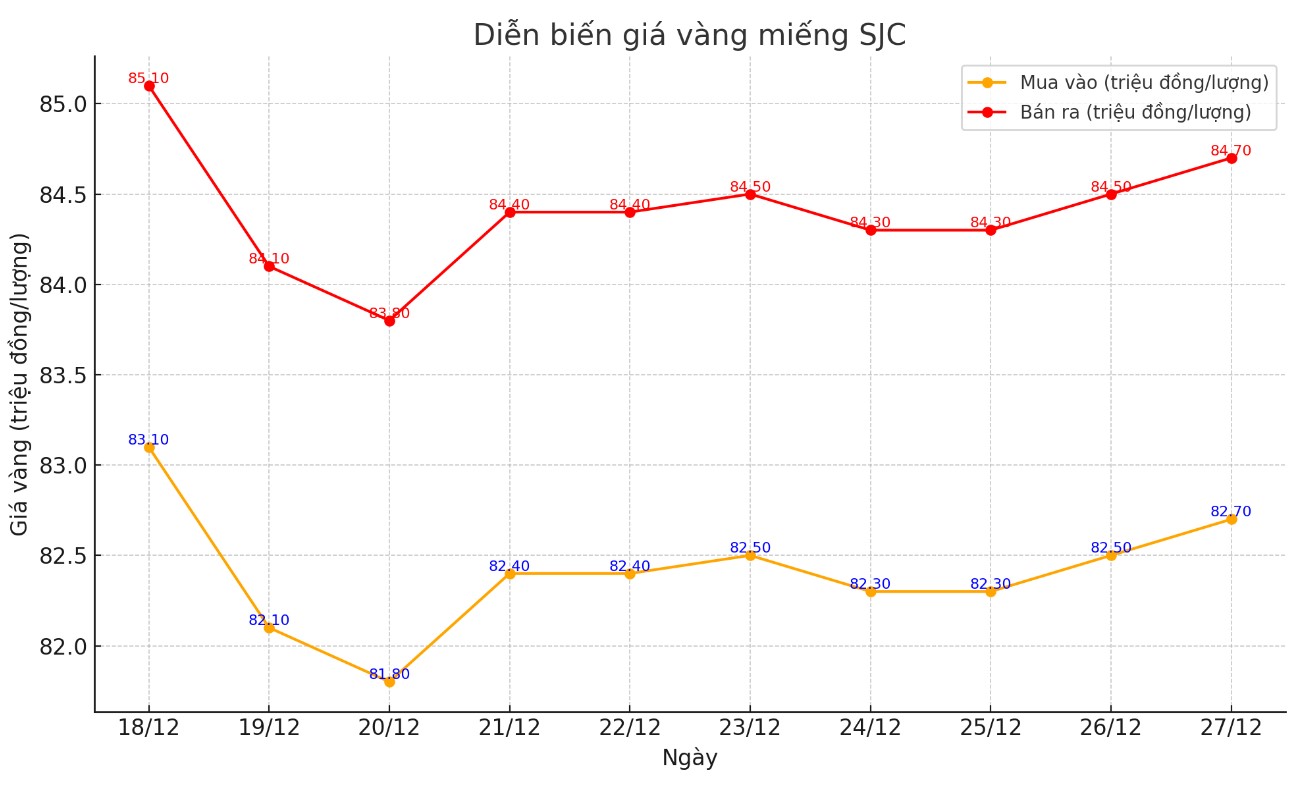

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.7-84.7 million/tael (buy - sell); an increase of VND200,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at 82.7-84.7 million VND/tael (buy - sell); an increase of 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.7-84.7 million VND/tael (buy - sell); increased 200,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

