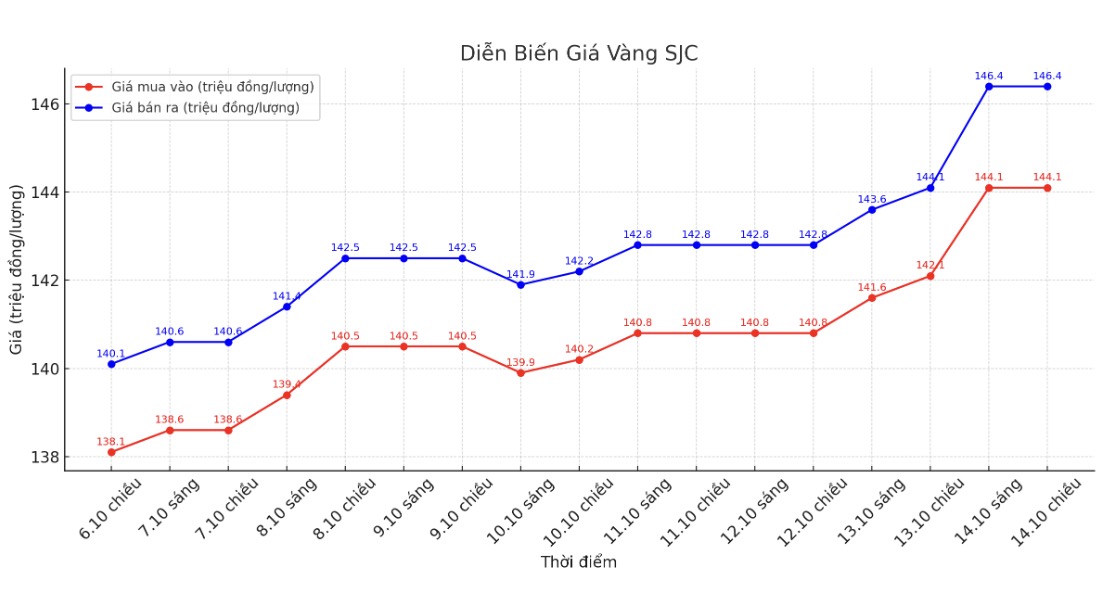

Despite a slight decrease in the afternoon of October 14, gold prices are still recording a breakthrough increase. Domestic market, recorded at 4:05 p.m., DOJI Group listed SJC gold bar price at 144.1-146.4 million VND/tael (buy in - sell out);

Bao Tin Minh Chau listed at 144.9-146.4 million VND/tael (buy - sell); Phu Quy listed at 143.5-146.1 million VND/tael (buy - sell).

Compared to the first trading session of the month (October 1, 2025), DOJI adjusted the price of SJC gold to increase by 8.1 million VND/tael for buying and increase by 8.4 million VND/tael for selling. Bao Tin Minh Chau's increase was 10.1 million VND/tael for buying and 9.6 million VND/tael for selling. Phu Quy recorded an increase of 8.3 million VND/tael for buying and 8.1 million VND/tael for selling.

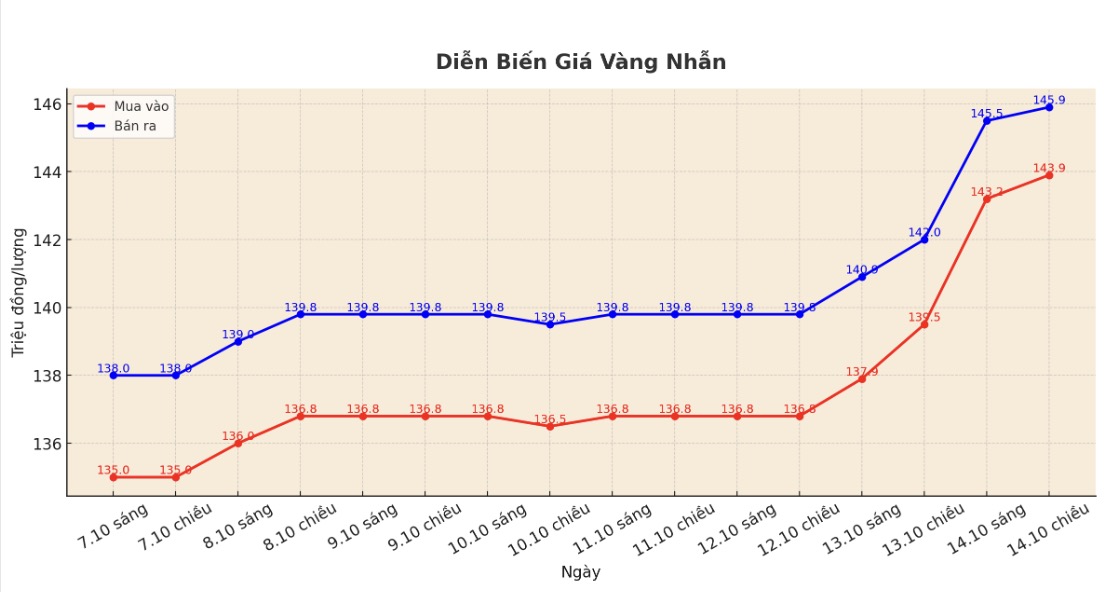

At the same time, the price of plain gold rings was listed by DOJI Group at 143.9-145.9 million VND/tael (buy in - sell out).

