Investors are concerned that Donald Trump's countervailing tariffs, due to come into effect on April 2, could increase inflation, slow economic growth and worsen trade tensions.

Concerns about US tax policy are said to have pushed gold prices to a record high of $3,057.21/ounce on March 20.

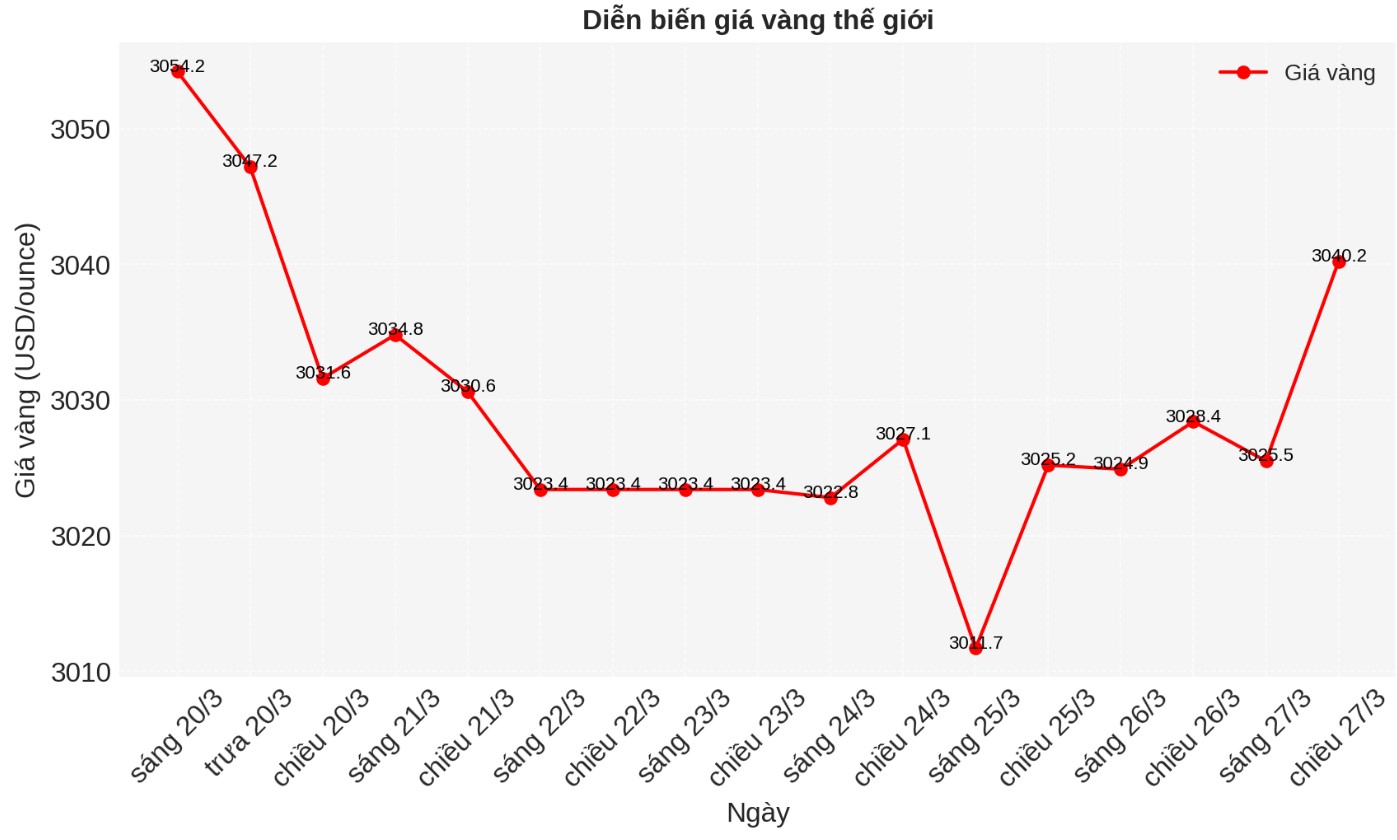

Recorded at 15:35 on March 27, the world gold price listed on Kitco was at 3,040.2 USD/ounce.

Aakash doshi - Global Director of gold at SPDR ETF Strategy predicts that gold prices will surpass 3,100 USD/ounce in the second quarter and may increase by 8% - 10% by the end of 2025 if macro support factors and market demand continue to persist.

On Wednesday, Goldman Sachs raised its forecast for gold prices in late 2025 to $3,300/ounce from $3,100/ounce previously, citing stronger-than-expected ETF inflows and stable demand from central banks.

Investors are waiting for US personal consumption expenditure data, expected to be released on Friday, for further clues on the US interest rate path.

Ilya Spivak - Director of Global Macro at Tastylive - commented: "The March high of nearly 3,057 USD was the immediate resistance level of gold. $3,100 will be the next target.

Last week, the US Federal Reserve (FED) kept the basic interest rate unchanged but signaled that it could cut interest rates by the end of the year. Gold - non-interest-bearing assets often benefit from a low interest rate environment.

Fed Fed Minneapolis President Neel Kashkari said that although the Fed has made a lot of progress in reducing inflation, we still have a lot of work to do to bring inflation to the 2% target.

Spot silver prices rose 0.1% to $ 33.73/ounce, platinum fell 0.4% to $ 970.34/ounce, while gold lost 0.5%, to $ 963.03/ounce.