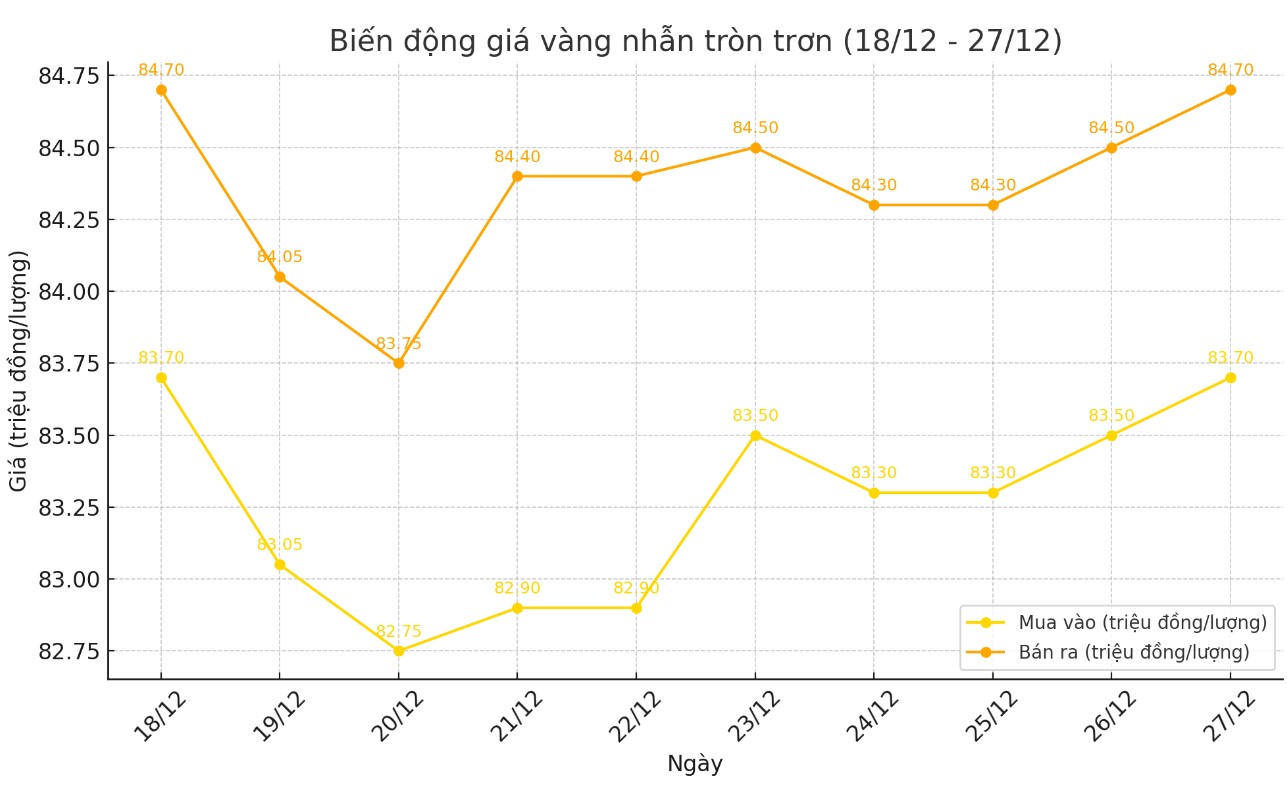

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.7-84.7 million VND/tael (buy - sell); an increase of 200,000 VND/tael for both buying and selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.9-84.7 million VND/tael (buy - sell), an increase of 200,000 VND/tael for both buying and selling compared to early this morning.

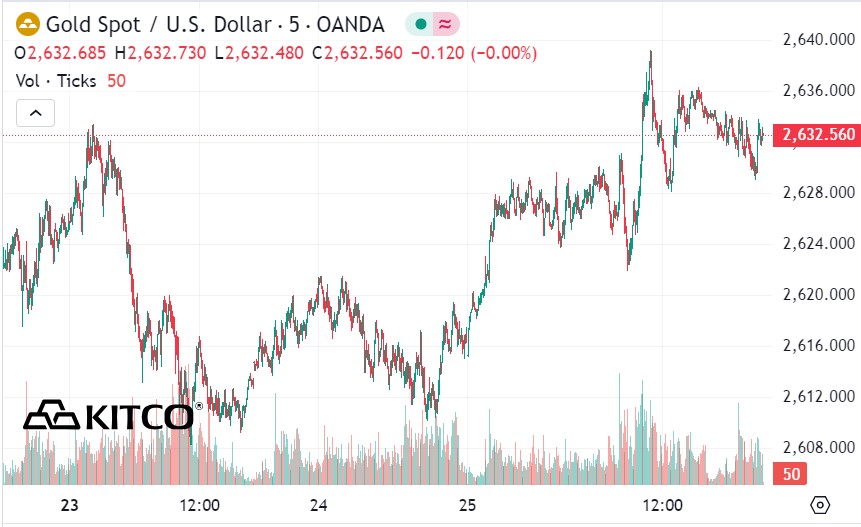

World gold price

As of 10:15 a.m., the world gold price listed on Kitco was at 2,632.5 USD/ounce, up 6.3 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices increased slightly as the USD did not change much. Recorded at 10:15 a.m. on December 27, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107,960 points (up 0.06%).

Strategist Daniel Pavilonis - RJO Futures said that the increase of gold on December 26 is related to the conflict between Russia and Ukraine. He predicted that the price of gold will exceed 3,000 USD / ounce next year thanks to demand from central banks and inflation leading to increased retail demand.

Gold, a hedge against geopolitical uncertainty and inflation, has risen 28% this year, peaking at $2,790.15 an ounce on Oct. 31. But high interest rates have limited its appeal.

Director Ajay Kedia - Kedia Commodities commented that next year, the gold market will be volatile, positive in the first half of the year due to geopolitical tensions, but the second half of the year may witness profit-taking.

With Donald Trump set to return to the White House, markets are closely watching US economic data and the Federal Reserve’s response to inflation from its new policies. After three rate cuts this year, the Fed is expected to slow its easing in 2025.

The market is also paying attention to US unemployment benefit data. The forecast for the week ending December 21 is 224,000 claims, up from 220,000 the previous week. If the number increases, the USD will be under pressure, pushing gold prices to trade more positively.

In the Commodity Outlook 2025 report, TD Securities analysts said the US Federal Reserve's interest rate cutting cycle, geopolitical uncertainty and strong gold buying demand from central banks have pushed gold prices to record highs this year, but capital flows have not provided strong support.

“There has been no shortage of compelling macro stories that have fueled gold’s rally in recent months ahead of the US election. However, the rally has not been supported by sustained capital flows,” the analysts wrote.

See more news related to gold prices HERE...