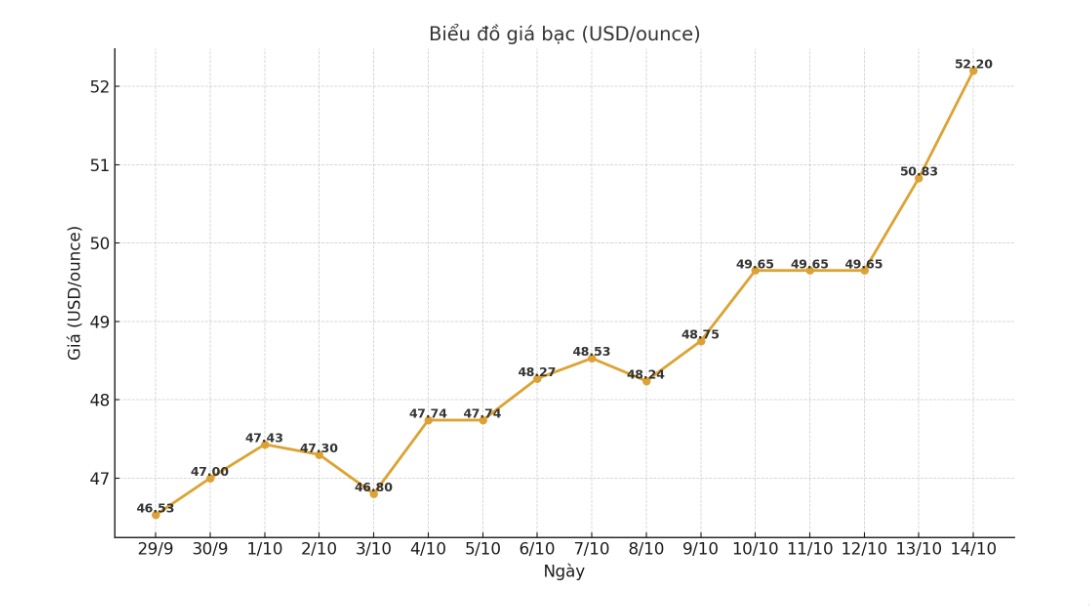

As of 2:30 p.m. today (October 14), world silver prices have decreased slightly by 0.31%, down to 52.2 USD/ounce.

Silver prices fell slightly after hitting a record high of over $53 an ounce, due to a historic short squeeze in London that increased momentum, driven by increased demand for safe-haven assets.

Short squeeze is a phenomenon in the financial market when the price of an asset increases sharply, forcing those who have illegally sold that asset to buy back to limit losses. This repurchase pushes the price of assets higher, creating a vicious cycle.

This phenomenon occurs when many traders expect prices to decrease through fake sales, but instead the price increases suddenly, causing pressure on fake sellers to buy at higher prices to cut losses. This leads to rapid and intense price increases exceeding the core value of assets.

According to Bloomberg, the spot price of silver decreased by 2.2% after reaching 53.55 USD/ounce in London. This level is about 1 USD higher than the peak set in January 1980 on a contract that no longer exists. Gold prices have eased their rally after climbing to a new record high, following a run of eight consecutive weeks of increase.

Concerns about a lack of liquidity in London have triggered a global silver hunt, with standard prices rising to near unprecedented levels compared to the New York market. This has prompted some traders to book silver transportation by transatlantic flights. This is considered an expensive means of transportation that is often only for gold to take advantage of the higher price difference in London. This difference at the beginning of the trading session on Tuesday was about 1.6 USD/ounce, down from the 3 USD difference last week.

Although precious metals have been officially exempt from taxes since April, traders are still worried about the results of the US government's investigation into "Real 232" involving strategic minerals including silver, platinum and palladium. The investigation has raised concerns that the metals could be subject to new tariffs, exacerbating market tightening.

According to analysts, the silver market "has lower liquidity and is about nine times smaller than gold, increasing the range of price fluctuations". Without central bank support to anchor silver prices, even a temporary withdrawal could cause prices to over-adjust, as that would also eliminate the tightening in London that has largely fueled recent gains.

The four major precious metals have risen 56% to 81% this year, in a period of dominating commodity prices. The increase in gold prices was supported by central bank purchases, increased holdings in exchange-traded funds (ETFs), and interest rate cuts by the US Federal Reserve (FED).

Demand for safe-haven assets has also been driven by prolonged US-China trade tensions, factors related to the Fed's monetary policy and the possibility of the US Government's closure.

"There seems to be no reason to resist the trend of both gold and silver," said Shyam devani, a investor in Singapore.

Earlier this week, Bank of America analysts Corp. has raised the target for silver prices by the end of 2026 from about 44 USD to 65 USD/ounce. Explaining the target increase, analysts cited a prolonged market deficit, high fiscal deficits and low interest rates.

Update on domestic silver prices

As of 3:45 p.m. on October 14, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at VND 2.011-2.049 million/tael (buy in - sell out).

The price of 999 Ancarat 999 (1kg) at Ancarat Jewelry Company is listed at 52.61-54.06 million VND/kg (buy - sell).

The price of 999 gold bars of Golden Rooster 999 (1 tael) of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) is listed at 2.031 - 2.082 million VND/tael (buy - sell).

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 2.036 - 2.099 million VND/tael (buy - sell); an increase of 92,000 VND/tael for buying and an increase of 95,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 53,066 - 54.719 million VND/kg (buy - sell).