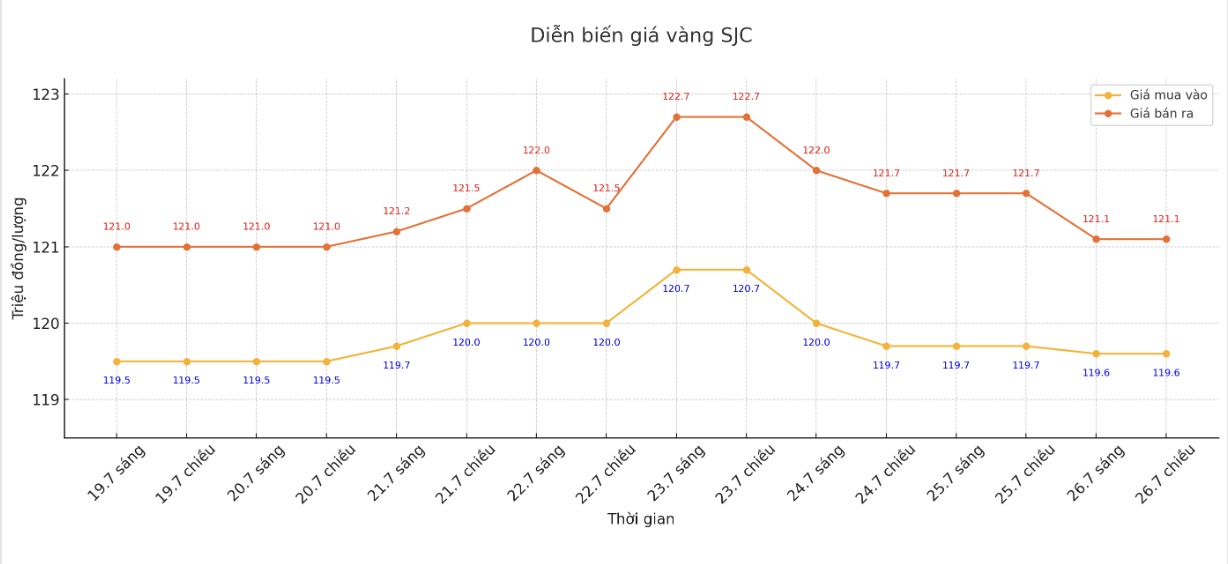

SJC gold bar price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.6-121.1 million/tael (buy - sell); down VND 100,000/tael for buying and down VND 600,000/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

DOJI Group listed at 119.6-121.1 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.6-121.1 million VND/tael (buy - sell); down 100,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 118.8-121.1 million VND/tael (buy - sell); down 400,000 VND/tael for buying and down 600,000 VND/tael for selling. The difference between buying and selling prices is at 2.3 million VND/tael.

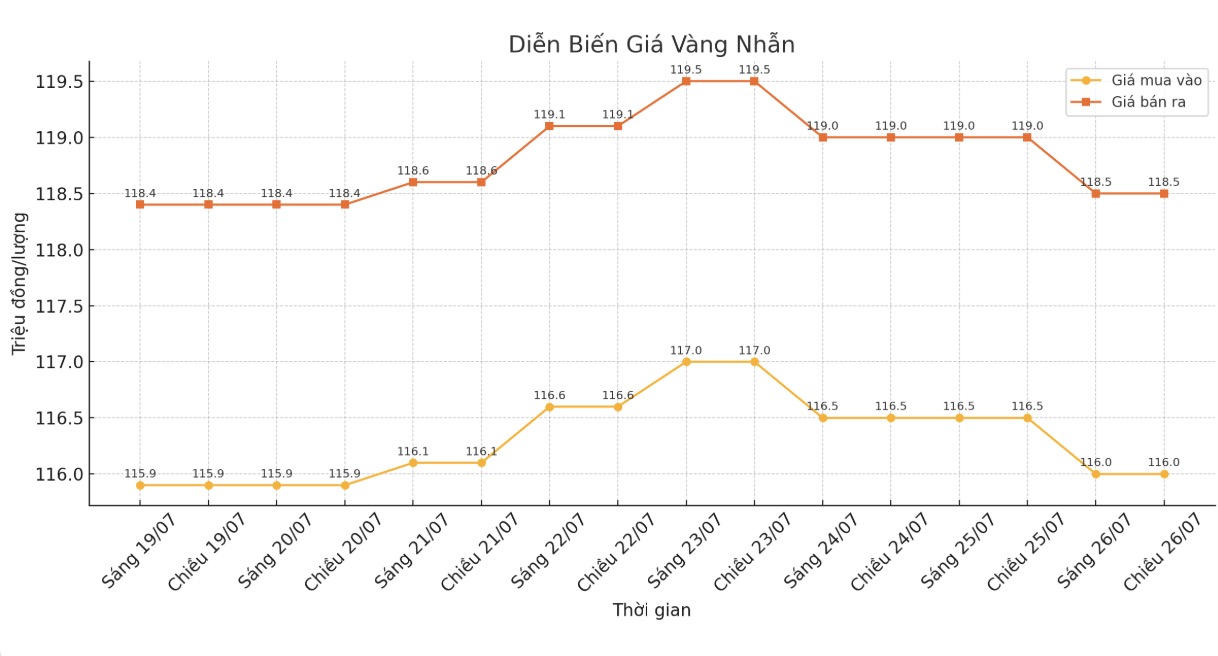

9999 gold ring price

As of 5:15 p.m., DOJI Group listed the price of gold rings at 116-118.5 million VND/tael (buy in - sell out), down 500,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.2-119.2 million VND/tael (buy - sell), down 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.1-118.1 million VND/tael (buy in - sell out), down 400,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

