Gold price developments last week

After the first weeks of US President Donald Trump's second term caused strong fluctuations in precious metal prices, this week the gold market has had a more stable development, focusing on economic data.

Spot gold prices opened the week at $2,882.48/ounce. After surpassing the $2,900/ounce mark, gold recorded a little volatility in the trading session on Monday, as the US market closed for President's Day.

In the Asian trading session, gold prices increased sharply. When North American markets opened on Tuesday, spot gold reached $2,924 an ounce - a price that remained supportive throughout the week.

In the trading session on Tuesday night, gold prices hit a weekly high of $2,946/ounce. However, the North American market pulled prices below $2,920/ounce at 1:45 p.m. (Eastern time) Wednesday.

This price quickly became a short-term support level. By 2:00 p.m. the same day, after the minutes of the US Federal Reserve's (FED) meeting last month were released, gold prices soared, reaching a weekly high of $2,955/ounce just before 4:00 a.m. Thursday.

However, this peak did not last long. At 8:30 a.m. on Friday, Fed Philadelphia's weekly jobless claims and production index data was released, sending gold down from $2,944 an ounce to $2,925 an ounce in just 30 minutes. When the North American market opened, gold prices recovered to nearly $2,940/ounce and peaked at $2,946/ounce at around 8:00 p.m.

At this time, it was the turn of Asian and European traders to lose confidence in gold, causing prices to fall overnight, reaching a weekly low of 2,919 USD/ounce 3:15 in the morning. However, gold quickly recovered to $2,930/ounce when the North American market opened.

A final attempt to check the weekly high failed as prices stagnated at $2,941 an ounce just before 2:00 p.m. The market then stabilized in a narrow range of 2,933 - 2,938 USD/ounce until the closing of the weekly trading session.

What do experts predict about gold prices next week?

