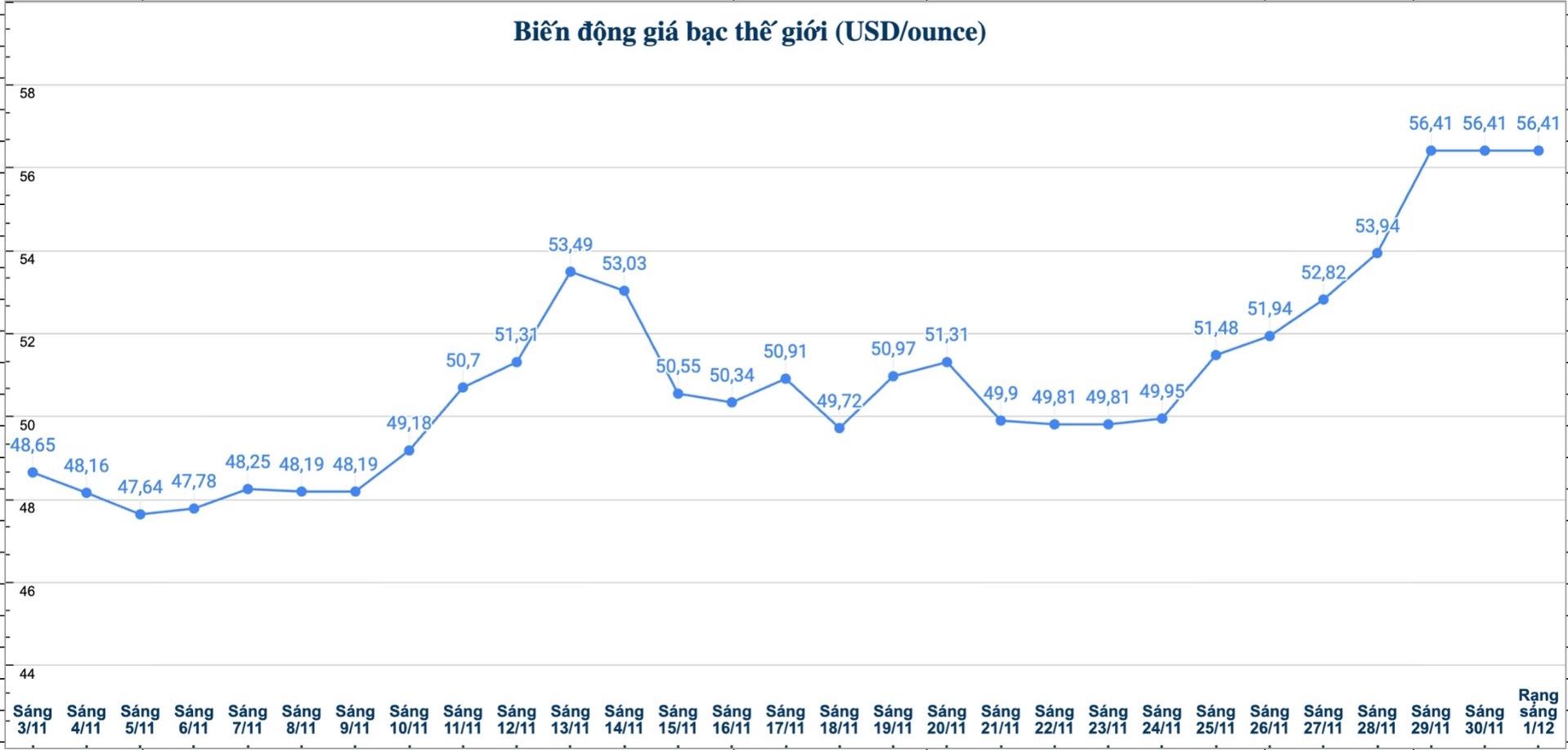

Silver prices continued to increase strongly, surpassing the 56 USD/ounce mark. As the US dollar weakens and bond yields fall, investors quickly enter the market, pushing silver prices to skyrocket even as the CME - a large futures exchange - temporarily stops trading due to technical problems.

According to precious metals analyst James Hyerczyk at FX Empire, the upward trend of silver has been formed in advance, but a series of weaker economic data than expected from the US has caused the USD to weaken, yields to decrease and investors to quickly return to buying silver.

" Production reports show a sharp decline, while the labor market continues to weaken, increasing concerns about recession. The probability of the US Federal Reserve (Fed) cutting interest rates in December increased to 89%, from 50% last week - a big change in a short time" - James Hyerczyk said.

The expert said that since the beginning of the year, silver prices have increased by about 84%, surpassing the increase of gold and is one of the strongest increases in decades. In the short term, the decline will remain limited if expectations of December interest rate cuts continue and the supply shortage has not improved.

" Any positive sign or a dovish signal from the Fed could help keep the silver rally going," James Hyerczyk stressed.

Meanwhile, the physical silver market is currently very scarce. Inventory in China is at a decade-low, while demand from India remains strong. Some businesses have to switch to air transportation to meet delivery time.

Industrial manufacturers, especially solar power and electric vehicles, are continuously purchasing from limited supply. When supply is scarce, the price increase is unlikely to decrease because users cannot really stay on the sidelines.

