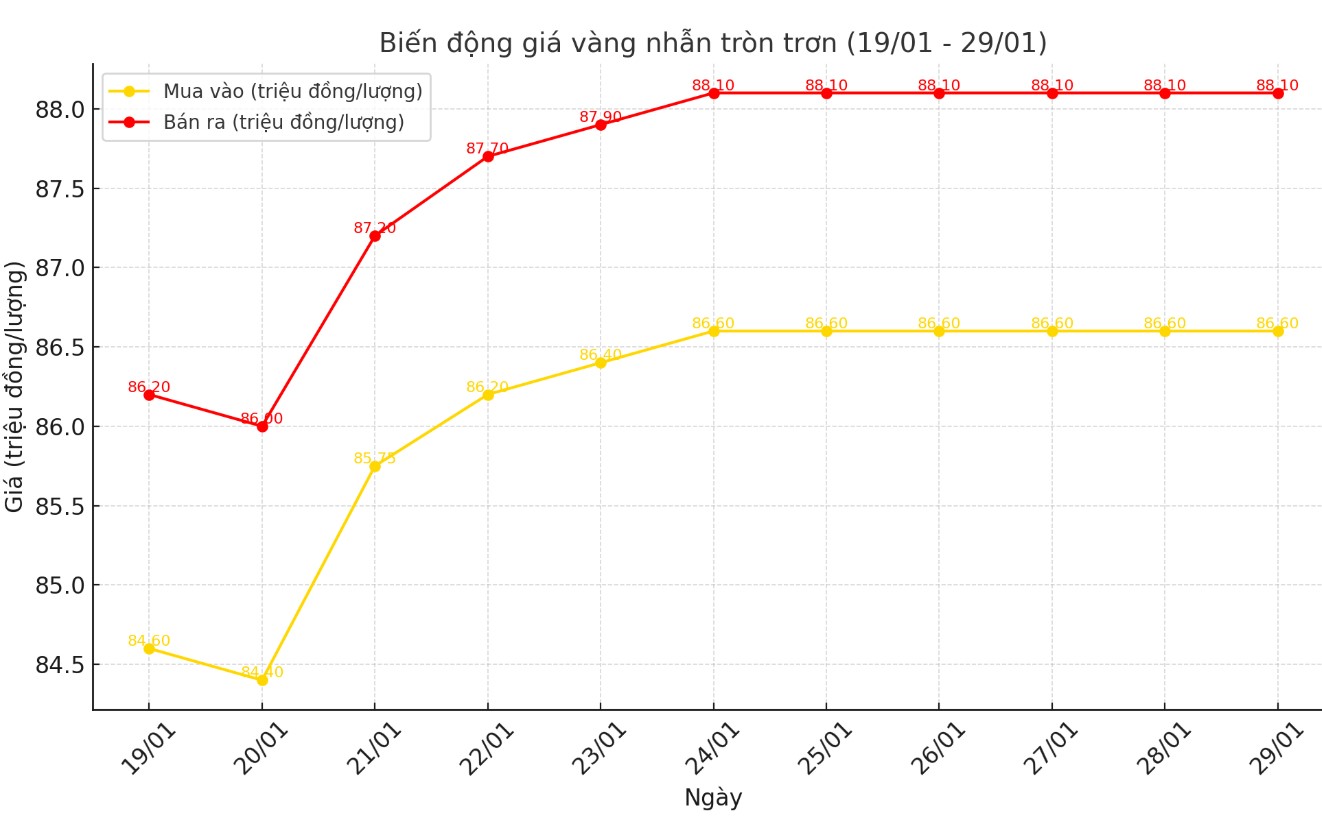

As of 9:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 86.6-88.1 million VND/tael (buy - sell); both selling prices remain the same compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 86.6-88.9 million VND/tael (buy - sell), keeping the buying price unchanged and increasing the selling price by 100,000 VND/tael compared to early this morning.

World gold price

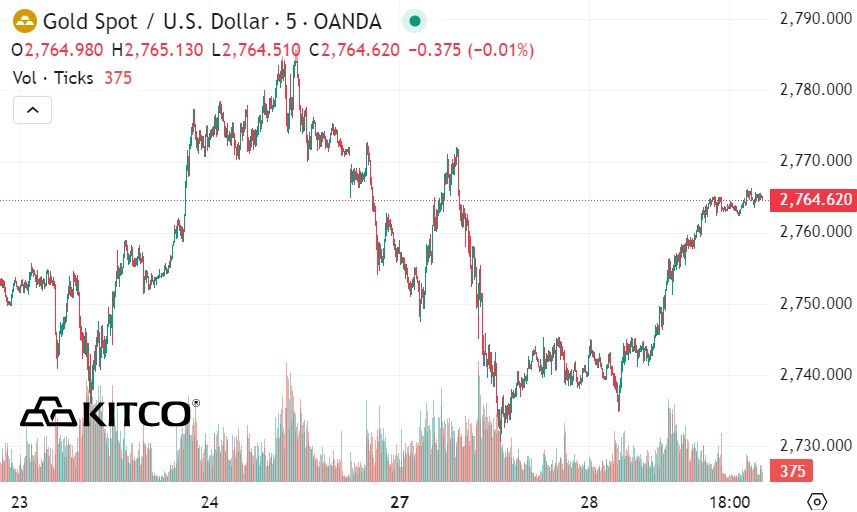

As of 10:00 a.m., the world gold price listed on Kitco was at 2,764.6 USD/ounce, up 23.7 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices recovered amid a decline in the US dollar. Recorded at 10:00 a.m. on January 29, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107,710 points.

Gold prices rose sharply on safe-haven demand amid volatility in the US stock market after a sharp sell-off on Monday, according to Kitco.

Uncertainty surrounding upcoming policies in the US has fueled risk-off sentiment in the market, helping precious metals prices rise.

In addition, information related to the US manufacturing sector is also supporting gold prices. Neils Christensen - an analyst at Kitco News commented that the gold market is trading near the session high as the US manufacturing sector continues to record slowing activity, with durable goods orders falling more than expected.

Orders for durable goods in the United States fell 2.2% last month, the Commerce Department said on Wednesday, following a revised 2% decline in November. The data was worse than expected, with economists forecasting a 0.3% increase.

Gold markets continued to recover after Monday's sell-off, when the precious metal fell into a lack of liquidity due to a sharp decline in the US stock market.

Thomas Ryan, North America economist at Capital Economics, said the main reason for the December decline was production and labor issues at Boeing, but he also stressed that while the core data remained stable, overall activity was slowing.

“While core capital goods shipments may have increased last quarter, the sharp decline in non-defense aircraft shipments suggests that overall business equipment investment has declined. The post-election uptick in small business confidence suggests we could see a recovery in the first half of next year, although high borrowing costs for businesses will remain a drag on investment plans,” he said.

Notable economic data this week

Wednesday: Monetary policy decisions by the Bank of Canada and the US Federal Reserve.

Thursday: ECB monetary policy decision, US Q4 GDP, US weekly jobless claims, US pending home sales.

Friday: US PCE index, personal income and spending.

See more news related to gold prices HERE...