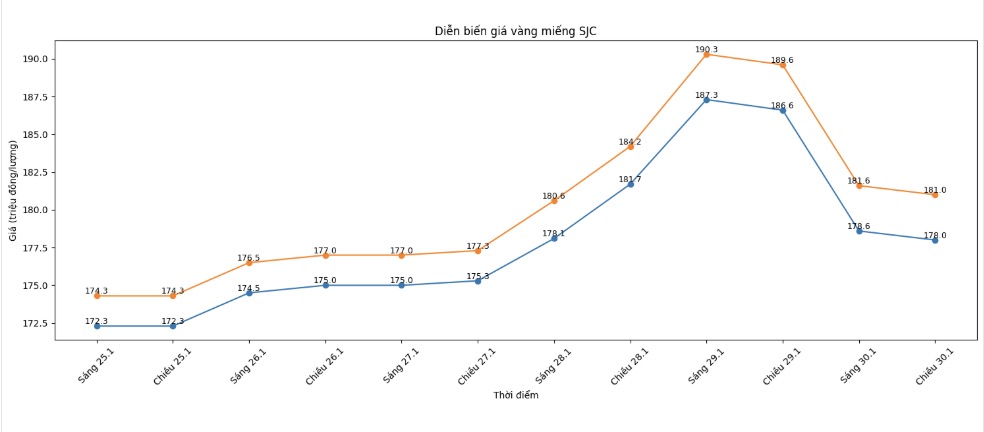

SJC gold bar price

As of 7:00 PM, SJC gold bar prices were listed by DOJI Group at 178-181 million VND/tael (buying - selling), a sharp decrease of 8.6 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price was listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), down 9.8 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 177.6-181 million VND/tael (buying - selling), down 9 million VND/tael on the buying side and down 8.6 million VND/tael on the selling side. The difference between buying and selling prices is at 3.4 million VND/tael.

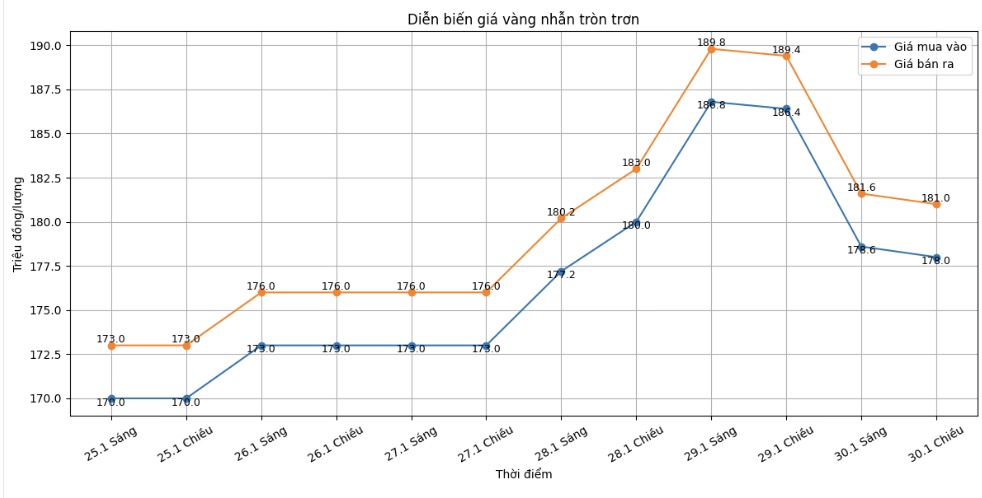

9999 gold ring price

As of 5:30 PM, DOJI Group listed the price of gold rings at 178-181 million VND/tael (buying - selling), down 8.4 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), down 9.8 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 177.3-80.3 million VND/tael (buying - selling), down 9.3 million VND/tael in both directions. The buying - selling difference is at 3 million VND/tael.

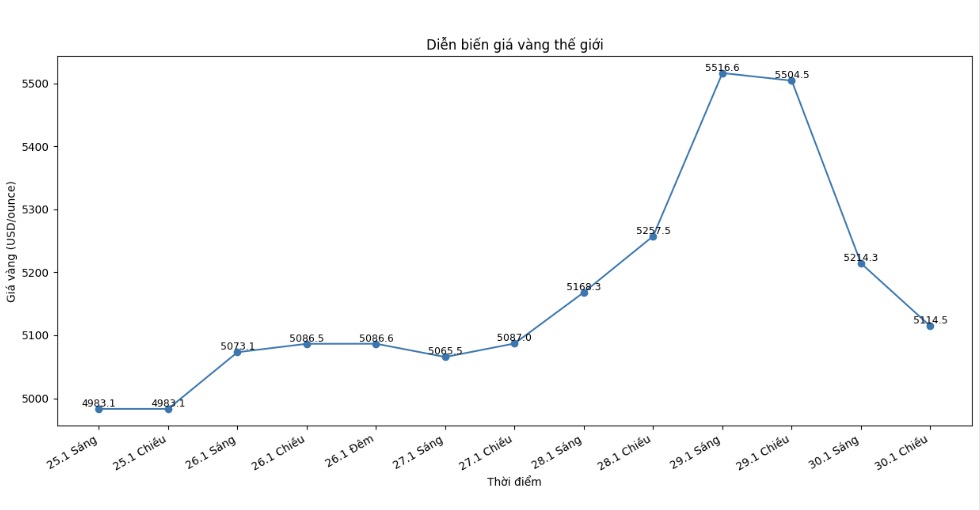

World gold price

At 7:00 PM, world gold prices were listed around the threshold of 5,114.5 USD/ounce; down 390 USD compared to the previous day.

Gold price forecast

After a series of hot increases breaking a series of forecasts, world gold prices are entering a period of strong correction, reflecting a rapid change in the expectation of monetary policy and the return of cautious sentiment from investors. The decline of more than 4% in just one session shows that the gold market is no longer operating according to pure shelter inertia, but is clearly affected by policy factors and speculative cash flow.

According to analysts, information surrounding the possibility of senior personnel changes at the US Federal Reserve (Fed) has become a catalyst for gold to reverse course. The prospect that the Fed may be led by a President with a tougher stance on inflation is causing monetary easing expectations to be adjusted, thereby putting pressure on non-profit assets such as gold.

Mr. Tim Waterer - chief trading expert at KCM, said that the current adjustment is a combination of many factors. "The possibility of the Fed choosing a less moderate Chairman, along with the recovery of the USD and prolonged excessive buying status, has made gold inevitably under adjustment pressure in the short term," he said.

Besides policy factors, technical indicators also show that gold has fallen into the overbought zone after a "parabolic" upward period. This forces many short-term investors to take profits to preserve profits, especially in the context of market liquidity decline and exchanges raising margin requirements for precious metal contracts.

However, many opinions believe that the current adjustment is not enough basis to confirm that the upward trend has ended. Mr. Christopher Wong - strategist at Oversea-Chinese Banking Corp., said that this decline is more technical than fundamental reversal. "Gold prices are rising too fast, so a rapid decline is inevitable. Information about the Fed only plays the role of'excuse' for the market to adjust a decreasing upward momentum," he said.

In the medium and long term, the foundational factors supporting gold are still present, including increased global public debt, prolonged geopolitical instability and the trend of diversifying central bank reserves. However, experts warn that in the coming period, gold may continue to fluctuate strongly, with a larger amplitude and higher risks for short-term cash flow.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...