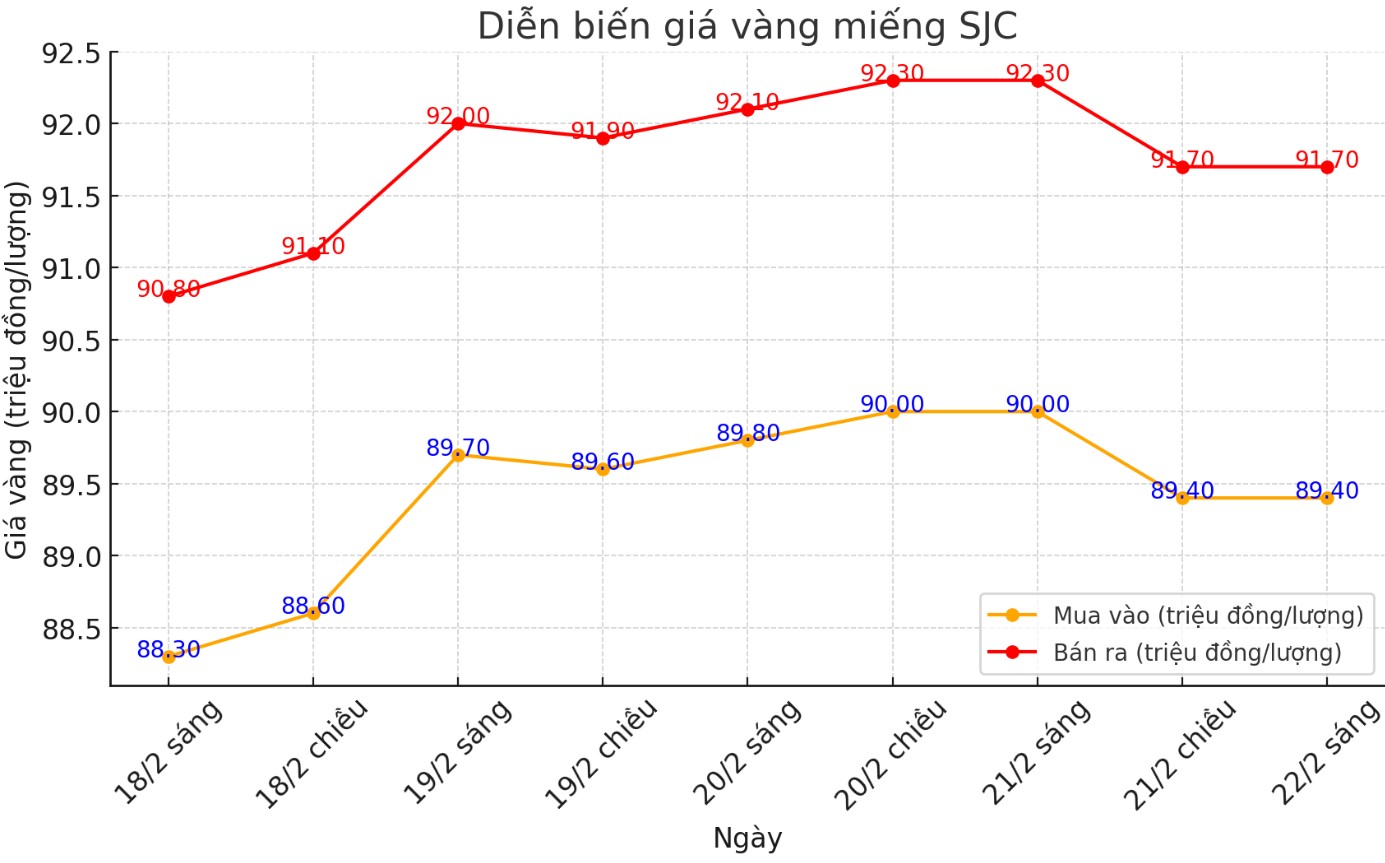

Updated SJC gold price

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND89.4-91.7 million/tael (buy in - sell out), down VND600,000/tael for both buying and selling.

The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at VND89.4-91.7 million/tael (buy - sell), down VND600,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2.3 million VND/tael.

DOJI Group listed the price of SJC gold bars at VND89.4-91.7 million/tael (buy - sell), down VND600,000/tael for both buying and selling. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2.3 million VND/tael.

