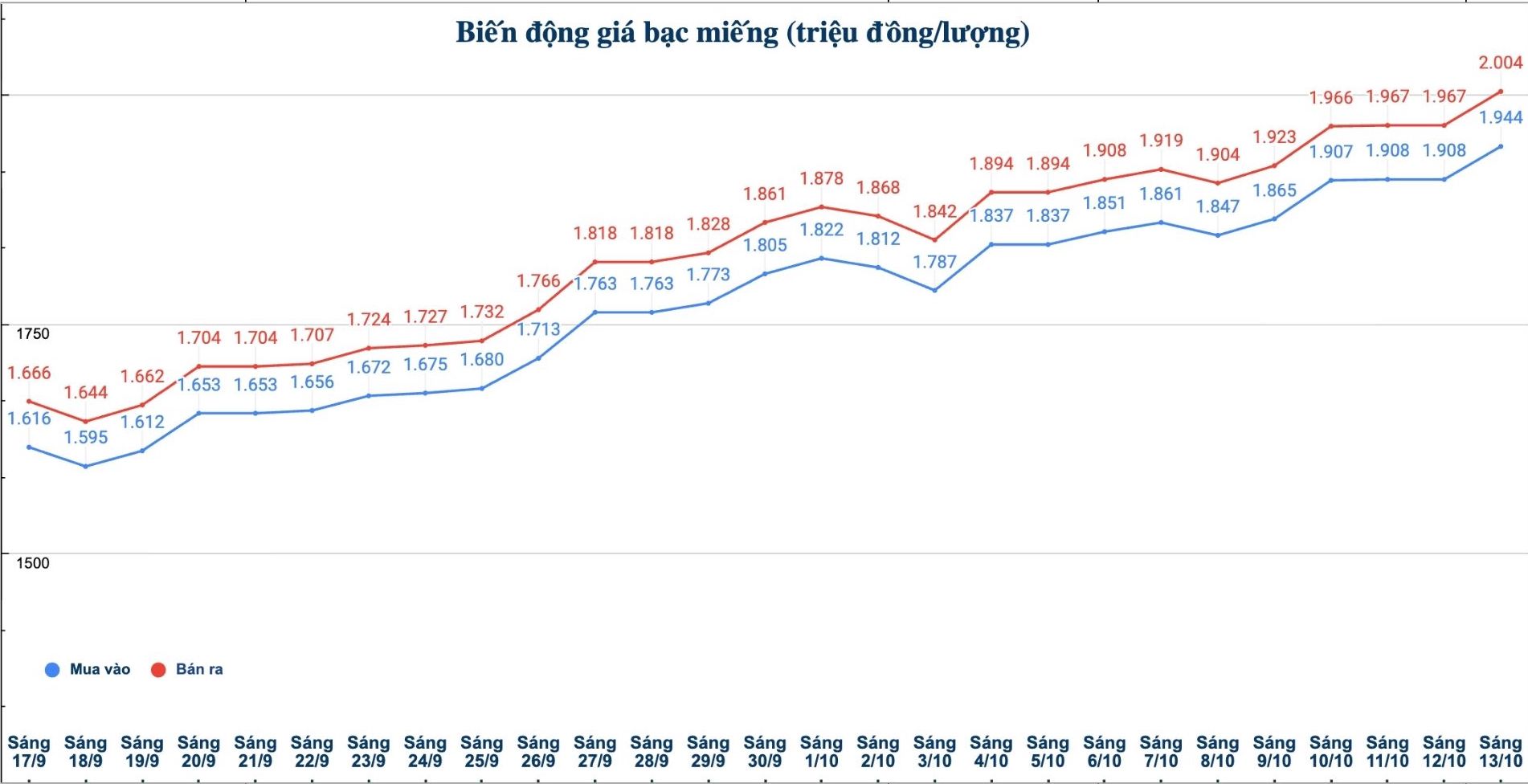

Domestic silver price

As of 10:00 on October 13, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 1.946 - 1.984 million VND/tael (buy - sell); an increase of 36,000 VND/tael in both directions compared to yesterday morning.

The price of 999 Ancarat 999 (1kg) of silver bars at Ancarat Metallurgy Company was listed at 50.876 - 52.326 million VND/kg (buy - sell); an increase of 960,000 VND/kg in both directions compared to yesterday morning.

The price of 999 gold bars of Saigon Thuong Tin Bank Gold and Gemstone Company Limited (Sacombank-SBJ) was listed at 1.968 - 2.013 million VND/tael (buy - sell); an increase of 24,000 VND/tael in both directions compared to yesterday morning.

At the same time, the price of 999 999 coins (1 tael) at Phu Quy Jewelry Group was listed at 1.944 - 2.004 million VND/tael (buy - sell); an increase of 36,000 VND/tael for buying and an increase of 37,000 VND/tael for selling compared to yesterday morning.

The price of 999 taels of silver (1kg) at Phu Quy Jewelry Group was listed at 51.839 - 53.439 million VND/kg (buy - sell); an increase of 960,000 VND/kg for buying and an increase of 986,000 VND/kg for selling compared to yesterday morning.

