Many warnings about the possibility of price reduction

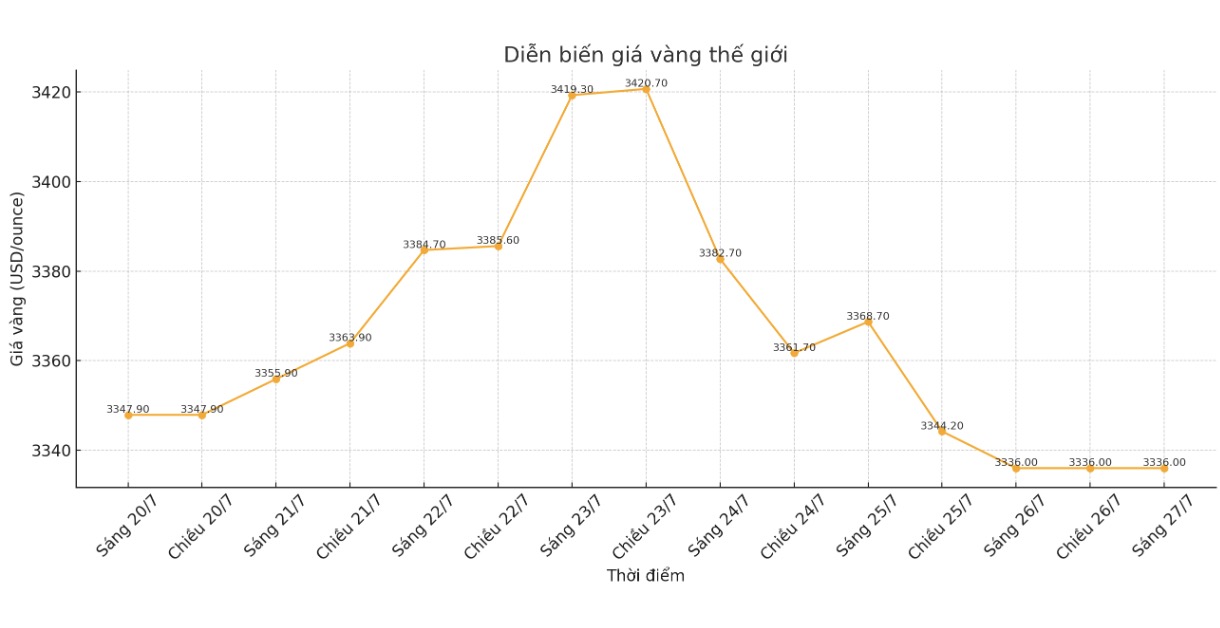

With gold sliding below the $3,350/ounce support level, some technical experts believe the correction trend has begun to emerge.

Michael Moor, founder of Moor Analytics, pointed out that short-term technical models have been signaling a reversal. According to him, gold prices have lost their previous upward momentum when they broke important levels.

Similarly, Mr. Marc Chandler - CEO of Bannockburn Global Forex - commented that gold is "heavy" and if the $3,321.5/ounce mark is penetrated, the decline could extend to the $3,250/ounce area. He also warned of a vibrant trading week ahead, with a series of important economic data such as US GDP, FOMC meeting and PCE price index.

Meanwhile, FxPro senior analyst Alex Kuptsikevich said gold is facing the risk of a deep correction if it continues to fail to maintain above $3,450/ounce - a price that has been denied four times since April. According to him, if the trend is broken down for the average of 50 days, prices could quickly fall to the 3,150 or even 3,050 USD/ounce zone.

For his part, Mr. Daniel Pavilonis - senior commodity broker at RJO Futures - commented that gold prices may weaken in the context of inflation not exploding as expected and bond yields continuing to decrease. He also noted the possibility of real estate reallocation by investors, causing cash flow to temporarily withdraw from gold.

Sharing the same view, Kitco senior expert Jim Wyckoff believes that gold will continue to accumulate, but tends to weaken as investors' risk appetite in the market is improving.

