Gold price developments last week

Despite no specific negative factors, traders and investors are still pushing gold prices down steadily, causing the precious metal to record its first week of decline in more than two months.

Spot gold prices opened the week at $2,939.1 an ounce. After falling slightly to $2,924 an ounce, gold looks set to test last week's record high, peaking at $2,955 an ounce at around 8:45 a.m. Eastern time (ET) on Monday.

However, this was gold's highest level of the week, when efforts to maintain the $2,950/ounce mark failed on Monday evening. However, just 15 minutes before the North American market opened on Tuesday, gold prices remained at $2,943/ounce. But US traders immediately pushed prices below $2,900 an ounce at 11:30, marking the strongest decline of the week.

Gold prices then entered a narrow range of $2,895 to $2,920 an ounce. But early Thursday morning, gold fell sharply below $2,890/ounce. As European traders failed to return prices to the support level, North American markets continued to pull gold down to a new low for the week.

Gold prices then broke through the $2,870/ounce mark at around 10pm on Thursday, and continued to trade down to $2,850/ounce in the European market. As the North American market opened on Friday morning, gold continued to enter the second sharp decline of the week, reaching a low of $2,834/ounce just 15 minutes later.

However, this time, US traders have helped gold prices recover, although they could not surpass the mark of 2,860 USD/ounce. Gold ended the week at a high of around $2,850/ounce.

What do experts predict about gold prices next week?

The latest weekly survey from Kitco News shows that the number of people optimistic about gold prices is decreasing, both among experts and individual investors, as gold continues to lose value every session.

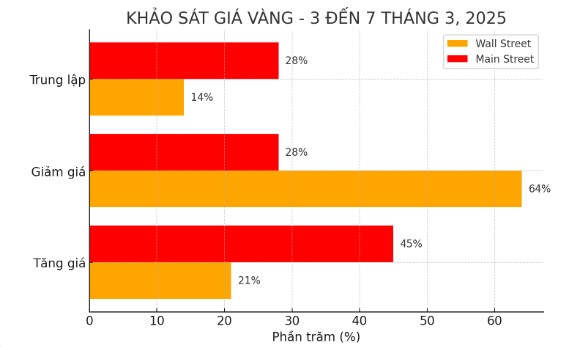

The weekly survey by Kitco News shows that out of 14 experts surveyed, only 3 people (21%) predict gold prices will increase next week, while 9 people (64%) predict prices will decrease. The remaining two experts (14%) see gold moving sideways.

In the private investor group (Main Street), out of 138 online polls, 62 people (45%) predicted gold prices to increase, 38 people (28%) predicted prices to decrease. The remaining 38 (28%) believe that gold will continue to move sideways in the coming time.

Last week, 53% of experts (9/17 people) predicted gold prices to increase, while this week, this figure decreased sharply to only 21% (3/14 people). At the same time, experts predict that gold prices will fall from 24% (4/17 people) to 64% (9/14 people), showing increasingly negative sentiment.

Optimism among individual investors has also declined. Last week, 71 (744/204 people) expected gold prices to increase, but this week, the ratio has decreased to only 45% (62/138 people). Meanwhile, investors forecast gold prices to fall from 17% to 28%, while the forecast price for sideways remains at 28%.

These figures clearly reflect the loss of confidence in gold's upward momentum as the precious metal has continuously adjusted over the past week.

Economic calendar affecting gold prices next week

Next week, the market will focus on employment data, with the US February non-farm payroll report released on Friday morning. Other key economic events include the Eurozone fast consumer price index and the US ISM manufacturing PMI on Monday, the ADP jobs report and the US ISM service PMI on Wednesday, and weekly unemployment data on Thursday.

Another major event of the week is the European Central Bank's monetary policy decision (ECB) on Thursday, with many experts expecting the ECB to make a rate cut.

See more news related to gold prices HERE...