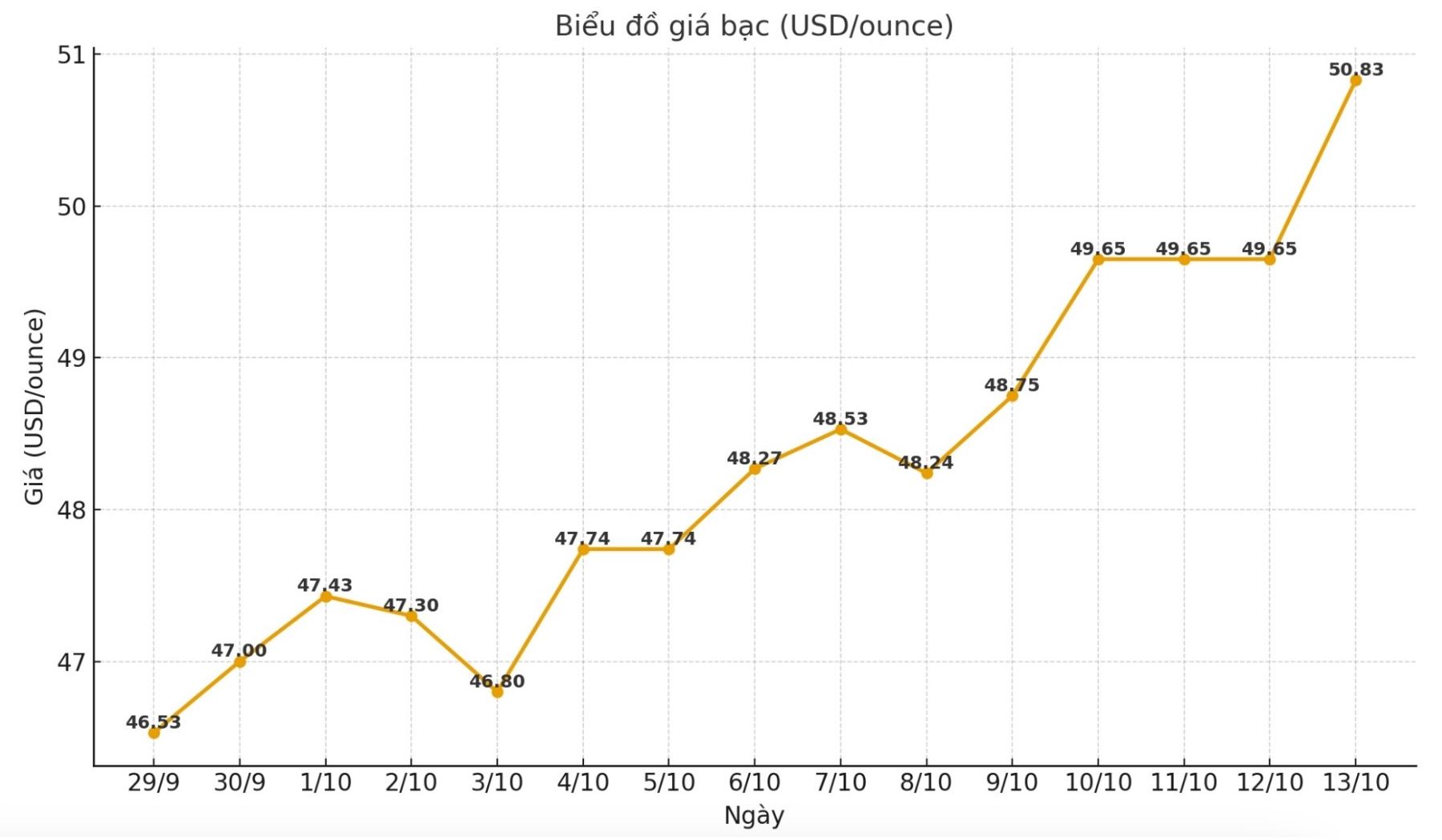

World silver price

On the world market, as of 10:00 a.m. on October 13 (Vietnam time), the world silver price was listed at 50.83 USD/ounce; an increase of 1.18 USD compared to yesterday morning.

Causes and predictions

Silver prices continue to increase strongly. According to expert James Hyerczyk, this is the first time in more than a decade that this precious metal has surpassed and held steady above the threshold of 49.81 USD/ounce - a ceiling that has existed for a long time. He added that buying cash flow is still dominant, but the next direction of silver prices depends largely on new signals from the US Federal Reserve (FED).

"According to CME FedWatch, traders are pricing in a 95% chance of a 0.25 percentage point rate cut at the meeting on October 29. However, the US government's closure into the fourth week has delayed the release of important data such as the September consumer price index (CPI), causing the market to lack directional information," said James Hyerczyk.

In that context, FED Chairman Jerome Powell's upcoming speech is of particular interest to investors. If Powell shows that the Fed is more concerned about jobs rather than inflation, investors could expect a smoother monetary policy which is often in the favor of silver prices, said James Hyerczyk.

The expert said that the silver market is still being consolidated thanks to limited supply of materials. The flow of capital into ETFs remains strong, while physical silver is said to be increasingly difficult to find in the market. "This shows solid demand, helping silver prices maintain heat despite short-term fluctuations" - James Hyerczyk expressed his opinion.

See more news related to silver prices HERE...