Neils Christensen - an analyst at Kitco News - also commented that the demand for silver in the industry, especially from industries related to electrification, is increasing strongly globally, leading to a supply shortage for 5 consecutive years.

He said that land reserves are almost exhausted, while available metals are often of the wrong type or not in the right position, causing many supply shocks in 2025.

"With increased demand and unlikely supply replenishment, the increase in silver may not be just a short-term phenomenon. Now, this precious metal seems to have finally affirmed its long-awaited importance," said Neils Christensen.

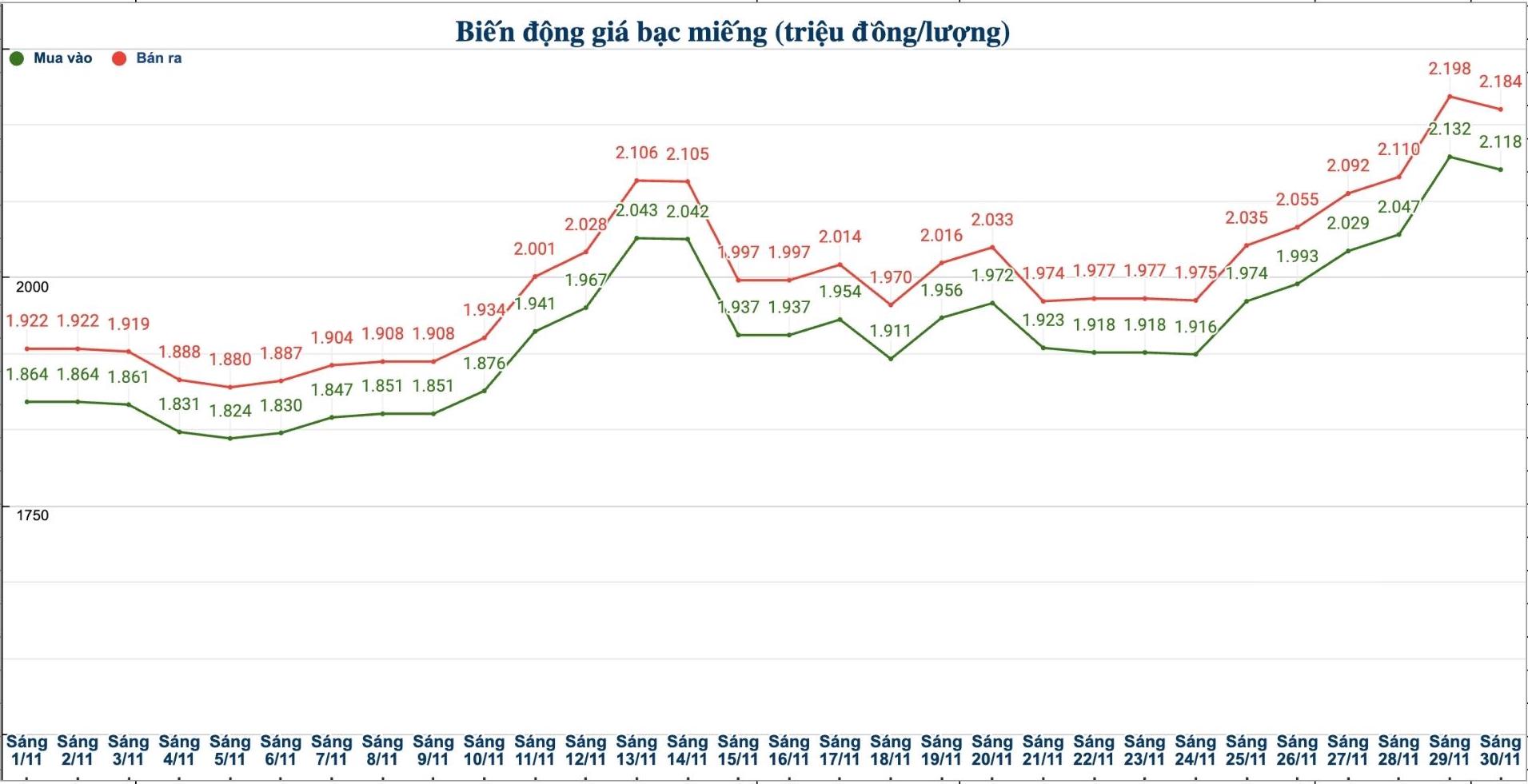

Update on domestic silver prices

As of 6:00 a.m. on December 1, the price of 2024 Ancarat 999 silver bars (1 tael) at Ancarat Metallurgy Company was listed at 2.114 - 2.164 million VND/tael (buy - sell).

The price of 999 999 Ancarat silver bars (1kg) at Ancarat Metallurgy Company is listed at 55.516 - 57.206 million VND/kg (buy - sell).

The price of 999 gold bars of the Golden Rooster Bank of Saigon - SBJ (Sacombank - SBJ) is listed at VND2.004 - 2.055 million/tael (buy - sell).

At the same time, the price of 999 coins (1 tael) at Phu Quy Jewelry Group was listed at VND 2.118 - 2.184 million/tael (buy - sell).

The price of 999 taels (1kg) at Phu Quy Jewelry Group was listed at 56.479 - 58.239 million VND/kg (buy - sell).

See more news related to silver prices HERE...