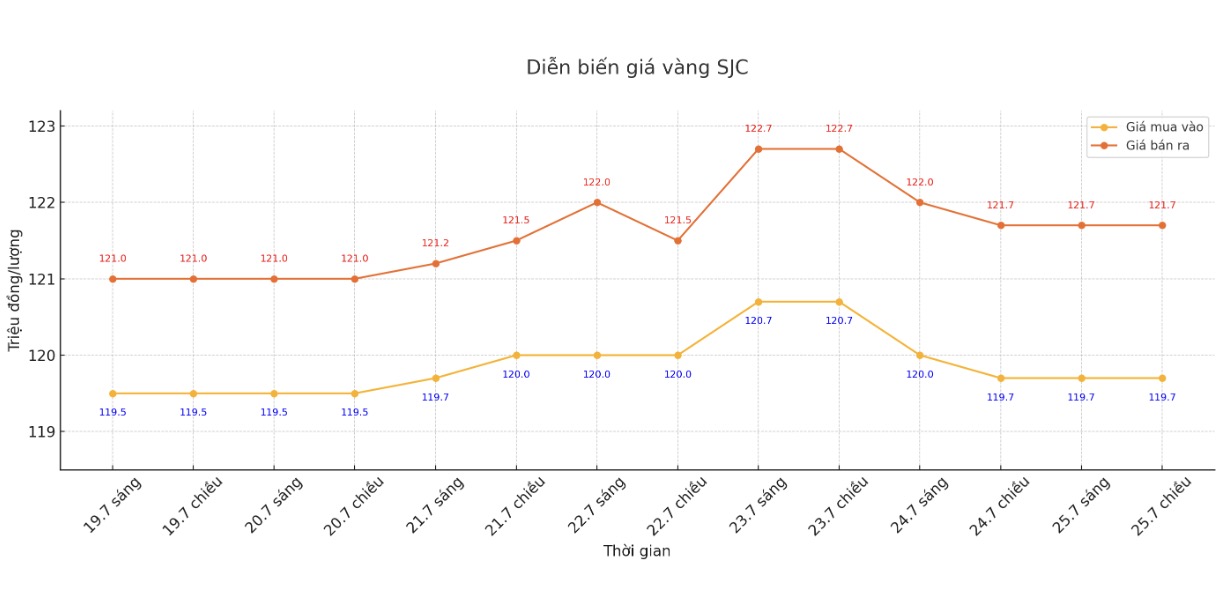

SJC gold bar price

As of 5:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 119.7-121.7 million/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 119.7-121.7 million VND/tael (buy - sell); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 119.7-121.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 119.2-121.7 million VND/tael (buy in - sell out); unchanged. The difference between buying and selling prices is at 2.5 million VND/tael.

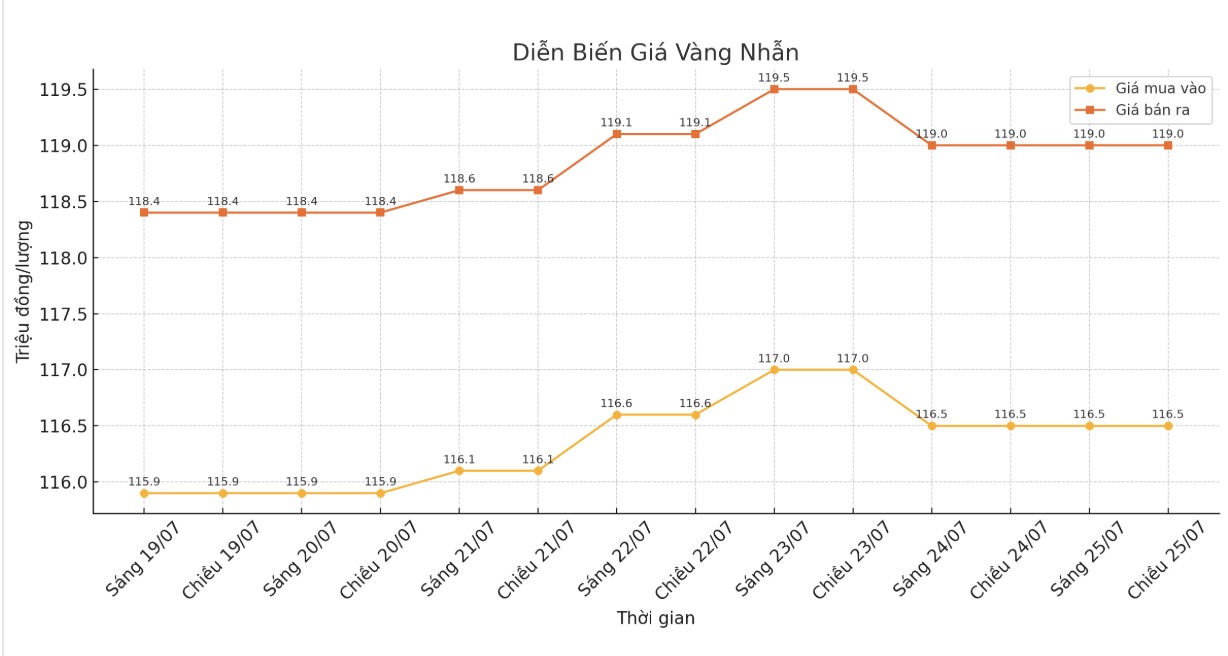

9999 gold ring price

As of 5:15 p.m., DOJI Group listed the price of gold rings at 116.5-119 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116.7-119 7.5 million VND/tael (buy in - sell out), unchanged. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 115.5-118.5 million VND/tael (buy in - sell out), down 200,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