Bao Tin Minh Chau listed the price of gold rings at 143.4-146.4 million VND/tael (buy in - sell out).

Phu Quy Gold and Stone Group listed the price of gold rings at 143-146 million VND/tael (buy in - sell out).

Compared to the first trading session of the month (October 1, 2025), the price of plain gold rings was adjusted by DOJI to increase by 12.9 million VND/tael for buying and increase by 11.9 million VND/tael for selling.

Bao Tin Minh Chau's increase is 12 million VND/tael in both directions. Phu Quy recorded an increase of 11.5 million VND/tael in both directions.

Thus, within just two weeks, if buying SJC gold bars at DOJI, Bao Tin Minh Chau and Phu Quy, the investors will receive profits of 6.1 million, 8.1 million and 6.9 million VND/tael respectively.

For gold rings, the profit when purchasing at the three units mentioned above is 9.9 million, 9 million and 8.5 million VND/tael respectively.

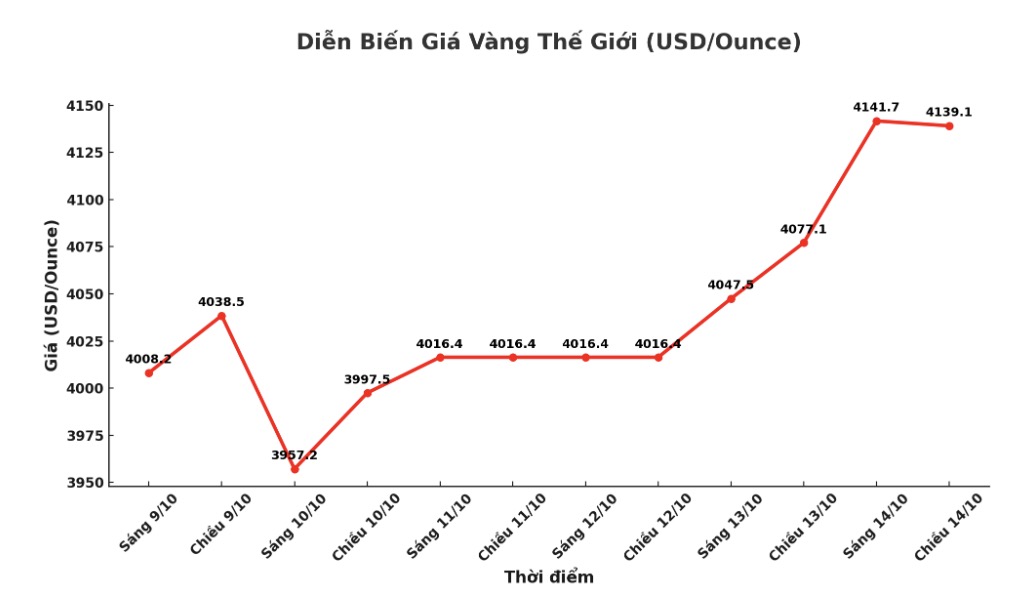

The strong increase in domestic gold is partly due to the influence of the world's increase. On October 1, the world gold price was listed at 3,867.7 USD/ounce. By 400:00 today (October 14), the price had increased to 4,139.1 USD/ounce (equivalent to an increase of 7.02%).

World gold prices increased sharply in the first half of October due to the convergence of many supporting factors. Increased trade tensions between major economies along with geopolitical risks and unstable global economic conditions have increased demand for safe-haven assets such as gold.

In addition, expectations of the US Federal Reserve (FED) cutting interest rates soon have weakened the USD, reduced the opportunity cost of holding gold and attracting investment cash flow into this precious metal.

Many central banks continue to increase gold reserves, while prices exceeding the psychological threshold of 4,000 USD/ounce activates technical purchasing power, further consolidating the increase.

The synthesis of the above factors has brought gold prices to a record high, reflecting investors' defensive sentiment in the context of many fluctuations in the global economy and finance.

Although gold prices bring a star profit after half a month, investors need to be very cautious about the risk of FOMO (fear of missing out on opportunities) when gold prices are at a historical peak.

In addition, the difference between domestic buying and selling prices is currently up to several million VND per quantity, causing a high risk of losses if the market reverses.

In the context of strong fluctuations in gold prices according to psychology and international information, investors should carefully consider the trading time, avoid following short-term trends, and should only allocate capital reasonably instead of focusing all on precious metals.