Domestic silver price

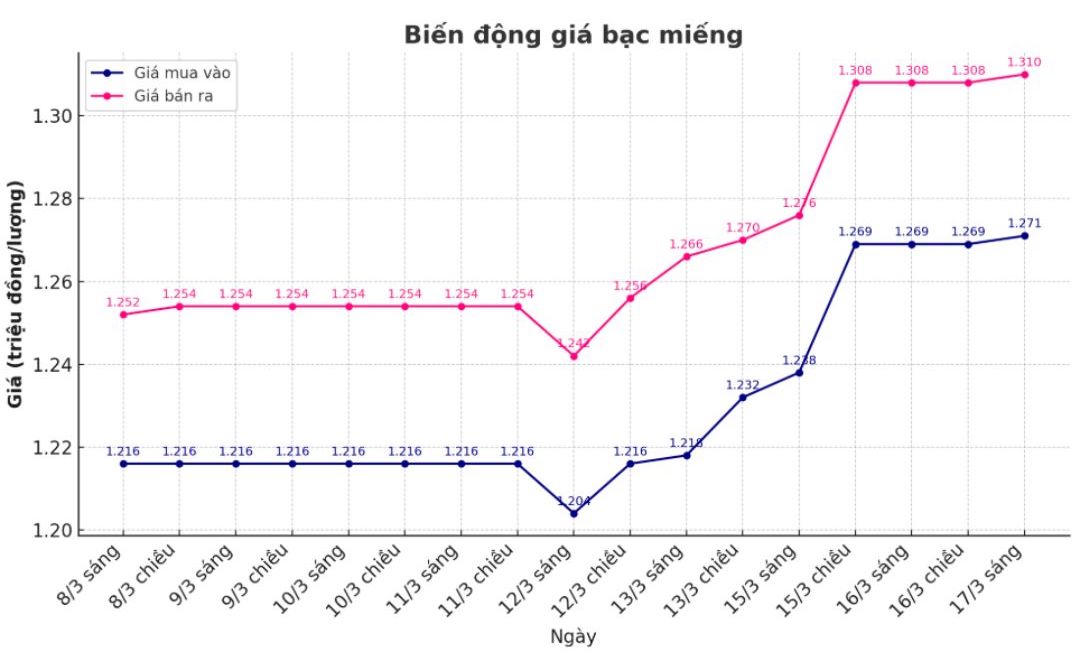

As of 9:30 a.m. on March 17, the price of 999 silver bars at Phu Quy Jewelry Group was listed at VND1.271 - 1.310 million/tael (buy - sell); an increase of VND2,000/tael for both buying and selling compared to early this morning.

At the same time, the price of 999 taels of silver at Phu Quy Jewelry Group was listed at 1.271 - 1.310 million VND/tael (buy - sell); an increase of 2,000 VND/tael for both buying and selling compared to early this morning.

World silver price

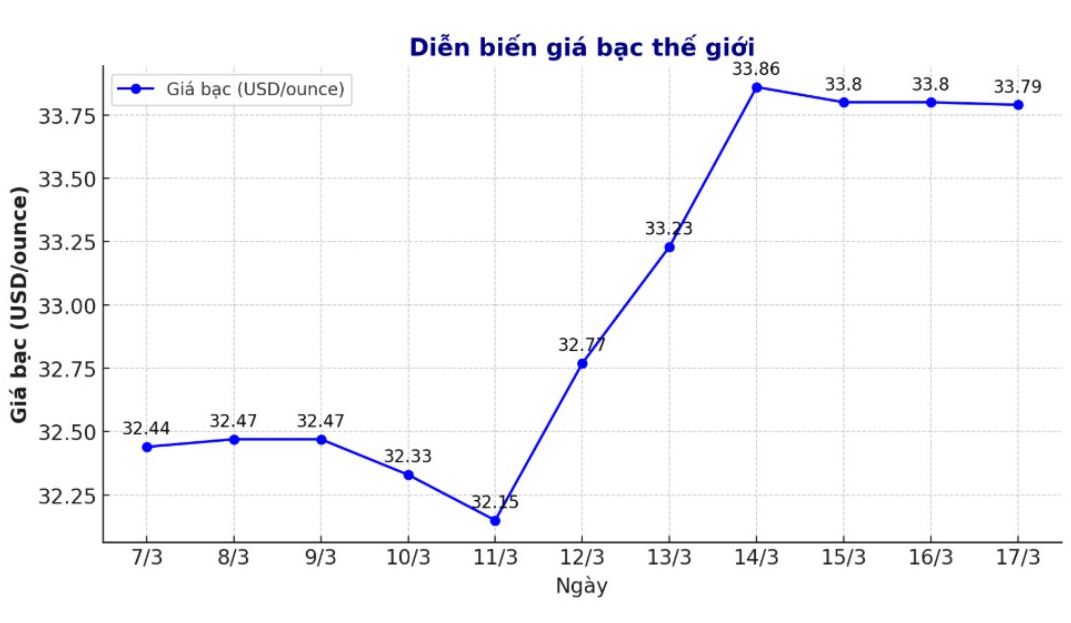

On the world market, as of 9:45 a.m. on March 17 (Vietnam time), the world silver price listed on Goldprice.org was at 33.79 USD/ounce.

Causes and predictions

According to FXStreet, silver prices increased by nearly 4% last week, reaching their highest level since the end of October 2024 as traders reacted to weaker inflation data, expectations from the US Federal Reserve (FED) and gold prices increased sharply.

However, new fluctuations in the stock market and the recovery of stocks at the end of the week put pressure on silver and gold prices, causing the increase to narrow last weekend.

The consumer price index (CPI) in February increased by 0.3%, while core inflation slowed down to 3.2%, reinforcing expectations that inflation is cooling down. Meanwhile, the producer price index (PPI) fell more slightly than expected, continuing to support the monetary easing argument.

As inflation shows signs of cooling down, many traders are betting that the Fed will cut interest rates by the end of this year. If monetary policy is loosen, the chance of holding silver - a non-profit asset - will decrease, helping silver prices maintain their upward momentum. However, the FED has not yet given a specific time for cutting interest rates, causing the market to remain uncertain.

While trade uncertainty could increase safe-haven demand, higher import costs could negatively impact industries that depend on silver, such as electronics and solar energy. Traders are closely monitoring these developments to find out the potential impact on the market.

Important economic data this week

Monday: US retail sales, Empire State Production Index

Tuesday: Housing started construction and construction permit in the US, monetary policy decision of the Bank of Japan

Wednesday: Fed monetary policy decision

Thursday: Swiss National Bank and Bank of England monetary policy decision, weekly jobless claims in the US, Philly Fed manufacturing survey, existing home sales in the US.

See more news related to silver prices HERE...