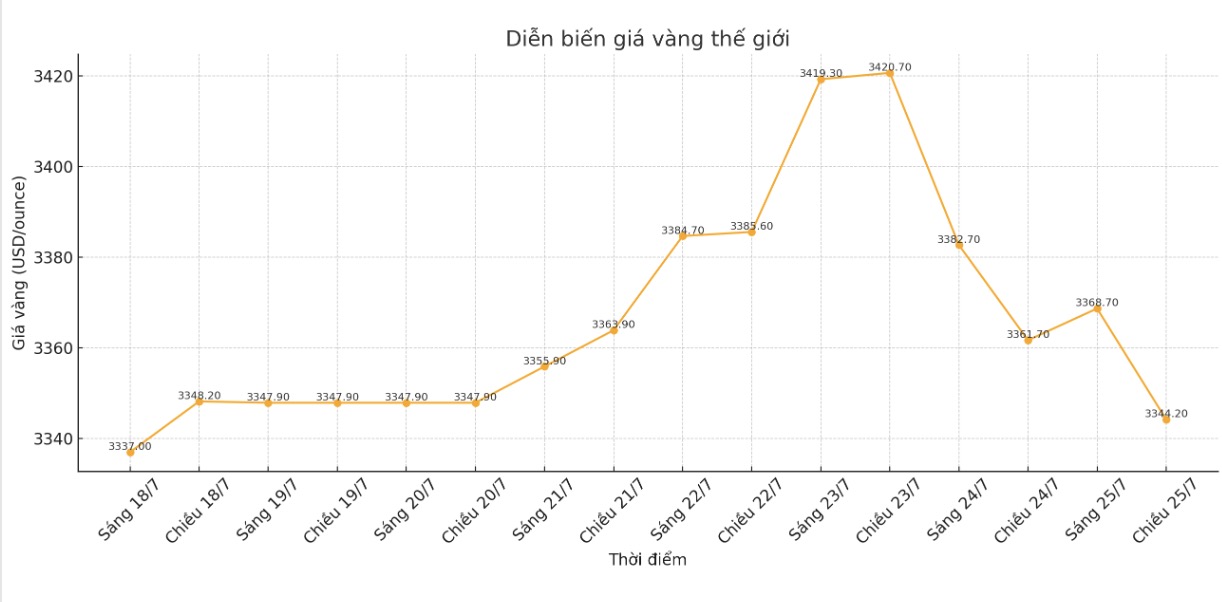

World gold price

The world gold price was listed at 5:15 p.m. at 3,344.2 USD/ounce, down 17.5 USD compared to 1 day ago.

Gold price forecast

Gold prices fell on Friday, under pressure from the recovery of the USD and optimism about the progress in trade negotiations between the US and the European Union. US gold futures also fell 0.7%, to $3,349.8/ounce.

The US dollar recovered from a more than two-week low, making gold more expensive for foreign buyers, while yields on 10-year US Treasury bonds increased.

The recovery in risk appetite due to optimism about potential tariff negotiations, along with lower-than-expected US unemployment claims, reinforces the view that the US Federal Reserve. (FED) is unlikely to cut interest rates putting pressure on gold - Mr. Ricardo Evangelista - senior analyst at brokerage ActivTrades commented.

There are still some uncertainties... with strong support around $3,300/ounce, I see gold prices likely to increase if new fluctuations appear, he added.

The European Commission said on Thursday that a trade negotiation solution with the United States is within reach, while EU countries have voted to impose countervailing tariffs on US goods at $93 billion if the negotiations fail.

Data shows that the number of Americans filing for new unemployment benefits last week fell to a three-month low, showing a stable labor market.

President Donald Trump has put pressure on Fed Chairman Jerome Powell to demand a rate cut during a tense visit to the central bank on Thursday less than a week before the next monetary policy meeting, where policymakers are expected to keep rates unchanged.

The market is now betting on the possibility of a rate cut in September.

Gold often tends to increase in price during times of uncertainty and when interest rates are low.

Spot silver prices also fell 0.6% to $38.85 an ounce, but are still on track for a weekly gain of about 1.6%. platinum prices fell 1.2% to $1,391.25, while palladium also lost 1.2%, to $1,213.76.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...