Investors are having to reconsider their long-standing views on gold - a precious metal that is breaking historical peaks as the AI-led stock wave and the hot rally of Bitcoin forced them to redefine the true driving force of one of the world's oldest assets.

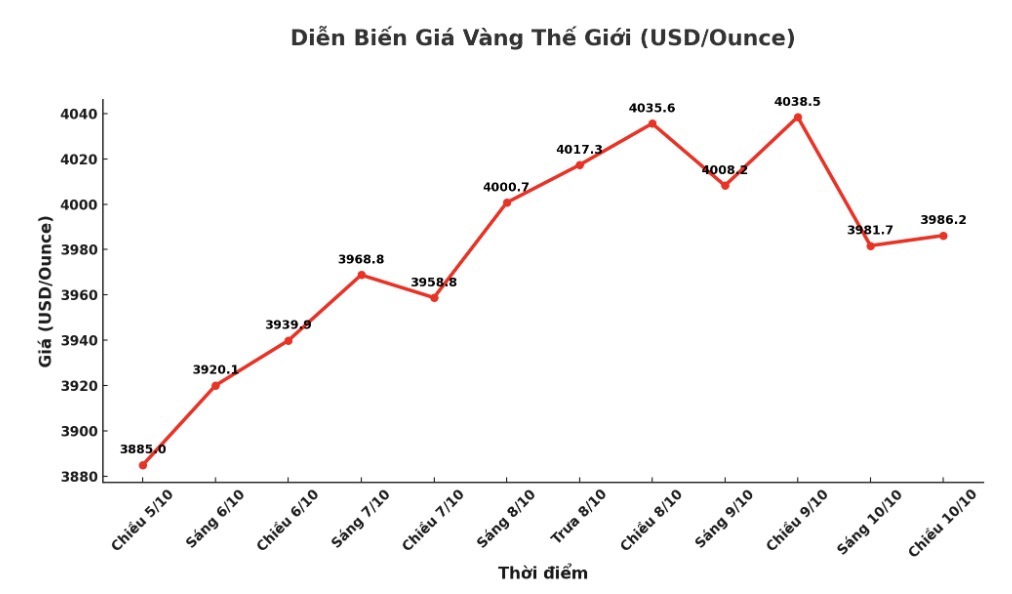

Gold prices this week surpassed $4,000/ounce for the first time, up 53% since the beginning of 2025 - the strongest increase since 1979, far exceeding the 30% increase of Bitcoin and 15% of the S&P 500 index.

Normally, gold increases sharply when investors are worried about inflation, recession or market instability; while when risk sentiment improves, gold is often less attractive than other profitable assets.

However, unlike previous cycles such as the 1980s or the 2008 financial crisis, gold is now rising in parallel with stocks and Bitcoin, in the context of investors betting on the possibility of the US Federal Reserve (FED) cutting interest rates and doubting the dominance of the USD.

Arun Sai - senior assets strategist at Pictet commented: "When there is a model change of the economic system, history shows that cash flow always goes to gold. Let's see it as a shield against currency depreciation."

Tight political situation, budget crisis in France, doubts about central bank independence, Ukrainian war war and peace signals in Gaza - all are making investors more insecure.

Meanwhile, the AI fever is fueling the upward momentum of Wall Street, raising concerns about a bubble, while huge spending plans, tariff policies and President Donald Trump's criticism of the Fed have caused the USD to lose 10% of its value compared to a basket of major currencies this year.

JPMorgan Jamie Dimon warned of the risk of a strong correction in the US stock market in the next 6 months to 2 years. US tariffs also increase inflation concerns - a factor that is always in the favor of gold. We are at a turning point for inflation, said Michael Metcalfe, chief macroeconomic strategist at State Street.

Average inflation in the G7 group rose to 2.4% in September (compared to 1.7% in the same period last year), while most central banks kept their rates unchanged or started cutting interest rates.

Donald Trump has repeatedly attacked Fed Chairman Jerome Powell, seeking to fire a Fed official and nominate his ally Stephen Miran as governor. Since August, gold prices have risen about 20%.

According to Rhona OConnell, Head of EMEA and Asia Market Analysis at StoneX, the simultaneous increase in gold and stocks can be explained by the concept of efficient frontier - where the portfolio manager achieves the highest profit within the acceptable risk limit.

When stocks increase sharply, adding gold helps balance risks and optimize profits. When stocks explode like they are now, part of that value spreads to gold, she said.

Gerry Fowler - Head of Stock Strategy at UBS, said that demand from individual investors also contributed to pushing prices up. Every time someone puts money into a gold ETF, the fund has to buy gold in corresponding physical quantities, he said, warning that excessive excitement is appearing in many places.

Meanwhile, concerns about the possibility of an AI-generated stock bubble burst - which the Bank of England and the IMF have both warned - make gold a new "defense barrier".

Investors are optimistic about AI as well as gold - Trevor Greetham, director of multi-asset investment at Royal London Asset Management commented - If the AI bubble explodes, gold could continue to break out another beat.

The main driver of this rally is still confidence in the US dollar. Central banks are holding about a quarter of their foreign exchange reserves in gold, as a way to reduce their dependence on the greenback. Mark Ellis - Investment Director of Nutshell Asset Management - believes that this trend will continue as US tax policies force exporting countries to seek new markets. In short, behind this gold fever is Donald Trump, he said.