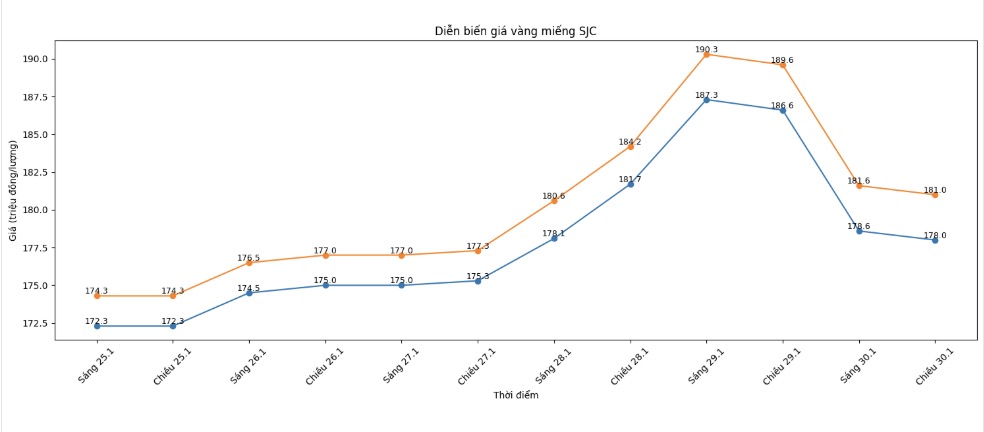

SJC gold bar price

As of 6:00 AM, SJC gold bar prices were listed by DOJI Group at 178-181 million VND/tael (buying - selling), a sharp decrease of 8.6 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), down 9.8 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 177.6-181 million VND/tael (buying - selling), down 9 million VND/tael on the buying side and down 8.6 million VND/tael on the selling side. The difference between buying and selling prices is at 3.4 million VND/tael.

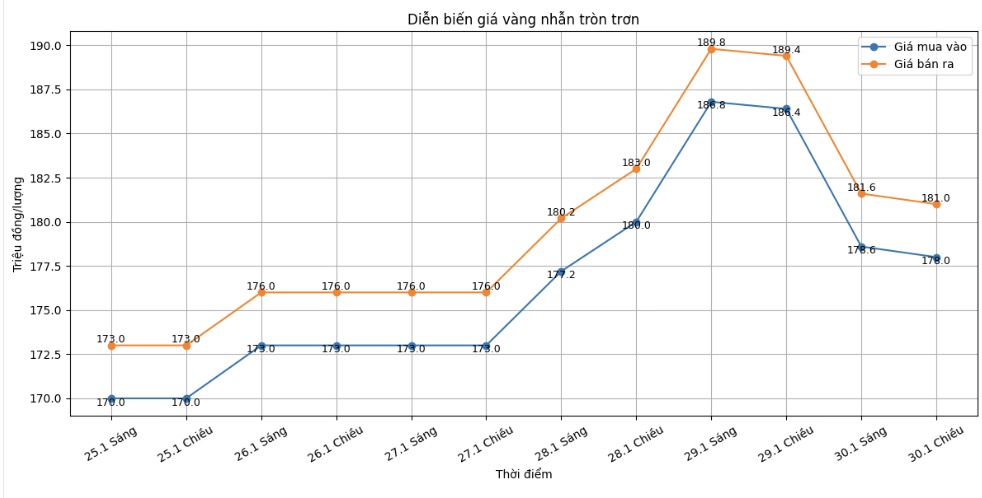

9999 gold ring price

As of 6:00 AM, DOJI Group listed the price of gold rings at 178-181 million VND/tael (buying - selling), down 8.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), down 9.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 177.3-80.3 million VND/tael (buying - selling), down 9.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

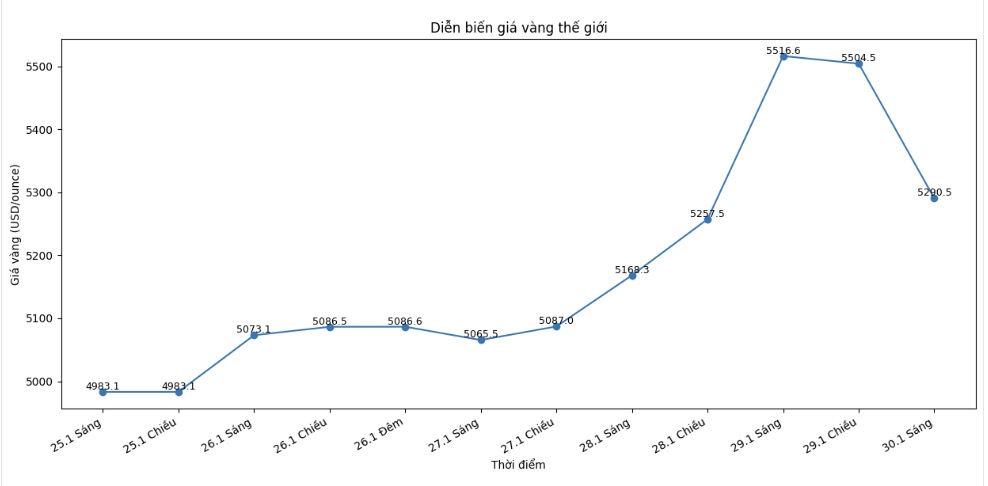

World gold price

At 1:20 am, world gold prices were listed around the threshold of 4,740 USD/ounce, down 550.5 USD compared to the previous day.

Gold price forecast

After a series of consecutive hot increases and setting new records, the world gold market is entering a period of strong correction, when a series of unfavorable factors appear at the same time. The recent decline shows that investor sentiment has changed significantly, from excitement to caution, especially in the context that expectations about US monetary policy are no longer too optimistic.

According to international news agencies such as Reuters and Kitco, the direct reason for the sharp drop in gold prices is the market's re-evaluation of the possibility that the US Federal Reserve (Fed) will soon cut interest rates. Signs that the Fed will maintain a more cautious stance, along with information related to senior personnel of this agency, have stabilized the USD, thereby creating clear pressure on the precious metal.

The market believes that Mr. Kevin Warsh is a relatively tough person and will not rush to ease monetary policy. This weakens interest rate cut expectations and encourages investors to take profits," said Tom Price, an analyst at Panmure Liberum.

Besides the interest rate factor, the strong rise of the USD also contributes to making gold less attractive in the short term. As the greenback recovers, gold prices – which are valued in USD – become more expensive for investors holding other currencies, reducing buying demand in the international market.

Another important factor is the wave of profit-taking after a period of too rapid increase. From the beginning of January to before the adjustment, gold prices have increased at a two-digit level, pushing many technical indicators into the overbought zone. In the context of thin liquidity and increased defensive sentiment, selling pressure quickly overwhelmed buying pressure.

Precious metals have increased too high and too fast. This adjustment is a reminder that this is a two-way market, with a not small level of risk," independent analyst Ross Norman warned.

However, many experts believe that the current decline is not enough basis to confirm that the long-term upward trend of gold has ended. Foundation factors such as high global public debt, prolonged geopolitical instability and the demand for gold hoarding from central banks are still playing a supporting role.

Gold price data is compared to the previous day.

The world gold market operates through two main pricing mechanisms. The first is the spot market, where prices are quoted for transactions and immediate delivery.

The second is the futures contract market, where prices are set for futures delivery. Due to year-end closing activities, December gold futures contracts are currently the most actively traded type on the CME.

See more news related to gold prices HERE...