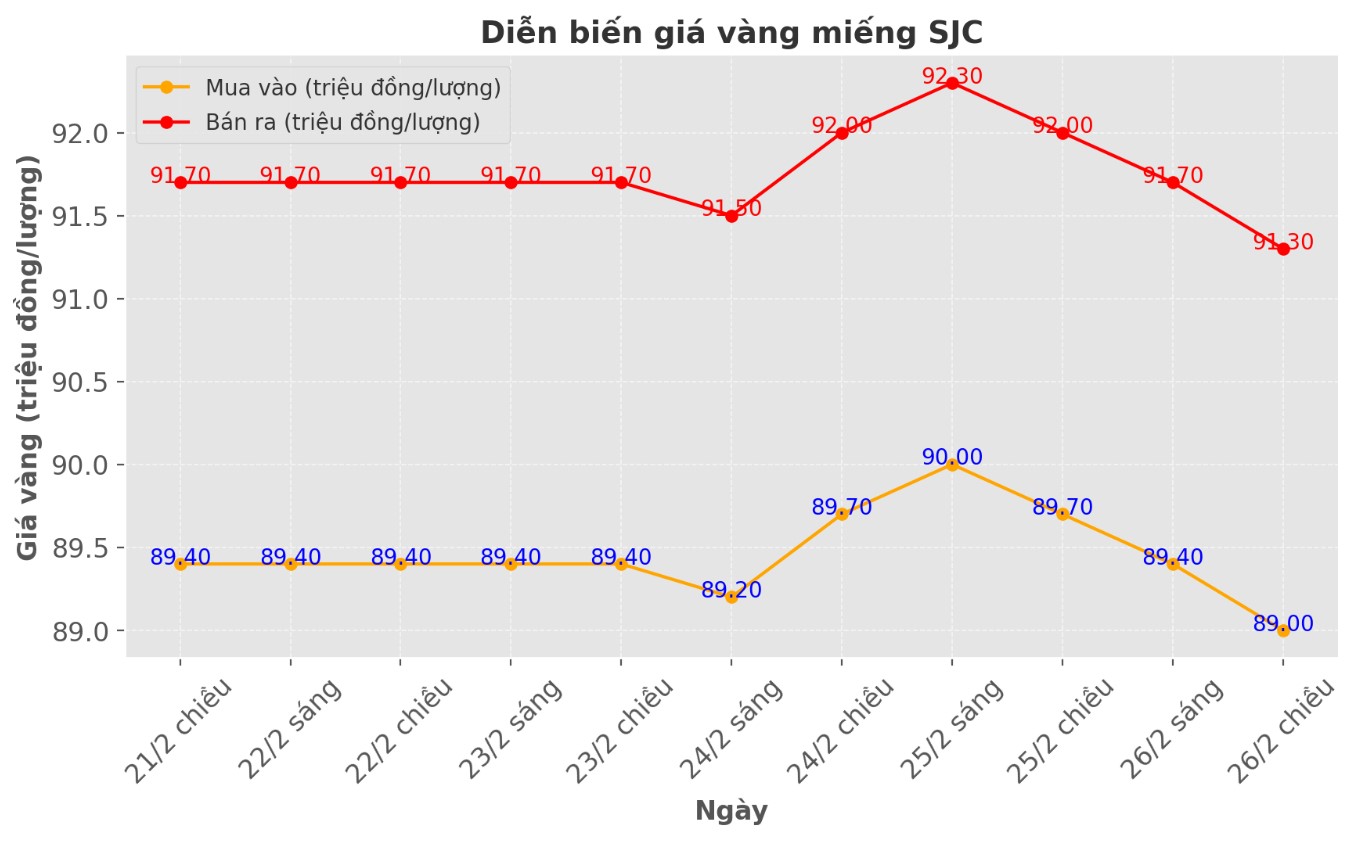

Updated SJC gold price

As of 5:30 p.m., DOJI Group listed the price of SJC gold bars at VND89-91.3 million/tael (buy in - sell out), down VND700,000/tael in both directions. The difference between the buying and selling prices of SJC gold was listed by DOJI at 2.3 million VND/tael.

