According to Reuters, Kitco and Bloomberg, the deep decline of precious metals stems from a series of unfavorable factors, including weakening expectations of interest rate cuts in the US, the USD stabilizing and the wave of massive profit-taking by investors after a period of hot growth.

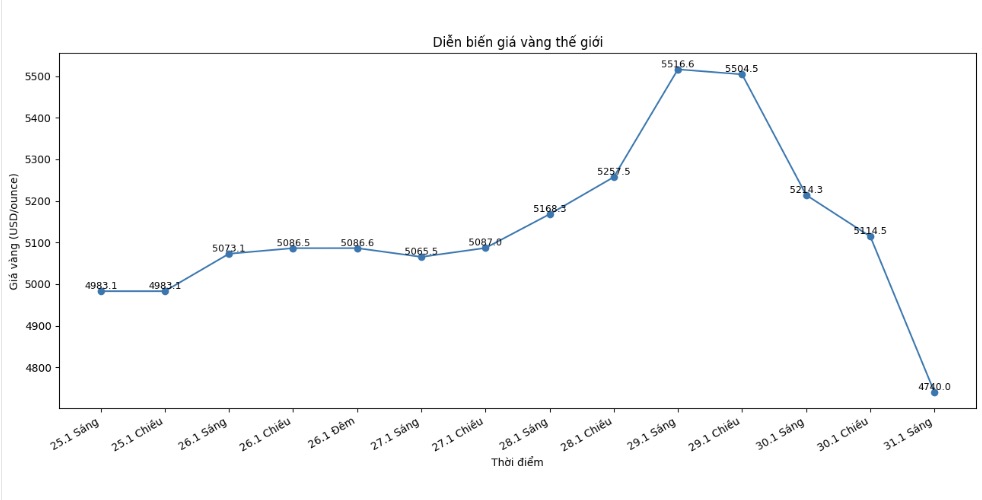

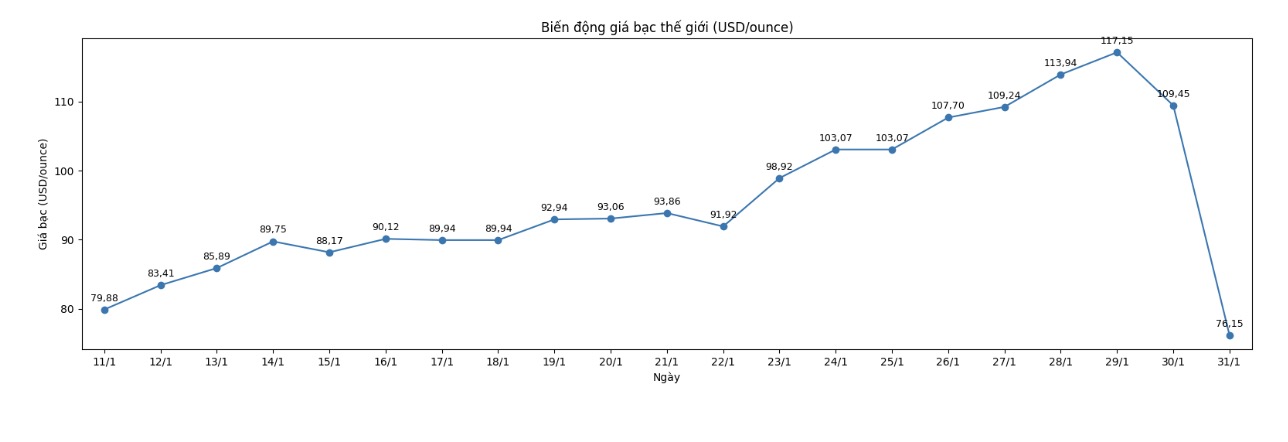

Last night, spot world gold prices continuously fell below important psychological thresholds of 5,000, 4,900 and then 4,800 USD/ounce, while silver also lost the 100 and then 90 USD/ounce mark. As of 1:20 am on January 31 (Vietnam time), spot gold prices were listed at the threshold of 4,740 USD/ounce, while spot silver fell to 76.15 USD/ounce.

This development caused the precious metal market to "cool down" quickly, completely contrary to the previous excited atmosphere.

Expectations for US interest rate cuts weaken

According to Reuters, the direct reason for the sharp drop in gold and silver is that the market is re-evaluating the outlook for US monetary policy. Expectations about the possibility of the US Federal Reserve (Fed) soon sharply cutting interest rates are gradually fading, after signs appeared that the Fed will maintain a more cautious stance.

Notably, US President Donald Trump announced that he had chosen former Fed Governor Kevin Warsh as Fed Chairman in the near future. This information immediately affected market sentiment.

The market believes that Kevin Warsh has a reasonable view and will not strongly push for interest rate cuts," said Tom Price, an analyst at Panmure Liberum. According to him, capital-saving investors have taken advantage of profit-taking as the prospect of monetary easing is no longer too clear.

Choosing Warsh is likely to help the USD stabilize somewhat, reducing the risk of the greenback weakening for a long time. That is also the reason for the sharp drop in gold and silver" - Evercore ISI Vice President Krishna Guha explained.

USD stabilizes again, putting pressure on precious metals

Along with the interest rate factor, the USD also played an important role in this price drop. After information about Fed personnel, the USD Index - a measure of the strength of the greenback against a large basket of currencies - has rebounded.

According to Reuters, the strengthening USD makes gold and silver - which are valued in USD - more expensive for investors holding other currencies. This reduces buying demand in the international market, while activating quantitative trading models of investment funds, thereby increasing selling pressure.

Analysts believe that the reverse relationship between the USD and precious metals has had a clear impact in the recent session, especially when the market lacks new supporting factors.

Wave of profit-taking after a "hot" rally

Another key factor causing gold and silver prices to plummet is strong profit-taking after a period of too rapid increase. Since the beginning of January, gold prices have increased by about 17%, while silver prices have even jumped to nearly 39%.

According to Kitco and Reuters, the profit-taking session took place right in the last trading session of the month, in the context of thin liquidity and fear of missing opportunities (FOMO) previously pushed prices up too much.

Both gold and silver are in a state of readiness to adjust, due to high speculation and a somewhat out-of-control increase in recent times," said Ole Hansen, Commodity Strategy Director at Saxo Bank.

By the middle of the European trading session, gold prices fell 4.7% to 5,143.40 USD/ounce, while silver prices lost 11%, falling to 103.40 USD/ounce, after setting record highs of 5,594.80 USD and 121.60 USD/ounce respectively the previous day.

Precious metals have been affected by gravity

Many experts believe that the recent sharp decline is a clear reminder of the risks of the precious metals market. "Precious metals have increased too high and too fast. This is a fierce correction, but it reminds speculators that this is a two-way market" - independent analyst Ross Norman commented.

Not only gold and silver, copper prices also turned down after hitting historical highs. Copper prices at times fell more than 1%, to 13,465 USD/ton, although still increasing by about 6% in January.

According to Ms. Alice Fox - an analyst at Macquarie, metal prices are likely to remain high but fluctuate strongly, as cash flow continues to pour into a market that is already small in scale and becoming too crowded.

Reuters said that traders are more cautious before the Lunar New Year holiday in China - the world's largest metal consumer. Many investors do not want to hold risky positions in the context of strong market volatility.