Gold prices react weakly to news

According to Ms. Rhona OConnell - Head of EMEA & Asia Market Analysis at StoneX, silver prices increased sharply thanks to a shift in investment flows and industrial demand, while gold reacted increasingly weakly to global risks, causing the increase to stagnate.

In a recent interview, Ms. O'Connell said that although gold is less attractive than silver in the short term, it is not possible to underestimate the role of this precious metal.

"I liken gold to being rolling around the fireplace to rest, but it's not necessarily a dream. At the end of last year, many people waited for gold prices to fall sharply to buy, but in the end the market increased sharply, forcing them to jump in. In fact, over the past 18 months, the gold market has gradually absorbed all the global risk factors, and investors have also positioned appropriately, she said.

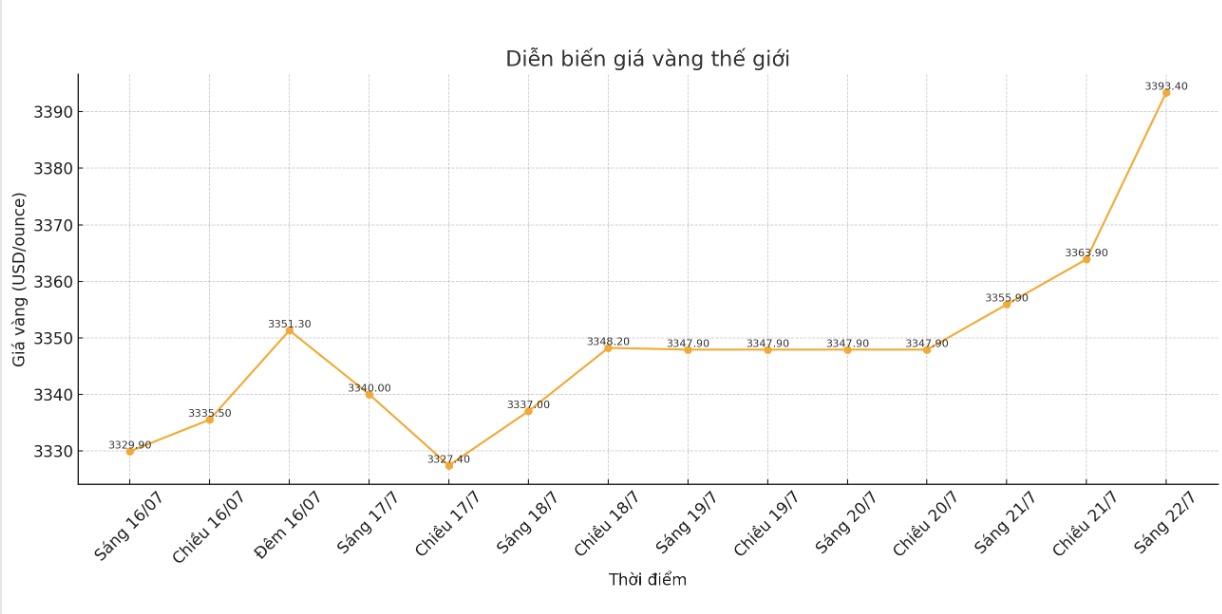

Because it has reflected all the uncertainties, gold is no longer reacting strongly to new news. In the past two months, the gold market has hardly reacted much to external factors, whether it is important news or just a short-term one.

This shows that the market needs new momentum to increase prices, while currently all supporting factors seem to have been reflected. However, there is still enough uncertainty to make investors buy if prices fall around $3,300/ounce, she said.

When asked whether geopolitical risks and market instability have passed, Ms. O'Conal said it was too early to conclude. I cant confirm that because no one knows the future. The risk comes not only from bilateral trade tensions but also from multilateral relations, human factors and many other variables.

She also expressed concern about US President Donald Trump's continuous pressure on US Federal Reserve Chairman Jerome Powell.

When asked what would happen if US monetary policy changed with each presidential term, Ms. O'Connell warned: "At that time, the US financial system will be like a boat without a roof. The US is the world's largest creditor, while Europe is the largest creditor. Although the US economy is still stable, the bond market still needs cash flow.

According to her, investment capital flow in long-term bonds is slowing down, especially from Japan, while Europe is no longer interested. If this trend continues, it will be a bad sign for the US economic outlook.

She also emphasized that central bank independence is a key factor to maintain a stable and predictable monetary policy.

Silver has attracted attention again

Moving to the silver market, Ms. O'Connell said there are three main factors supporting silver prices to increase faster than gold, including two short-term factors and one long-term factor.

In the short term, as the gold market became crowded, some investors from OTC institutions to hedge funds and family offices sold less gold to move to silver and platinum, which were being priced lower. They are simply adjusting the portfolio, she said.

This is also the reason why many people participate in trading at the gold/ silwer ratio. This ratio was above 100 in April and has now dropped to around 90. and many expect it to continue to decline.

However, what caused silver to stagnate was that 70% of demand came from industry. In the context of China's slow economy, Europe's uncertainty and the US's uncertainty, industrial demand for silver has weakened, said Ms. O'Conal.

Now, silver has attracted attention again. "Cryberie prices are receiving more attention, and in the long term, the silver market is lacking in supply even without taking into account investment factors.

This situation will continue due to the development of artificial intelligence (AI), solar power and electric vehicles - all of which require a lot of silver - she added.

The world gold price was listed at 23:00 on July 22 at 3,424.9 USD/ounce, up 27.8 USD compared to 1 day ago. Silver also recorded a return, reaching 39.23 USD/ounce.