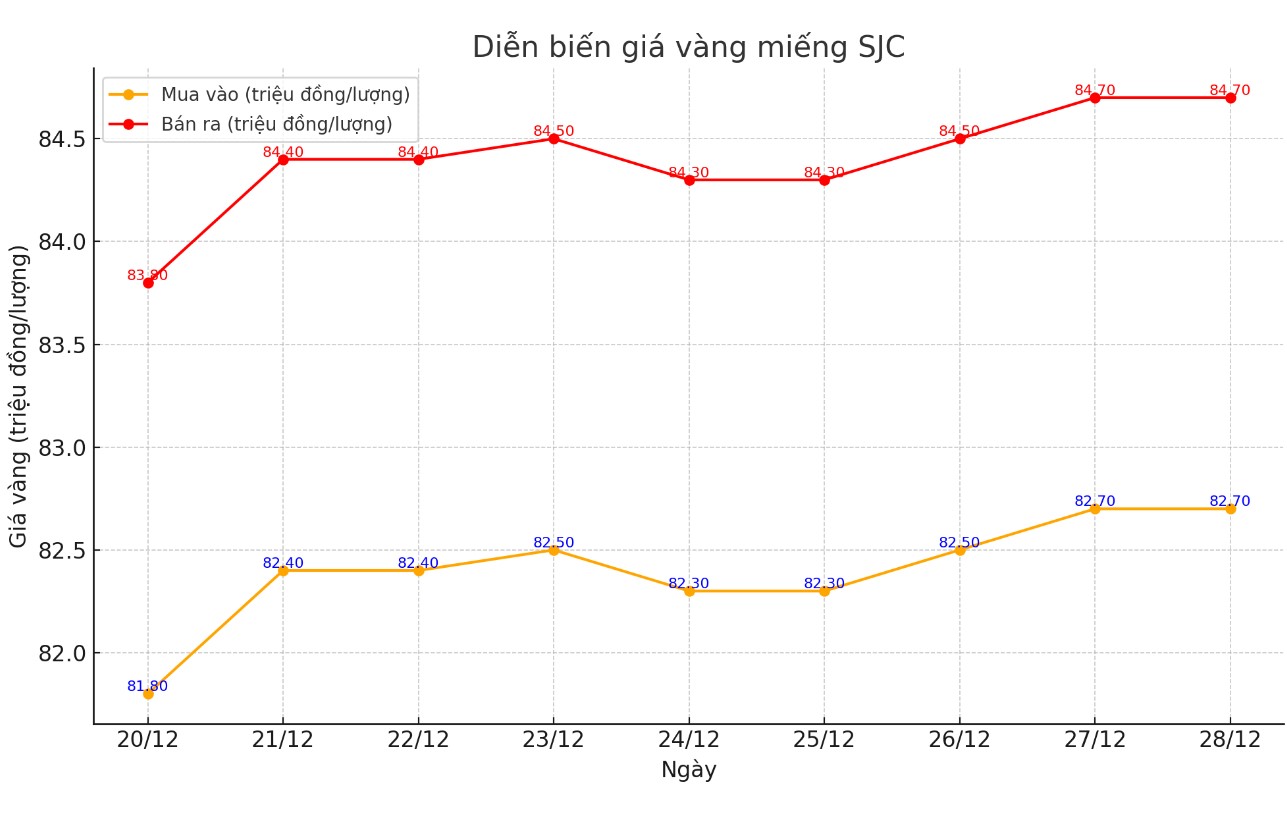

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 82.7-84.7 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 82.7-84.7 million VND/tael (buy - sell); unchanged.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.7-84.7 million VND/tael (buy - sell); unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

