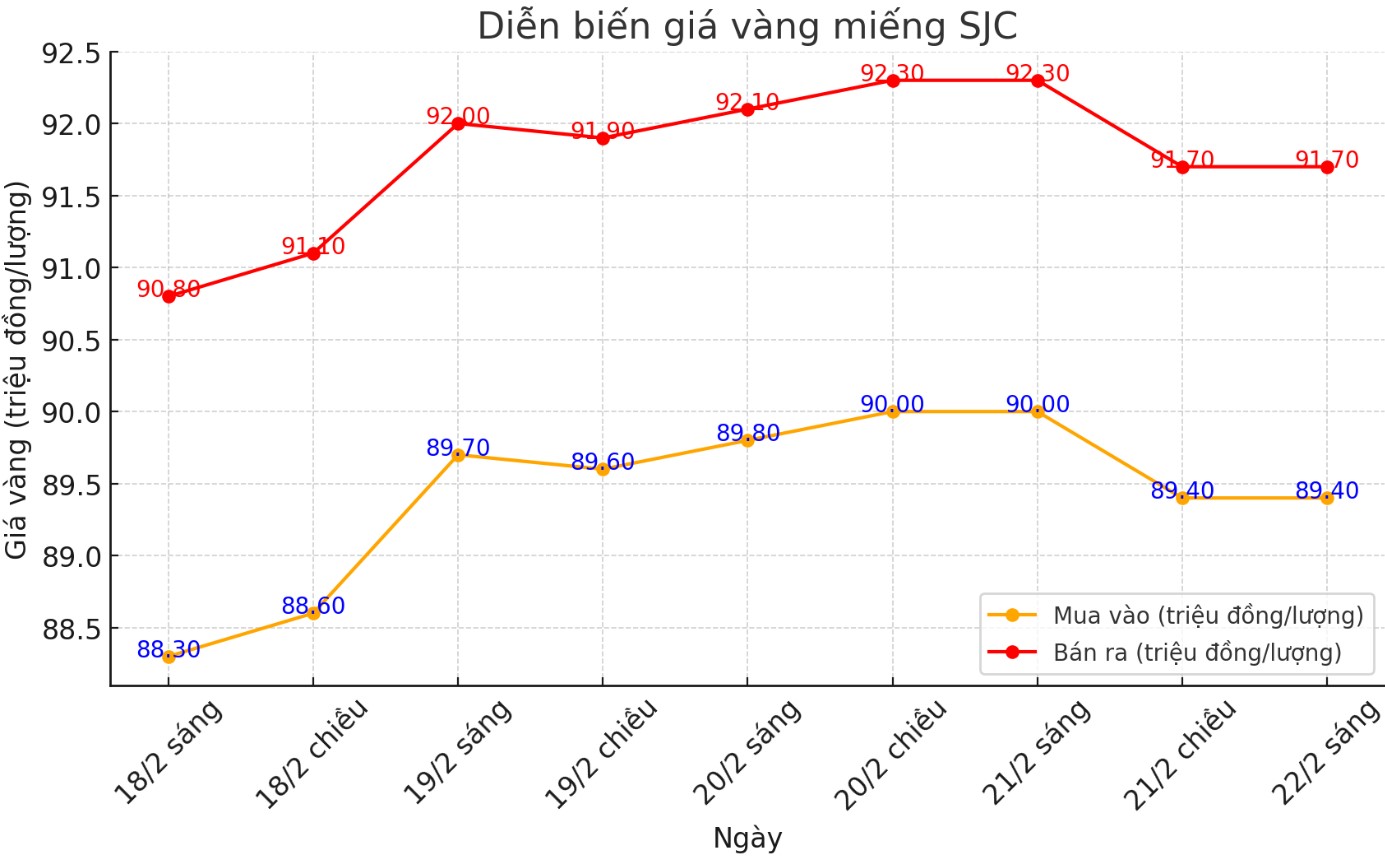

Updated SJC gold price

As of 9:10 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND89.4-91.7 million/tael (buy in - sell out), down VND600,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, the price of SJC gold bars was listed by DOJI Group at VND89.4-91.7 million/tael (buy - sell), down VND600,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

At the same time, Bao Tin Minh Chau listed the price of SJC gold bars at 89.6-91.7 million VND/tael (buy - sell); down 500,000 VND/tael for buying and down 700,000 VND/tael for selling.

The difference between buying and selling SJC gold at Bao Tin Minh Chau is at 2.1 million VND/tael.

Gold prices decreased while the difference between buying and selling prices at gold trading enterprises remained high, causing many risks for investors.

The high difference puts investors at risk of losses. When prices decrease, gold buyers face the risk of double depreciation: a decrease in gold prices leads to depreciation of assets, while a high difference between buying and selling makes it more difficult to sell off with a minimum loss. Investors will have a hard time surfing, because as soon as they buy, they will suffer a big loss if they sell immediately.

When gold prices decrease but the difference remains high, the market is at risk of losing liquidity when investors hesitate to trade. Buying becomes risky when the gold price has not shown any signs of creating a bottom, but selling again causes gold holders to suffer heavy losses due to the large difference. This could lead to a fearful mentality, reducing gold's appeal to other investment channels.

