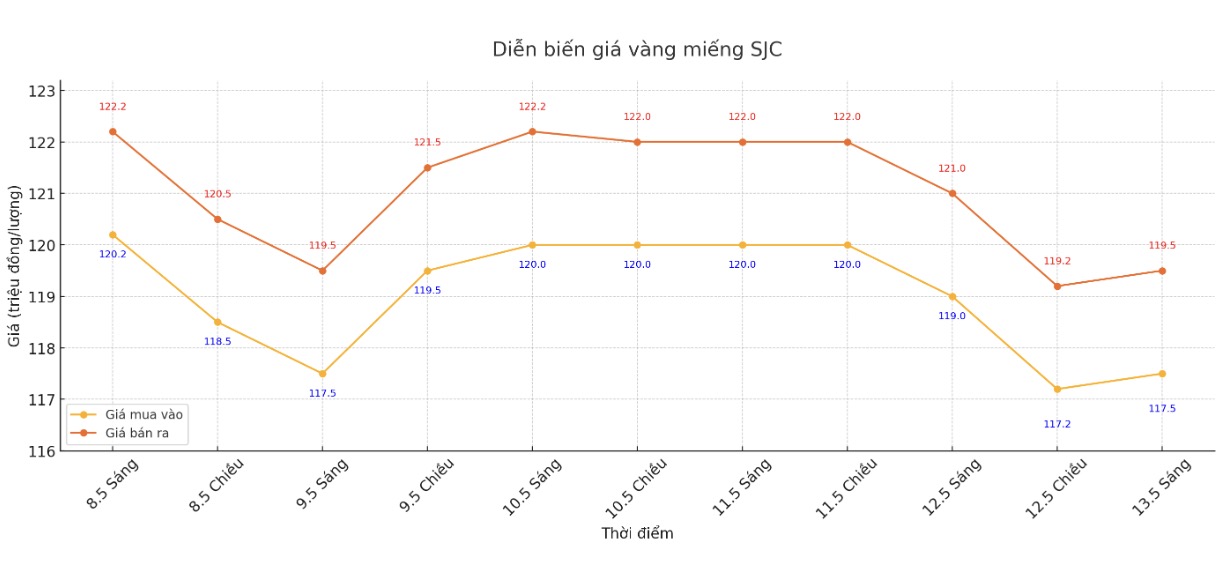

Updated SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 117.5-111.5 million VND/tael (buy in - sell out), down 1.5 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Gold and Stone Group listed the price of SJC gold bars at VND 116.5-111.5 million/tael (buy in - sell out), down VND 1.5 million/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

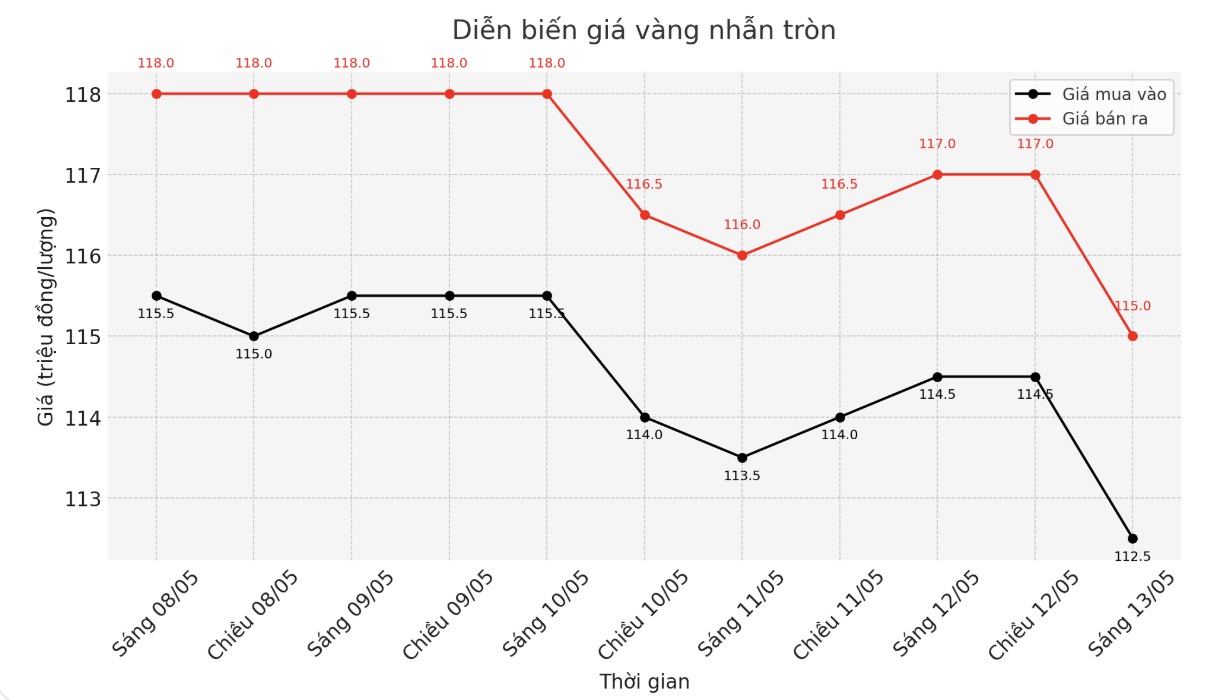

9999 round gold ring price

As of 9:30 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 112.5-115 million VND/tael (buy in - sell out), down 1 million VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 115-118 million VND/tael (buy - sell), down 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 113.5-116.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