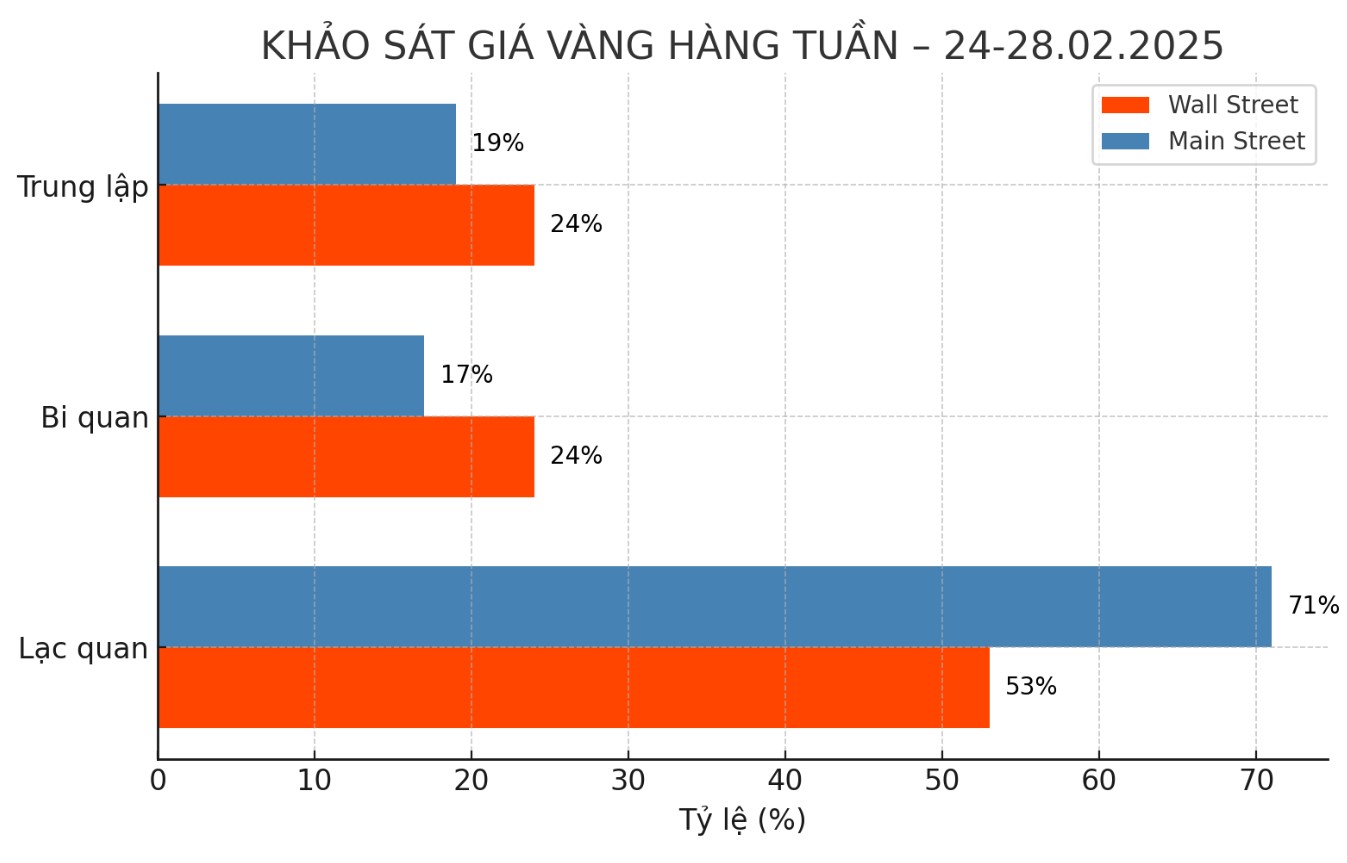

Kitco News' weekly gold survey shows that industry experts are increasingly cautious about gold's short-term prospects, while individual investors are more optimistic about the possibility of price increases.

Last week, a survey by Kitco News with 14 experts showed that 71%, (10 people) predicted gold prices would continue to increase, while only 14% (2 people) predicted prices would decrease and the remaining 14% expected gold to go sideways.

However, the latest survey results with 17 experts show that optimism on Wall Street is showing signs of being restrained. Only 53% (9 people) predict gold prices will increase next week, while the percentage of experts who believe that prices will decrease and go sideways will reach 24% (4 people per group).

This change shows that the level of optimism has decreased compared to last week, when optimism dominated with more than 70% of the price increase forecast, and now analysts are more cautious in their assessment of the trend of the precious metal.

Meanwhile, Kitco's online survey shows clear signs of positive change in the sentiment of individual investors towards gold prices.

In last week's survey with 201 votes, 65% of traders expect gold prices to increase next week, while 24% predict prices will decrease and 11% believe that gold will only move sideways in the short term. However, this week's figures with 204 participants show further optimism as 71%, investors predict gold prices will increase, only 17% believe prices will decrease and 13% believe prices will go sideways.

The increase from 65% to 80% of bulls and a significant decrease in downside forecasters have reflected investors' stronger confidence in the upward trend of gold. Experts say that the current market context may be creating favorable conditions for gold's recovery, as investors seek safe channels in the context of global fluctuations.

However, a small segment remains cautious, saying that gold prices may only move sideways in the short term. This differentiation shows that although the general trend is optimistic, the gold market still has many factors to monitor in the coming time.

Economic calendar affecting gold prices next week

This week's economic event schedule starts earlier than usual, as investors will closely monitor the results of Germany's parliamentary election on Sunday. On Tuesday morning, the US Consumer Confidence report for February will be released, followed by the New Homeowned Sales data for January on Wednesday.

Thursday, the market will receive a preliminary report on US Q4 GDP, January long-term goods orders and weekly unemployment claims, followed by US home purchase contract data pending processing late in the morning.

However, the most important event of the week will be the US core PCE index on Friday, along with the January personal income and spending report. This is the FED's preferred inflation measure, helping gold traders assess the interest rate outlook in the coming time.

See more news related to gold prices HERE...