At the same time, the price of SJC gold bars was listed by Saigon Jewelry Company at VND89-91.3 million/tael (buy in - sell out), down VND700,000/tael in both directions. The difference between the buying and selling prices of SJC gold at Saigon Jewelry Company SJC is at 2.3 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 89.3-91.3 million VND/tael (buy - sell), down 800,000 VND/tael for buying and down 900,000 VND/tael for selling. The difference between the buying and selling prices of SJC gold was listed by Bao Tin Minh Chau at 2 million VND/tael.

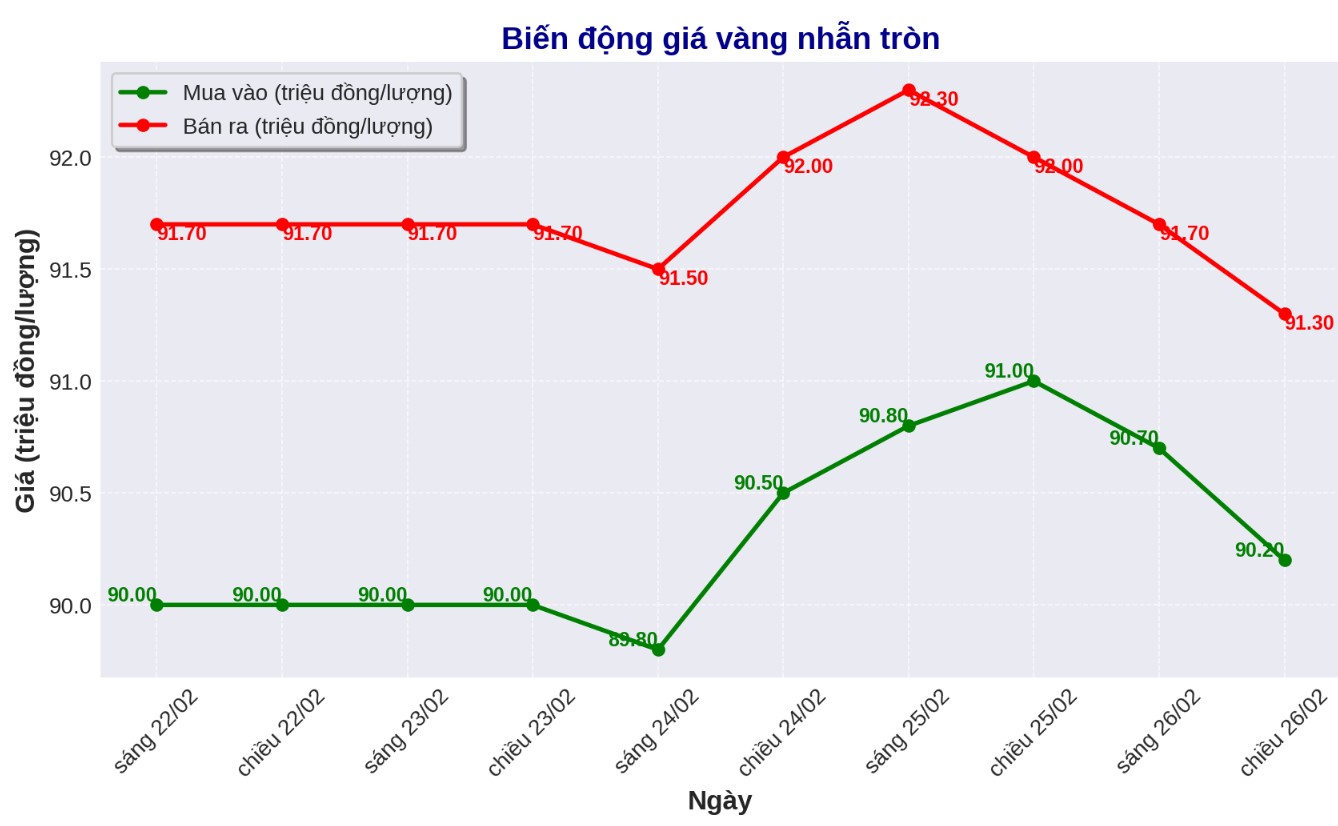

9999 round gold ring price

As of 5:30 p.m. today, the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 90.2-91.3 million VND/tael (buy - sell); down 800,000 VND/tael for buying and down 700,000 VND/tael for selling. The difference between buying and selling is listed at 1.1 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 90.2-91.8 million VND/tael (buy - sell); down 500,000 VND/tael for both buying and down 400,000 VND/tael for selling. The difference between buying and selling is 1.6 million VND/tael.

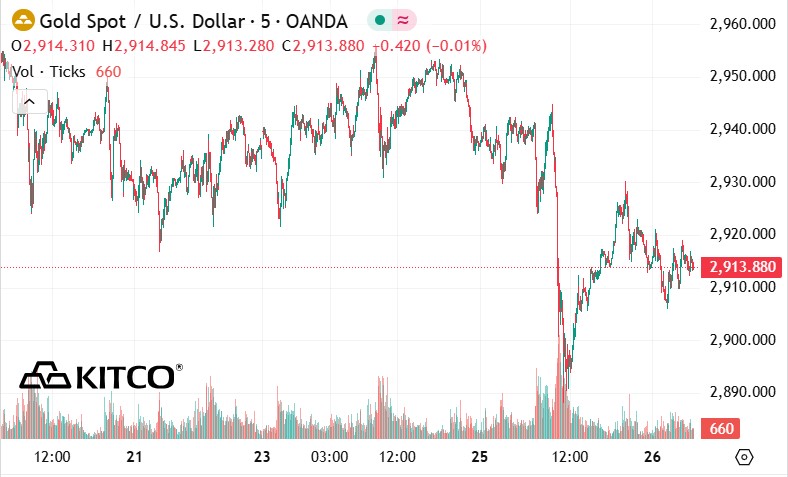

World gold price

As of 5:30 p.m., the world gold price listed on Kitco was at 2,913.8 USD/ounce, down 15 USD/ounce compared to the same time of the previous session.

Gold price forecast

World gold prices fell amid an increase in the USD. Recorded at 5:30 p.m. on February 26, the US Dollar Index measuring the fluctuations of the greenback against 6 major currencies was at 106,400 points (up 0.16%).

After rising nearly 14.46% for more than two months, gold prices slowed down as investors began taking profits.