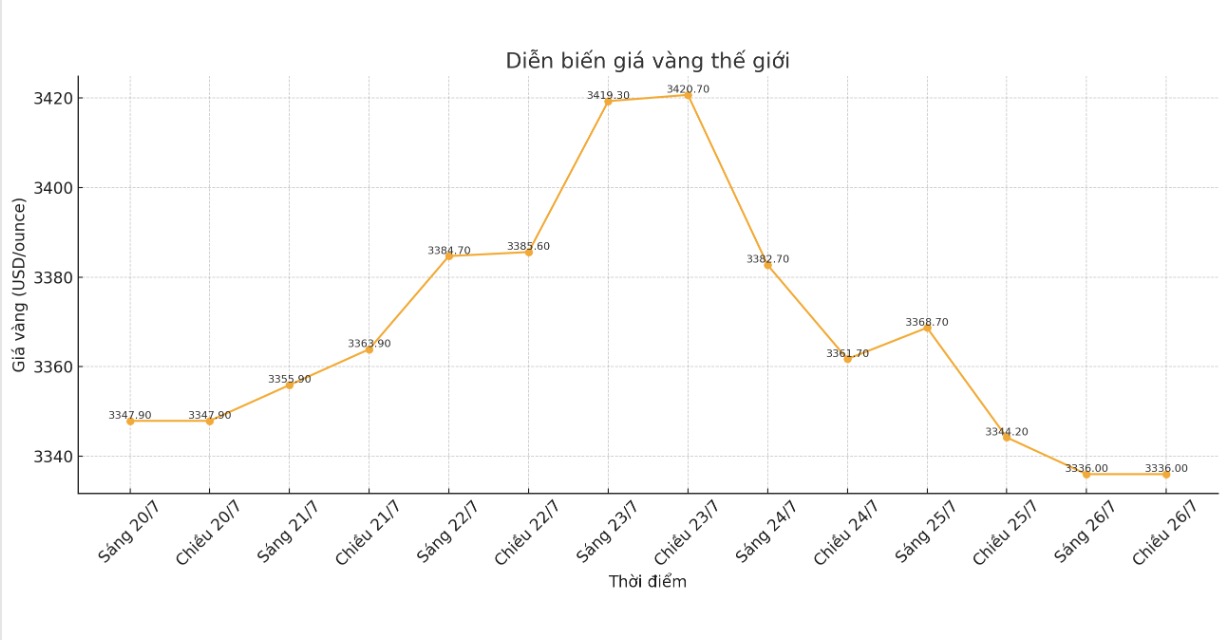

World gold price

The world gold price was listed at 5:15 p.m. at 3,336 USD/ounce, down 8.2 USD compared to 1 day ago.

Gold price forecast

Market developments last week are proof that gold prices can fluctuate strongly in the context of the lack of clear economic data.

The increase above the threshold of 3,400 USD/ounce at the beginning of the week partly reflects expectations that a stable economy will create conditions for the US Federal Reserve (FED) to start cutting interest rates, in addition to less concerns about recession.

However, the sell-off that took place soon after showed that investors had returned to a simpler investment mindset: expectations of an economic recovery and stable trade increased risk appetite, dragging cash flow away from gold to high-yielding channels such as stocks.

Mr. Kelvin Wong - senior market analyst at OANDA - commented that the gold market is witnessing profit-taking activities from short-term speculators, after a period of price increase thanks to expectations of progress in trade negotiations.

Despite being pressured for a short-term correction, gold is still supported by many sustainable factors in the long term. Mr. Brian MacHaney - an expert at Raymond James - said that structural risks such as budget deficits, prolonged inflation and trade instability will continue to play a supporting role in gold prices.

A recent report from the World Gold Council (WGC) also recorded global gold demand in the first half of 2025 at a very high level, with an average trading volume per day reaching a record of 329 billion USD. Global investment funds have increased their gold holdings by about 397.1 tonnes equivalent to $38 billion over the same period, showing that the price increase is still solidly based despite short-term fluctuations.

From a technical perspective, Peter Grant of Zaner Metals believes that $3,300/ounce will play an important support role. However, the possibility of gold setting a new peak may not appear until the Fed makes a policy decision next week.

The next trading week, also the last week of July, is expected to be full of fluctuations as the market enters a series of important economic events. Investors will focus on monitoring the GDP report for the second quarter of 2025, employment data for July and especially the Fed's monetary policy decision on July 30.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...