Gold and silver prices increased again in the trading session on Friday (US time), after falling sharply yesterday. Notably, silver led the recovery with a strong increase. However, analysts warn that the market may fluctuate strongly today, when investors close their positions before the weekend break.

Major fluctuations in recent sessions show that the risk level in the gold and silver markets is still high - a not-so-positive signal in the short term.

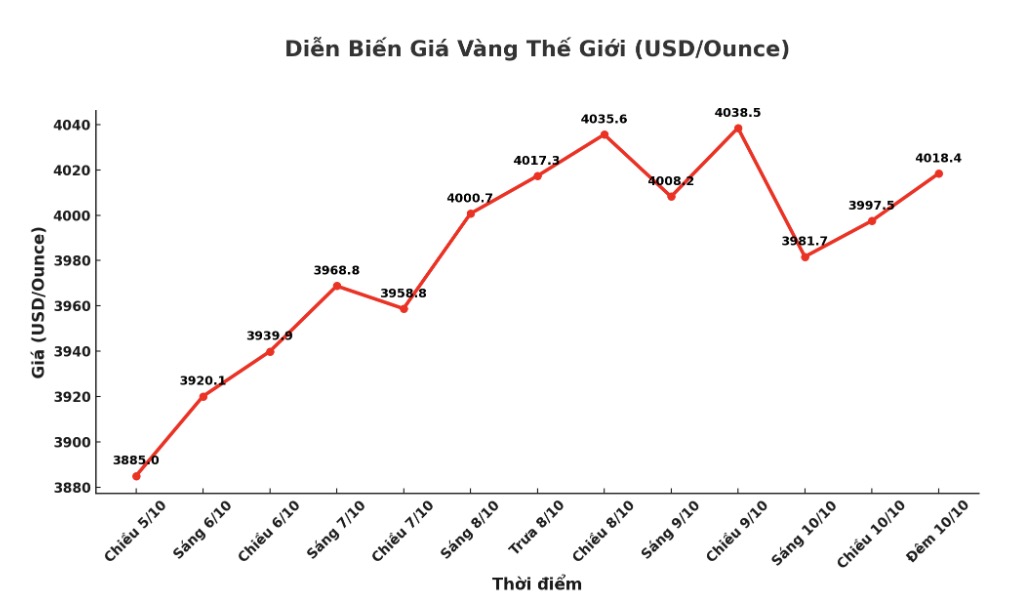

Currently, December gold contract increased by 37.1 USD to 4,009.1 USD/ounce, while December silver contract increased by 1.17 USD to 48.36 USD/ounce.

The global stock market last night had mixed to weak movements. US stock indexes are expected to open slightly when the New York session begins.

Gold prices increased as US-China trade tensions showed signs of escalating. China has announced that it will impose special fees on US ships docking in the country from October 14, in response to the US plan to impose port fees on Chinese ships.

According to the Chinese Ministry of Transport, the initial fee is 400 yuan (equivalent to 56 USD)/MT and will gradually increase to 1,120 yuan in April 2028.

The move is seen as a response to the US plan to impose tariffs on ships built, operated or owned by China - something Beijing said was a "serious violation of international trade principles and bilateral maritime agreements".

At the same time, the State Market Management Agency of China (SAMR) announced the launch of an antitrust investigation into the Qualcomm (US) acquisition of Autotalks deal. SAMR will see if the deal violates China's antitrust laws. After this information, Qualcomm shares decreased by 4% in the trading session before opening time in New York.

Bloomberg quoted the source as saying: "The latest moves show that the two sides are preparing to " wear a suit" ahead of the meeting between President Donald Trump and President Xi Jinping scheduled to take place this month on the sidelines of the Asia-Pacific Economic Cooperation (APEC) Summit in South Korea."

The US Bureau of Labor Statistics (BLS) has recalled staff to return to work to prepare the September inflation report - key data to calculate the Social Security pension increase next year. This CPI report is expected to be released later in the month, in time for the Fed's monetary policy meeting on October 28-29.

Investors expect the Fed to continue cutting interest rates, but some officials remain cautious as inflation remains above target. The US government has now entered the second week of a closed state, with no signs of reaching a deal between the two parties.

In another development, the US has issued a $20 billion "lifeline" to Argentina. The US Treasury completes a currency exchange agreement with the Central Bank of Argentina and directly buys pesos to stabilize the exchange rate.

Bloomberg said, The goal of this move is to help President Javier Milei consolidate his position before the midterm election and reassure the market that is concerned about the possibility of the left-wing opposition returning to power.

The USDX is heading for its strongest week of growth in a year, with an increase of nearly 2% due to the strong weakness of the Japanese Yen and the euro. The yen is expected to fall nearly 4% against the USD after Ms. Sanae Takaichi - who has a "calm" stance - won the leadership election in Japan.

Meanwhile, the euro fell about 1.5% due to political instability in France as President Emmanuel Macron has yet to find a sixth prime minister in less than two years.

Technically, December gold futures continue to maintain a strong near-term technical advantage. The next target for buyers is to close above the strong resistance level of 4,100 USD/ounce. Meanwhile, the sellers aim to pull the price below the solid support zone of 3,850 USD/ounce.

The first resistance zone was determined to have an all-night high of $4,020.50 an ounce, followed by a record peak of $4,081/ounce. The closest support zone is Thursday's bottom at $3,957.9/ounce, followed by $3,900/ounce.

In outside markets, the USD index decreased slightly due to technical adjustments, crude oil prices fell to around 60.75 USD/barrel, and the yield on the 10-year US Treasury note was 4.14%.

See more news related to gold prices HERE...