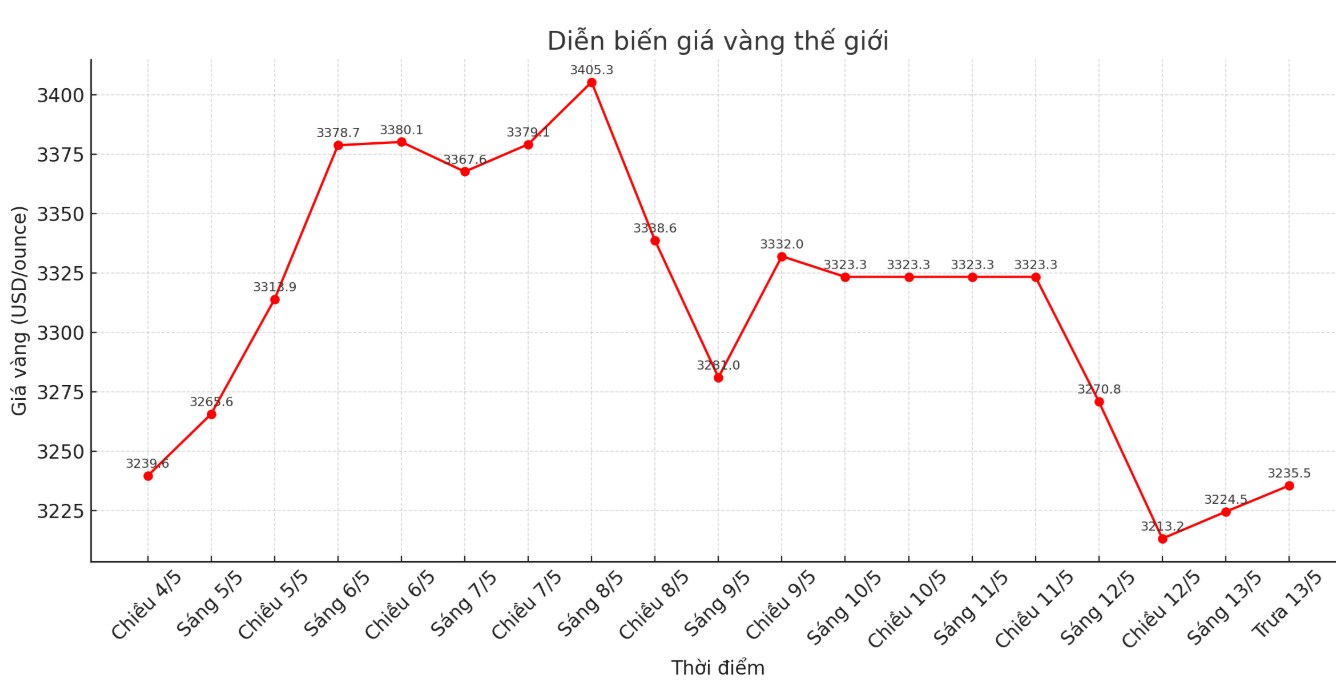

According to Kitco, world gold prices fell sharply after the US reached landmark trade agreements with China and the UK. These deals helped the USD increase strongly, changing the economic picture and causing investors to sell off gold.

The June 2025 gold futures contract fell by 2.62% (equivalent to $87.3). Analysts said gold could find support around $3,176.50 (Fibonacci pullback milestone of 61.8%) and $3,157.7 (50-day moving average).

The main reason for the decline in gold prices is that the US and China reached a tax reduction agreement after negotiations in Geneva last weekend. US Treasury Secretary Scott Bessent said the negotiations were very effective, paving the way for deep tax cuts from Wednesday.

The US will cut tariffs on most Chinese goods from 145% to 30% (except for items such as steel, aluminum and cars), while China will cut tariffs on US goods from 125% to 10%.

The deal will last for 90 days and could become permanent. Economists expect it to help reduce consumer inflation and boost US exports, especially in the agricultural and manufacturing sectors.

At the same time, the new trade agreement between the United States and the UK also expanded the door for American goods to access the UK market. The White House estimates that this agreement will create an export opportunity of about US $ 5 billion for US farmers and producers. The agreement on the basic tax rate of 10%, with special terms for cars.

The agricultural sector has benefited significantly. The deal includes exports of more than $700 million and $250 million of other agricultural products, according to ProAg, a federal agricultural insurance agency.

US Secretary of Agriculture bro bro broads Rollins stressed that the deal will boost beef exports far exceeded the 1,970 tonnes (worth about $32 million) that the US exported to the UK last year.

Immediately, the USD increased sharply. USD Index Increased by 1.37% to 111.63 points. Half of gold's decline today was due to the stronger US dollar (because gold is priced in USD, it often moves in the opposite direction to the greenback). The rest came from the sale-off of gold futures.

For the economy, these agreements help reduce trade costs, expand markets, boost GDP growth and reduce inflationary pressures. Imported goods are cheaper, while US goods have more opportunities to export.

However, for gold investors, the outlook is no longer as positive as before. Gold is often seen as a safe haven in times of uncertainty and a hedge against inflation. But in an environment of economic stability and controlled inflation, gold's role may decline. So, although gold has had a strong upward cycle in recent years, the current trend is under downward pressure.

Markets will continue to monitor the impact of new policies starting from Wednesday, especially the impact on inflation, growth and monetary policies of central banks - key factors deciding gold prices in the coming time.