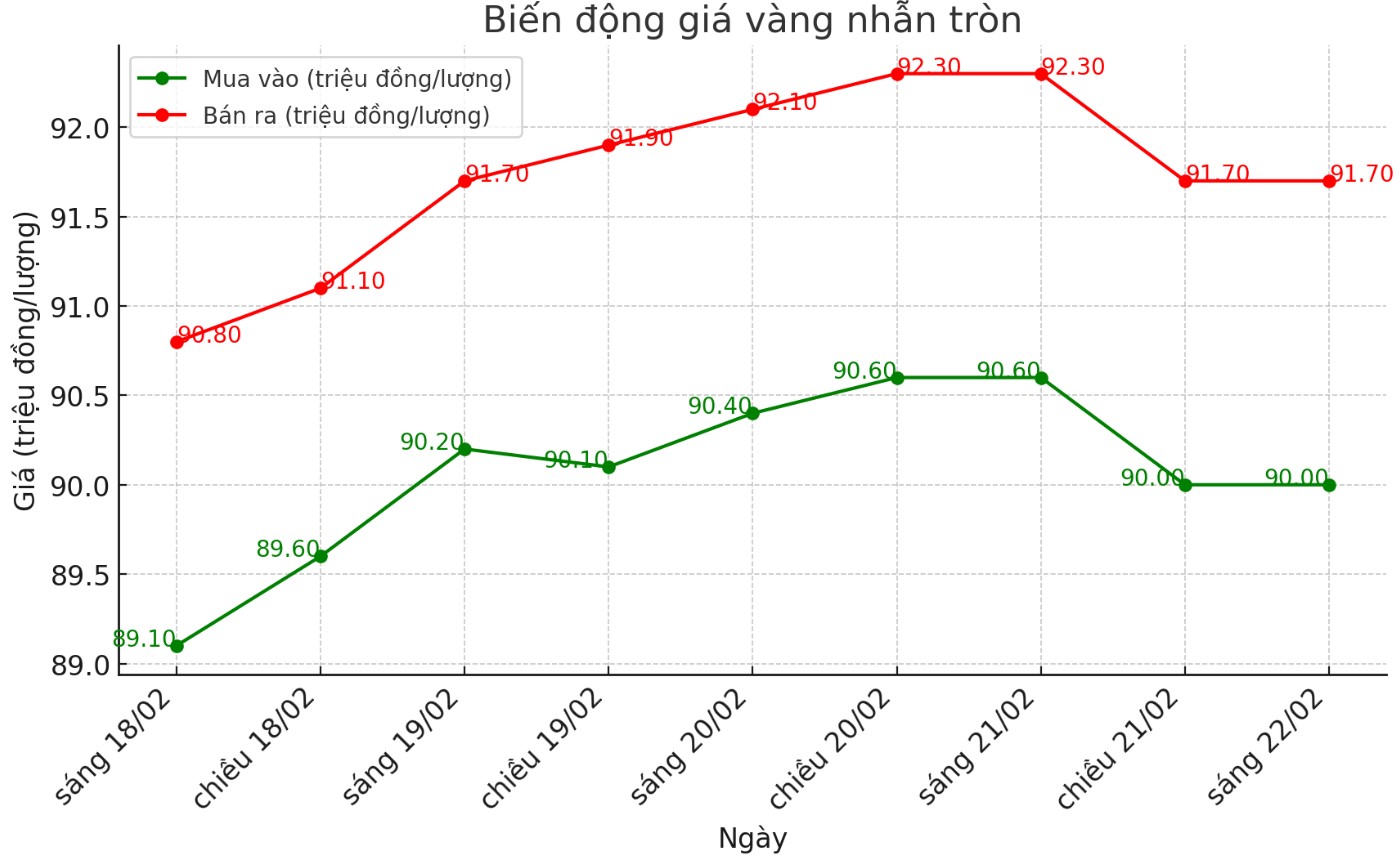

9999 round gold ring price

As of 6:00 a.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at VND90-91.7 million/tael (buy in - sell out); down VND600,000/tael for both buying and selling. The difference between buying and selling is listed at 1.7 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.05-91.8 million VND/tael (buy - sell); down 550,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling is 1.75 million VND/tael.

World gold price

As of 6:22 a.m. on February 22, the world gold price listed on Kitco was at 2,936.2 USD/ounce, down 4.5 USD/ounce compared to early this morning.

Gold price forecast

World gold prices fell amid a rising USD. Recorded at 6:22 a.m. on February 22, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106.540 points (up 0.26%).

Gold prices fell in the trading session last night mainly due to profit-taking pressure after the precious metal hit a record high yesterday. However, safe-haven demand and technical purchasing power still hold the foundation to support gold.

Gold futures for April fell $8.1 to $2,948 an ounce. March silver futures fell $0.091 to $23.395 an ounce.

The Asian and European stock markets have mixed movements but have mostly increased. Hong Kong's Hang Seng index (China) increased by about 4%, reaching its highest level since February 2022. Meanwhile, US stock indexes are expected to open with a tug-of-war trend.

Notably, the Trump administration is considering the possibility of easing sanctions against Russia in search of an agreement to end the war in Ukraine.

Gold futures for April terms are still in a strong uptrend with a clear advantage in favor of buyers. Prices are maintaining their upward momentum on the daily chart, showing a positive outlook in the short term.

Currently, the next target for buyers is to push prices above the important resistance level of $3,000/ounce, while the sellers are trying to pull prices below the solid support level of $2,850/ounce.

For now, the most recent resistance level is at the historical peak of 2,973.40 USD, followed by 2,985 USD. In contrast, the first support level is determined at 2,930.10 USD, if broken, the price may retreat to the 2,900 USD zone.

Other major markets recorded WTI crude oil prices falling slightly, trading around 71.75 USD/barrel. The yield on the 10-year US Treasury note is currently at 4.486%.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...