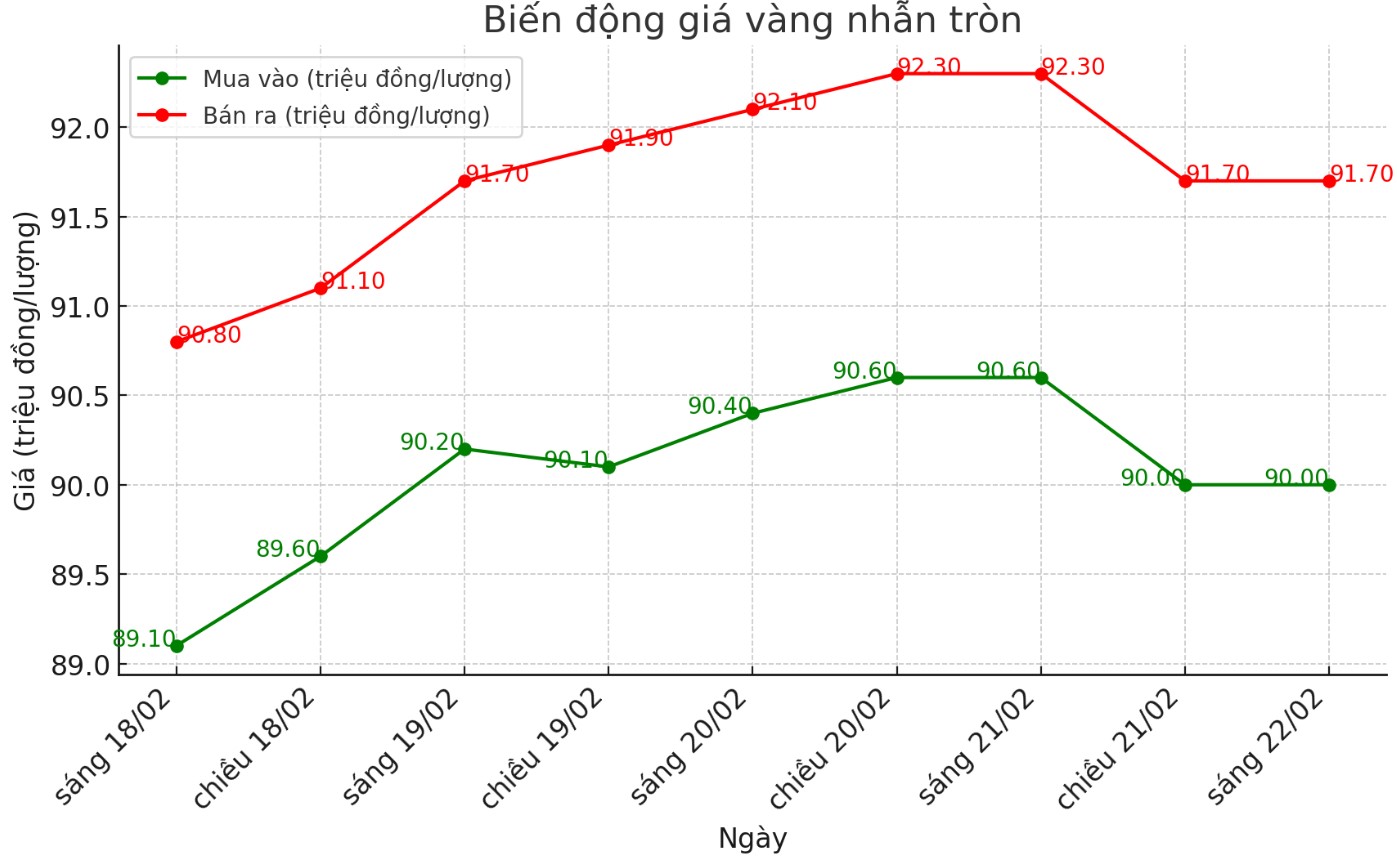

9999 round gold ring price

As of 9:10 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND90-91.7 million/tael (buy - sell); down VND500,000/tael for both buying and selling compared to early this morning.

The difference between buying and selling is at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.1-91.8 million VND/tael (buy - sell), keeping the same buying price and decreasing 500,000 VND/tael for selling compared to early this morning.

The difference between buying and selling is at 1.7 million VND/tael.

World gold price

As of 9:10 a.m., the world gold price listed on Kitco was at 2,936.2 USD/ounce, down 3.4 USD/ounce compared to the beginning of the previous trading session.

Gold price forecast

World gold prices fell amid an increase in the USD. Recorded at 9:10 a.m. on February 22, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.520 points (up 0.24%).

Gold prices were under pressure as the US Federal Reserve (FED) reaffirmed its cautious stance due to concerns about persistent inflation.

At the first meeting of 2025, the FED decided to keep interest rates unchanged and no longer showed any signs of a sharp cut as previously expected. Minutes from the January 28-29 monetary policy meeting show that the Fed may only cut interest rates once this year, with a reduction of 0.25 percentage points. The Fed had previously forecast four cuts in 2025.

Normally, when the Fed maintains high interest rates or shows a tough stance, gold prices tend to decrease due to increased opportunity costs of holding gold - a non-interest-bearing asset.

Some experts believe that this precious metal has decreased in price due to profit-taking waves as prices increase. It is worth mentioning that the decline is unlikely to last as investors will often buy at low prices.

According to allegiance Gold CEO Alex Ebkarian, profit-taking after prices hit a new record is normal. He said that gold is still firmly supported by fundamental factors.

See more news related to gold prices HERE...