Some analysts say low trading volumes during the 2024 holiday season are expected to keep gold prices trading in a narrow range.

Markets will be closed midweek on January 1, so many analysts will still be focused on welcoming the New Year rather than watching the financial markets.

Barring a major surprise, many experts predict gold prices will continue to face a tug-of-war between rising bond yields and safe-haven demand fueled by growing geopolitical and economic uncertainties.

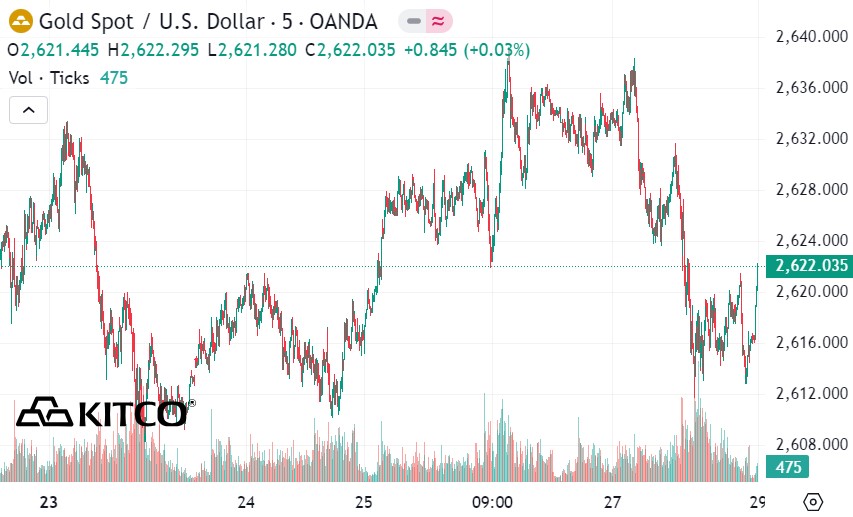

Gold prices were limited to $2,650 an ounce last week, but the market struggled as the yield on the 10-year US Treasury note rose to 4.64%, its highest level in seven months.

The precious metal remained in a narrow range heading into the weekend, despite bond yields remaining elevated above 4.6%. Spot gold futures last traded at $2,618.30 an ounce, down 0.57% on the day. Meanwhile, gold prices fell 0.18% for the week.

"Gold's resilience this week has been underpinned by escalating geopolitical tensions. Investors are keeping a close eye on conflicts in Eastern Europe and the Middle East," James Hyerczyk, market analyst at FX Empire, said in a note Friday. "Israeli airstrikes on Houthi targets in Yemen and Russian drone strikes in Ukraine have increased gold's appeal as a safe-haven asset. This geopolitical backdrop continues to keep gold in the spotlight, with traders hedging against the risk of escalating conflict."

In addition, some analysts also noted that President-elect Donald Trump's social media comments expressing his intention to annex Canada, the Panama Canal and Greenland have added to geopolitical instability and tension.

Hyerczyk said the key support level to watch next week will be $2,607 an ounce. He added that gold needs to break $2,665.65 to regain bullish momentum. In the current environment, he said the path of least resistance appears to be to the downside.

“The near-term outlook for gold remains negative, with rising yields and a stronger US dollar acting as stronger drivers than geopolitical risks,” he said. However, the current action is taking place during a historically low-volume trading week, and thin trading volumes could limit further volatility.

The year will end with a fairly light economic data schedule, as markets will get some reports on home sales and manufacturing data.

Markets will also continue to watch the US labor market, especially weekly jobless claims data next week.

Continuing unemployment claims rose to their highest level in a year last week, data showed that while the number of Americans filing for unemployment benefits for the first time has remained relatively stable, those who have been laid off are having trouble finding new jobs.

Jeffrey Roach, chief economist at LPL Financial, said the persistently high level of claims suggests the labor market is slowing.

Economic calendar next week

Monday: US pending home sales.

Wednesday: Happy New Year.

Thursday: US weekly jobless claims data.

Friday: US ISM manufacturing PMI.