Most likely to pass

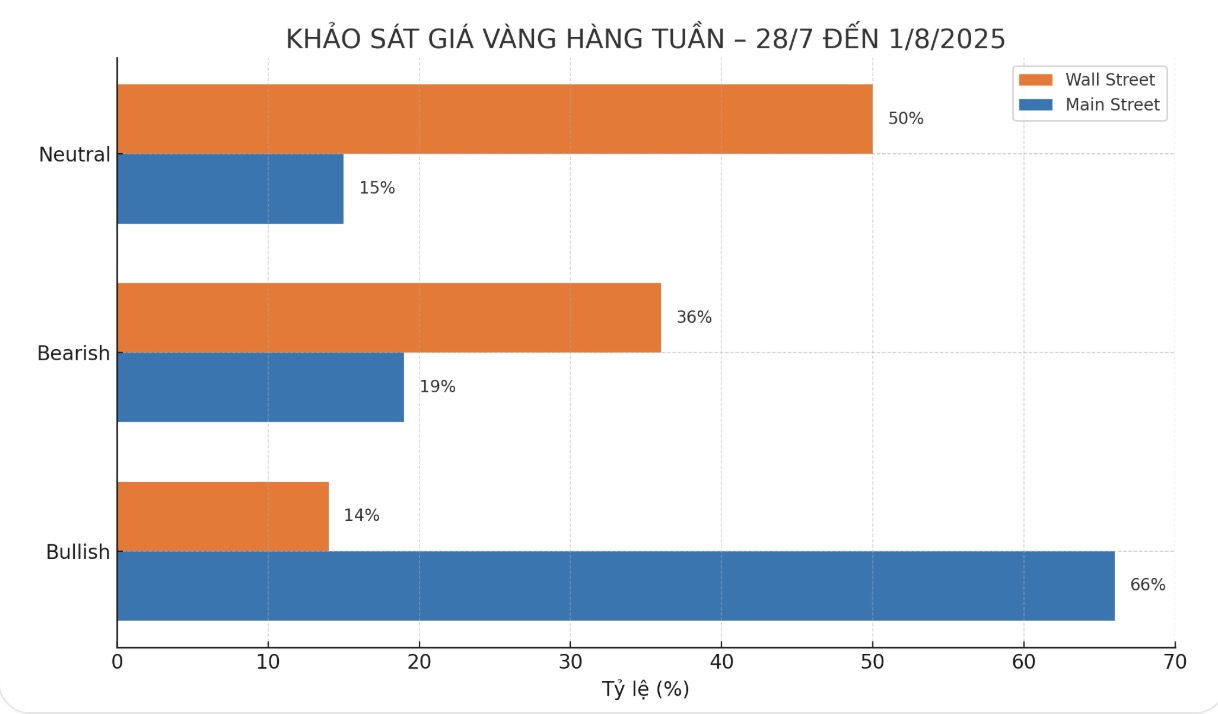

In addition, many experts believe that the gold market will continue to be "unclear", at least in the short term.

There is no reason for gold to collapse, but there is also a lack of momentum to boost strongly, according to Barchart.com veteran analyst Darin Newsom. He said prices could slide slightly as cash flow shifts to silver and copper, but golds safe haven role remains unchanged.

Commerzbank's analysis team also expressed a neutral view. According to them, gold is struggling with supporting and hindering factors, in which international trade agreements are weakening the safe-haven appeal of this precious metal.

From another perspective, Mr. Adrian Day - Chairman of Adrian Day Asset Management - predicted that gold will continue to fluctuate within a narrow range as it has been since mid-April. He emphasized that only when there are strong enough puts such as economic crises, surprise policies or major changes from the Fed, can gold make a clear breakthrough.

The gold market has been forming a "row-end" model since April with peaks gradually decreasing and bottoms gradually rising reflecting investors hesitation.

Experts still believe gold prices will increase

In contrast to the cautious atmosphere, some experts believe that gold is facing a new opportunity to increase.

Regardless of whether the US Federal Reserve (FED) keeps interest rates unchanged or cuts at its upcoming meeting, both scenarios could support gold and silver prices to increase, according to Rich Checkan, Chairman and COO of Asset Strategies International.

From a similar perspective, Mr. James Stanley - senior market strategist at Forex.com - said that what the market is witnessing is just a temporary correction. If the Fed continues to maintain expectations of a rate cut this year without being too dovish, gold will continue to benefit - as it has for the past year and a half, he said.

Meanwhile, Mr. Kevin Grady - Chairman of Phoenix Futures and Options - said that the slight adjustment of the gold market due to positive news from trade agreements is normal. However, he emphasized that gold can still increase in parallel with stocks, especially when central banks continue to buy strongly and the trend of separating from the USD is becoming increasingly clear.