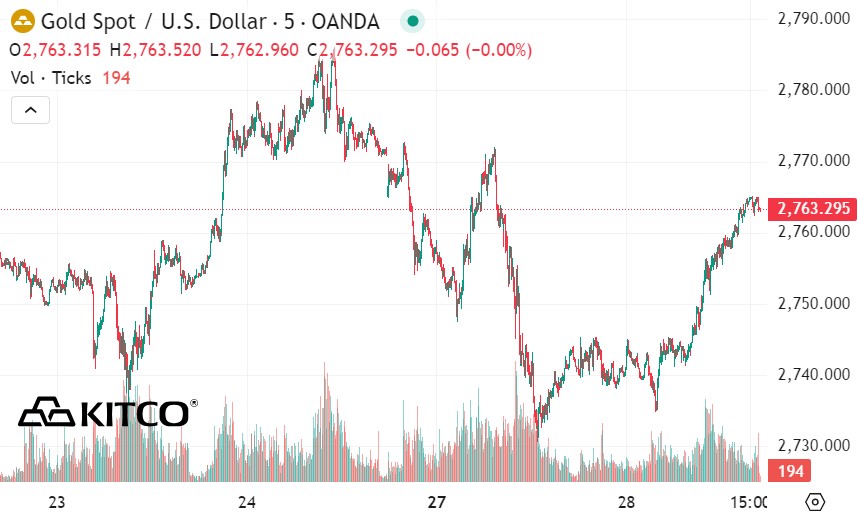

According to Kitco - Gold prices increased sharply thanks to safe-haven demand amid volatility in the US stock market after a sharp sell-off on Monday.

Uncertainty surrounding upcoming policies in the US has fueled risk-off sentiment in the market, helping precious metals prices rise.

In addition, information related to the US manufacturing sector is also supporting gold prices. Neils Christensen - an analyst at Kitco News commented that the gold market is trading near the session high as the US manufacturing sector continues to record slowing activity, with durable goods orders falling more than expected.

Orders for durable goods in the United States fell 2.2% last month, the Commerce Department said on Wednesday, following a revised 2% decline in November. The data was worse than expected, with economists forecasting a 0.3% increase.

Gold markets continued to recover after Monday's sell-off, when the precious metal fell into a lack of liquidity due to a sharp decline in the US stock market.

Thomas Ryan, North America economist at Capital Economics, said the main reason for the December decline was production and labor issues at Boeing, but he also stressed that while the core data remained stable, overall activity was slowing.

“While core capital goods shipments may have increased last quarter, the sharp decline in non-defense aircraft shipments suggests that overall business equipment investment has declined. The post-election uptick in small business confidence suggests we could see a recovery in the first half of next year, although high borrowing costs for businesses will remain a drag on investment plans,” he said.

In another development, President Donald Trump proposed much higher global tariffs than the 2.5% initially proposed by US Treasury Secretary Scott Bessent. Mr Trump said the tariffs were aimed at restructuring US supply chains and “protecting our country”. The US dollar rose after his latest statements.

The key U.S. economic data this week is the Federal Reserve’s interest rate decision, with rates widely expected to remain unchanged at the FOMC meeting that begins Tuesday morning and ends Wednesday afternoon with a statement and press conference from Fed Chairman Jerome Powell. The market consensus is that no rate change will be in sight, but the language and tone of the FOMC statement and Powell’s press conference will be closely watched.

See more news related to gold prices HERE...