Gold prices have had an impressive increase since mid-December 2024, reaching a record high before showing signs of going down. The precious metal rose from $2,599.6 an ounce on December 18 to an all-time high of $2,974 an ounce yesterday, equivalent to an increase of 14.46% ($375) in just over two months. As gold hit record levels, many investors are starting to consider a strategy to exit the market.

Commerzbank experts said: "It is clear that these investors believe that the upside potential of gold has run out and are therefore taking profits." They cited the latest data from the US Commodity Exchange (CSTC) showing that hedge funds have reduced nearly 12,000 gold purchase contracts.

Although there are still more than 200,000 net buy contracts, this move shows that gold's upward momentum may be weakening.

Market sentiment also shows that gold has been overbought after a recent strong rally. However, today's decrease comes amid rising trade tensions, as US President Donald Trump announced a 10% tariff on energy imports from Canada and a 25% tariff on goods from both Canada and Mexico - the two largest trading partners of the US.

These tariffs, along with the current 10% tax on imports from China, are expected to curb global economic growth and reduce consumer demand.

Analysts at Saxo Bank commented: "Safe haven demand remains high due to tariff concerns. President Trump has confirmed that tariffs on imports from Canada and Mexico will be implemented, leaving the risk of inflation and trade war at the center."

The market is waiting for new data on US Q4 preliminary GDP, US long-term goods orders, US weekly jobless claims, and US pending home sales.

Note: The article data compares with the same time of the previous trading session.

See more news related to gold prices HERE...