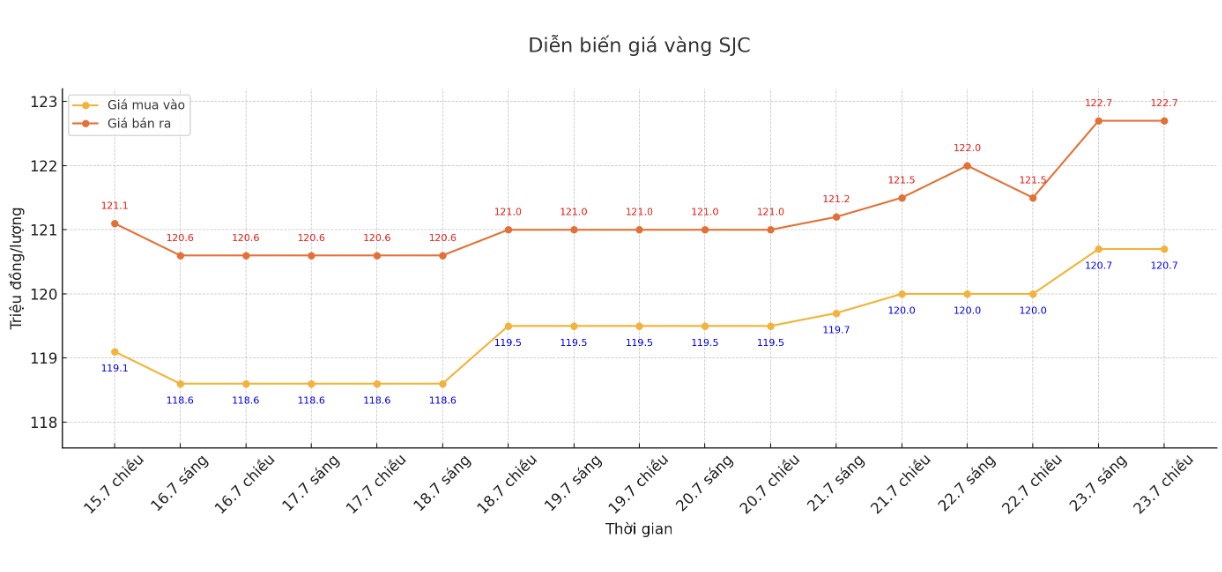

SJC gold bar price

As of 6:15 p.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 120.7-122.7 million/tael (buy - sell); increased by VND 700,000/tael for buying and increased by VND 1.2 million/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

DOJI Group listed at 120.7-122.7 million VND/tael (buy - sell); increased by 700,000 VND/tael for buying and increased by 1.2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 120.7-122.7 million VND/tael (buy - sell); increased by 700,000 VND/tael for buying and increased by 1.2 million VND/tael for selling. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 120.2-122.7 million VND/tael (buy in - sell out); increased by 700,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

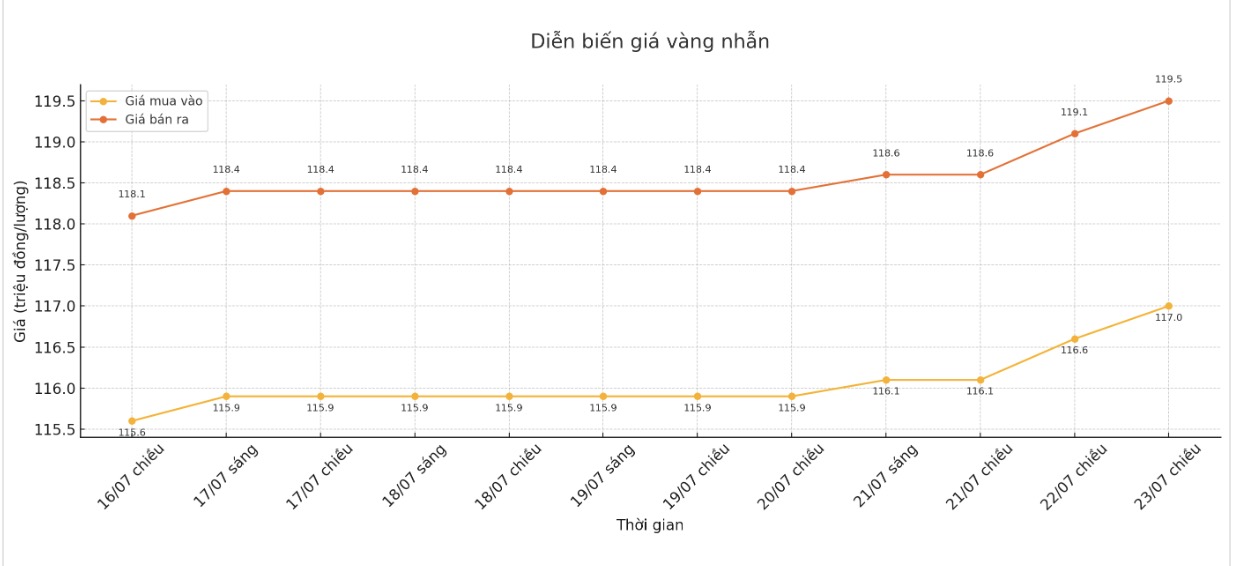

9999 gold ring price

As of 6:15 p.m., DOJI Group listed the price of gold rings at 117-111.5 million VND/tael (buy in - sell out), an increase of 400,000 VND/tael in both directions. The difference between buying and selling is 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 117.2-120.2 million VND/tael (buy - sell), an increase of 900,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 116.2-119.2 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

