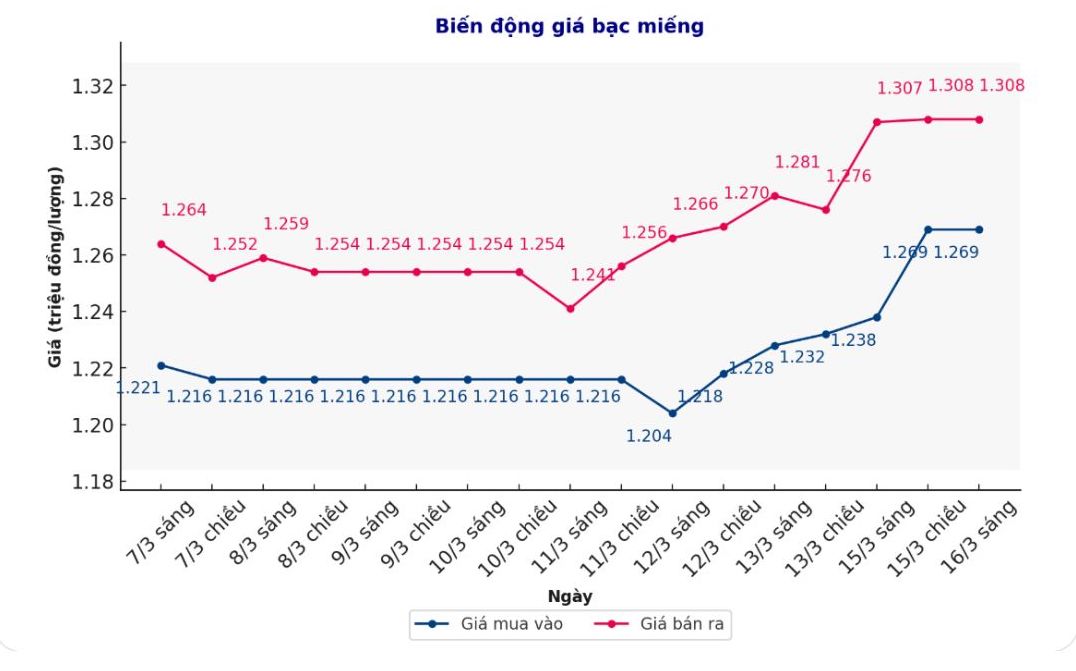

Domestic silver price

As of 9:30 a.m. on March 16, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.269 - 1.308 million/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

If buying silver bars at Phu Quy Jewelry Group on March 9 and selling them this morning (October 16), buyers at Phu Quy Jewelry Group will make a profit of VND 15,000/tael.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.269 - 1.308 million VND/tael (buy - sell); unchanged in both buying and selling directions compared to early this morning.

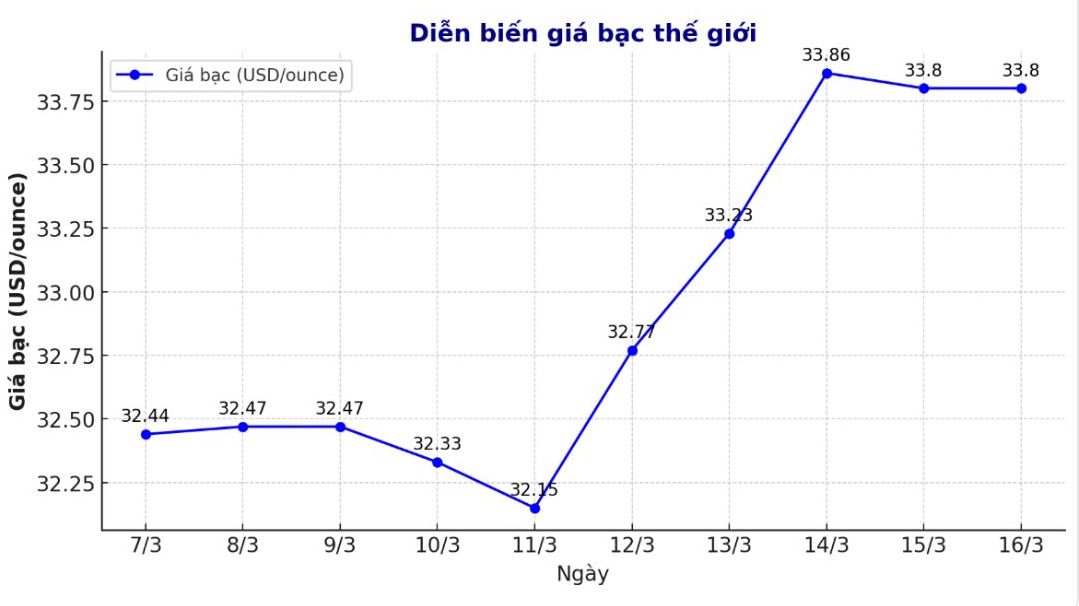

World silver price

On the world market, as of 9:45 a.m. on March 16 (Vietnam time), the world silver price listed on Goldprice.org was at 33.80 USD/ounce; unchanged from the same time of the previous trading session.

Causes and predictions

According to FXStreet, silver prices increased thanks to the benefits of safe-haven demand as global trade tensions escalated.

Concerns have increased after US President Donald Trump threatened to impose a 200% tax on wine, ginseng and other alcoholic beverages from Europe, in response to the 50% tax that the EU imposes on US whisky.

Along with that, silver prices continue to be supported by increasingly high expectations that the Federal Reserve (FED) will cut interest rates after having weak inflation data from the US.

On Thursday, the US Producer Price Index (PPI) rose 3.2% year-on-year in February, down from January's 3.7% and forecast at 3.3%. The core PPI, which excludes food and energy, rose 3.4% year-on-year, up from 3.8% in January.

Consumer Price Index (CPI) data released on Wednesday showed inflation fell from 3.0% to 2.8% year-on-year, while core inflation fell from 3.3% to 3.1%.

However, the increase of silver may be limited if the USD continues to strengthen. A stronger US dollar makes silver more expensive for foreign buyers, which could reduce demand.

See more news related to silver prices HERE...