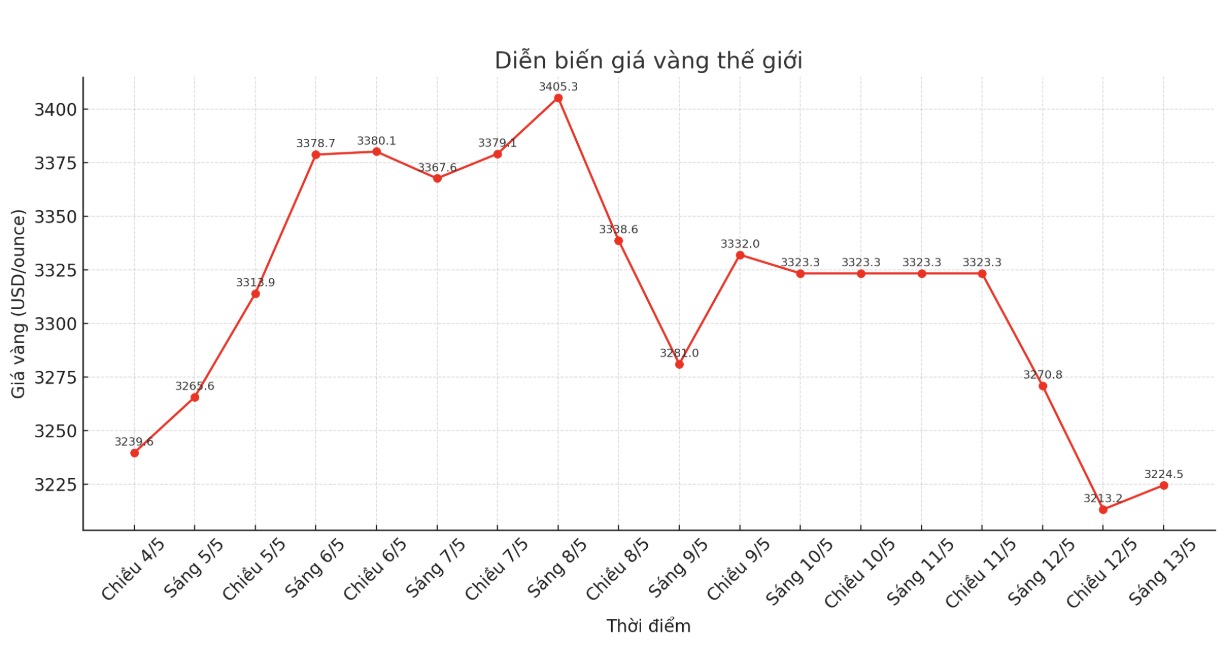

World gold price

At 9:30 a.m., the world gold price listed on Kitco was around 3,224.5 USD/ounce, down 46.3 USD/ounce.

Gold price forecast

According to Adrian Ash - Research Director of Bullion Vault, gold prices in the past month have often reacted quickly to signals from the White House. This makes the precious metal vulnerable to changes in the stance of US President Donald Trump.

This expert believes that gold is unlikely to recover its upward momentum in the context of the dominating optimistic sentiment in the market. This precious metal can only find upside potential when that optimism weakens, Adrian Ash said.

In other markets, after a recent trade deal, the USD surged to its highest level in more than a month, while global stocks increased in price simultaneously. The strengthening of the greenback makes gold more expensive for international investors.

June gold futures speculators have lost their short-term technical advantage, said Jim Wyckoff, senior analyst at Kitco Metals. The next target for buyers is to close above the solid resistance level of $3,350/ounce. The upcoming resistance levels are $3,250/ounce and $3,275/ounce, respectively.

Garlic - which is considered a protective barrier against economic and geopolitical instability - hit a record high of $3,500.05/ounce last month, as concerns about rising global tariffs.

Traders are now awaiting US consumer price index (CPI) data, due out on Tuesday, to assess the next direction in the US Federal Reserve's monetary policy. In addition, this week there are other important reports such as the Producer Price Index (PPI) and retail sales.

In another development, the latest Gallup survey shows that gold prices have left their mark when they took the second place in the most favorite long-term investment portfolio in the US, behind only real estate.

The survey, conducted from April 1 to 14, showed that Americans' confidence in stock safety has declined in the second half of Donald Trump's second term, while the appeal of gold has increased, allowing the two types of assets to swap their rankings with each other.

Currently, 23% of respondents believe that gold is the best long-term investment channel, up 5 percentage points compared to 2024. Only 16% of respondents chose stocks, down 6 points compared to last year.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...