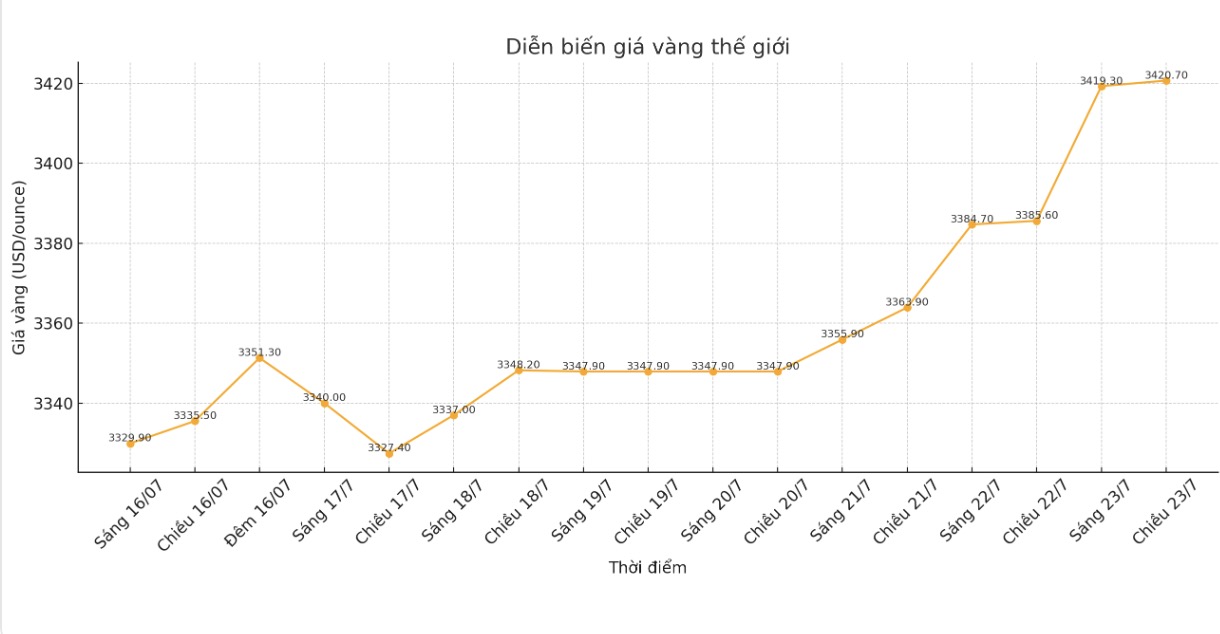

World gold price

The world gold price was listed at 6:15 p.m. at 3,420.7 USD/ounce, up 35.1 USD compared to 1 day ago.

Gold price forecast

The world gold price increase is slowing down as the trade agreement between the US and Japan announced by President Donald Trump increases risk appetite, while higher US Treasury bond yields also put more pressure.

Spot gold fell 0.2% after reaching its highest level since June 16 in the previous trading session. US gold futures also fell 0.2% to $3,437.9/ounce.

Mr. Trump has reached a trade deal with Japan, reduced import duties on cars and exempted other items from high new tariffs, in return, a package of investment and loans worth 550 billion USD towards the US.

"Shooting gold prices are partly reducing profits after the US-Japan trade deal reduced demand for safe-haven assets. The slight recovery of the US dollar is also putting pressure on the precious metal, although this is natural as gold investors can rest after a 3-day continuous rally," said Han Tan, chief market analyst at Nemo.Money.

The USD (.DXY) has stabilized against other currencies after three consecutive sessions of decline, while the yield on the 10-year US Treasury note has recovered from its lowest level in nearly two weeks.

Higher bond yields increase the opportunity cost of holding unperforming gold, while the stronger US dollar makes gold more expensive for holders of other currencies.

US and Chinese officials will meet in Stockholm next week to discuss extending the deadline for trade deal negotiations, according to US Treasury Secretary Scott Bessent.

Investors are also paying attention to the Federal Reserve's (FED) policy meeting scheduled for July 29-30, with the expectation that the interest rate market will remain stable.

In addition, spot silver prices rose 0.2% to 39.37 USD/ounce, the highest level since late September 2011.

"The supply-demand factors of silver are attractive and deserve to be reassessed at a higher price and now that silver prices have reached a 14-year high, we will have to wait and see if the convincing is strong enough to overcome the important psychological threshold of $40" - independent analyst Ross Norman said.

platinum increased by 0.2% to 1,444.4 USD/ounce and palladium increased by 1% to 1,286.93 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...