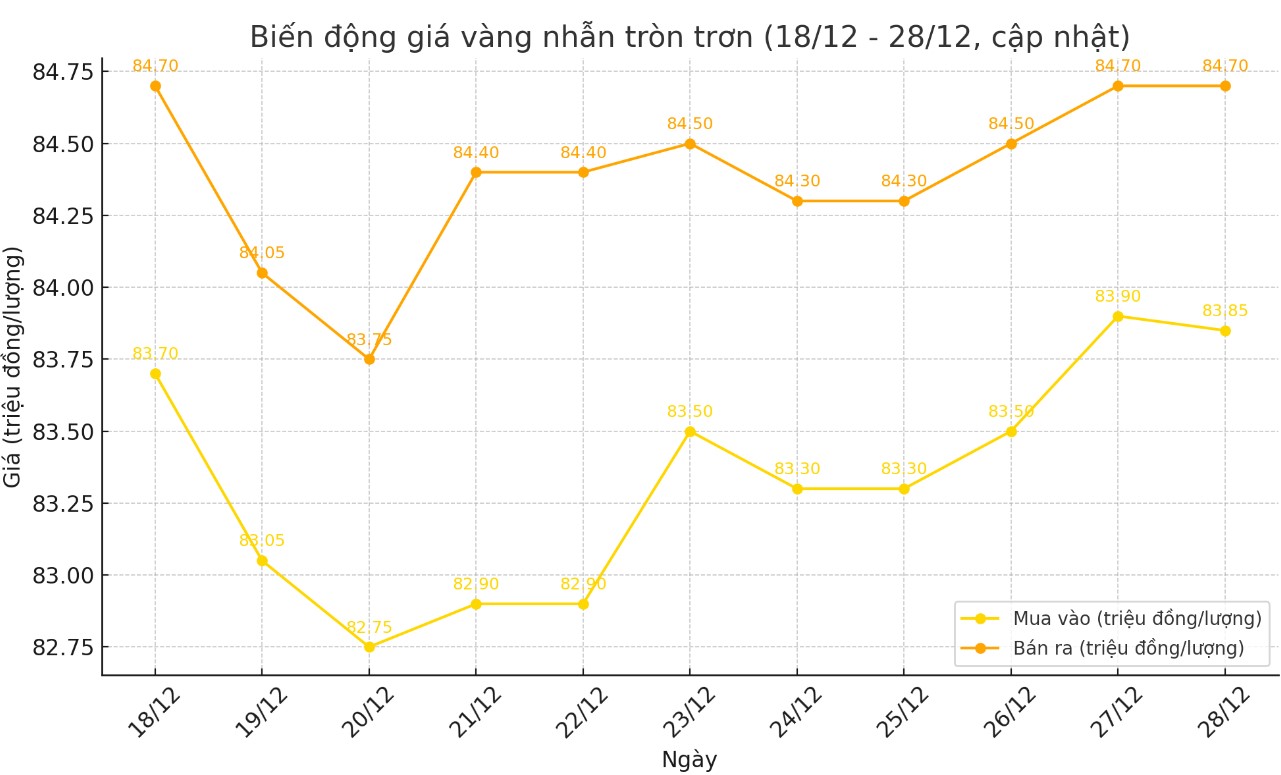

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.85-84.7 million VND/tael (buy - sell); an increase of 150,000 VND/tael for buying and unchanged for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.10-84.70 million VND/tael (buy - sell), an increase of 200,000 VND/tael for buying and unchanged for selling compared to early this morning.

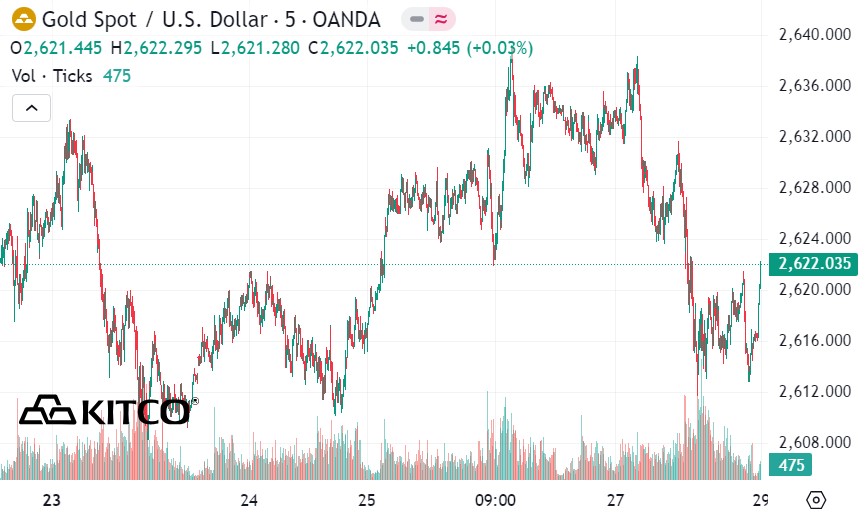

World gold price

As of 10:15 a.m., the world gold price listed on Kitco was at 2,622 USD/ounce, down 10.5 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell despite the cooling of the USD. Recorded at 9:35 a.m. on December 28, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.790 points (down 0.09%).

Although the market showed signs of slowing down in the second half of the year when the People's Bank of China (PBOC) suspended gold purchases for six months and gold imports dropped sharply, this did not diminish the country's influence in the precious metals market, according to Kitco.

Most analysts remain bullish on gold in 2025, despite the Federal Reserve’s expected fewer rate cuts next year. Most believe that global geopolitical tensions will remain high, central banks will continue to add to their gold holdings, and political uncertainty will persist when Donald Trump returns to the White House in January 2025. His proposed tariffs and trade policies also risk triggering a trade war, adding to gold’s appeal as a safe haven.

Central bank buying could push gold prices to $3,000 an ounce next year if the precious metal continues at its current pace, said Bob Haberkorn, senior market strategist at RJO Futures.

Looking ahead to 2025, a research firm predicts that Chinese gold demand will remain strong, providing important support for gold prices. Weak economic activity and a weaker yuan will boost gold demand in China next year, said Hamad Hussain, assistant climate and commodities economist at Capital Economics.

“We believe the Chinese real estate situation will be a major drag on economic growth and increase safe-haven demand for gold,” he said in a recent research note.

Meanwhile, TD Securities commodity strategists forecast spot gold prices to hit $2,675 an ounce in the first quarter of 2025 and peak at $2,700 an ounce in the second quarter, before falling to $2,625 an ounce in both the third and fourth quarters.

See more news related to gold prices HERE...