Krishan Gopaul - Senior analyst of EMEA at the World Gold Council said that the National Oil Fund of the Republic of Azerbaijan (SOFAZ) has purchased 16 tons of gold in the second quarter of 2025.

This raises SOFAZs total net gold purchases in the first half of the year to 35 tons, bringing its total holdings to 181 tons (equivalent to nearly 29% of the funds total portfolio) he said.

According to its investment policy, the national asset fund has now reached the allowable ceiling for gold.

SOFAZ is very active in the gold market, with purchases surpassing most central banks this year.

To date, only Poland has bought more gold than SOFAZ in the first half of the year, when it raised its official reserves by 67.2 tons as of May.

The People's Bank of China has also been buying gold continuously for the past 9 months, but the total purchase in the first half of the year reached only 16.9 tons as of May.

Some other prominent buyers in the first half of the year include: the Central Bank of the Republic of Turkey (14.9 tons), Kazakhstan (14.7 tons), the Central Bank of the Czech Republic (9.2 tons), and the Reserve Bank of India (3.42 tons).

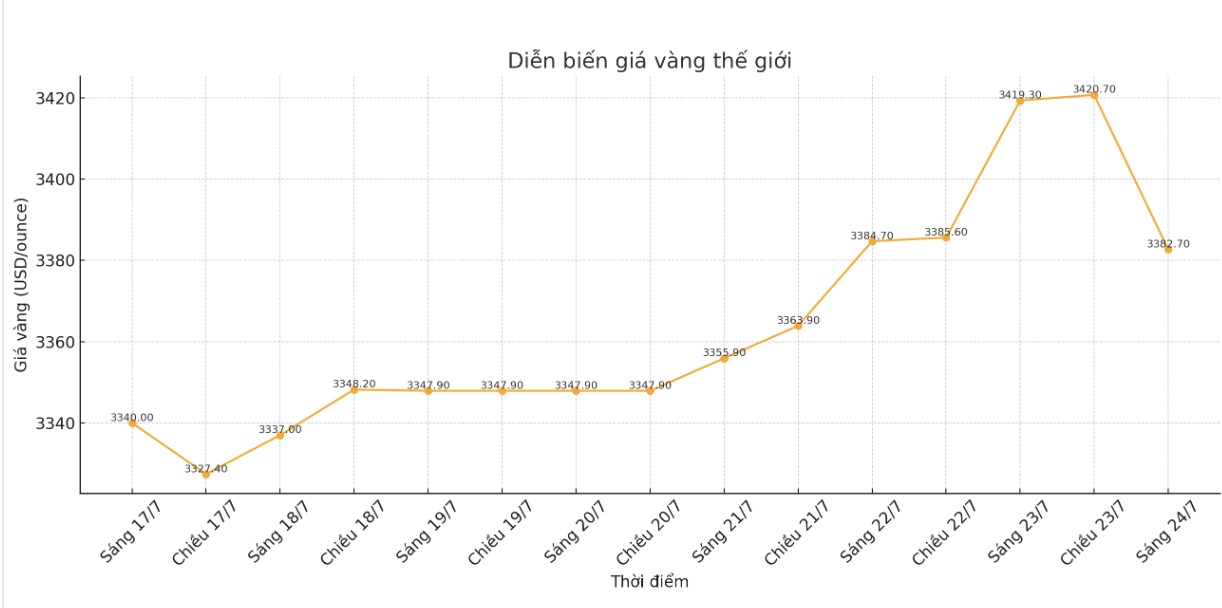

Analysts said that the continued purchase by central banks is a strong support factor for gold prices, strengthening the strategic attractiveness of the precious metal in the context of macroeconomic instability. Demand from the outside market is expected to keep gold prices stable above $3,000/ounce.

Even as gold prices are accumulating at high levels, surveys released last month show that central banks are still expected to increase gold reserves in the next 12 months.

The World Gold Council said in its annual survey released in June that 95% of participants predict global gold reserves will continue to increase in the next 12 months. 43% of central bank reserve managers said they plan to increase their official gold holdings this year up from 29% in the survey last year.

According to another survey released by the Official Monetary and Financial Policy Forum (OMFIF) in June, 32% of central banks plan to increase their investment in gold in the next 12 to 24 months the highest level in the past 5 years.

Analysts expect central banks to continue buying an additional 1,000 tons of gold this year a level that has been maintained for three consecutive years.