Last week, AuAg Funds (an investment fund management company from Sweden, specializing in assets related to precious metals, especially gold and silver) announced its 2026 outlook report.

Analysts say they expect gold prices to break through decisively above the 6,000 USD/ounce mark this year, while silver prices may reach 133 USD/ounce - the level that brings the gold/silver ratio back to the multi-year low of 45 last month.

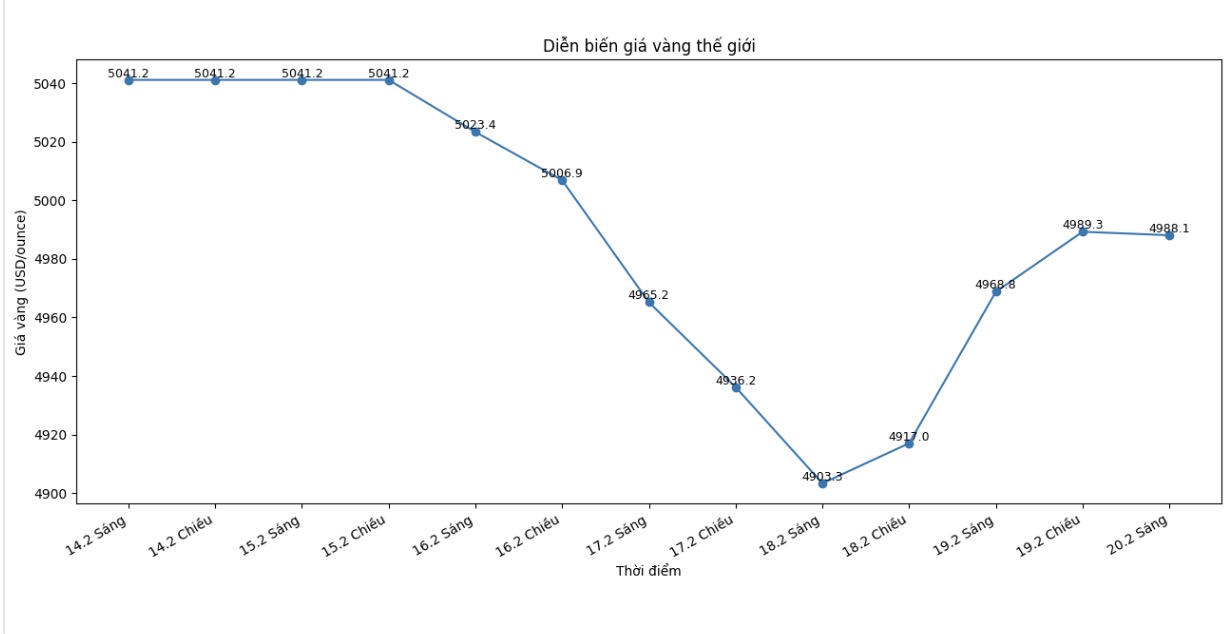

This prospect is given in the context that gold prices once climbed to nearly 5,600 USD/ounce last month, then quickly decreased by 20%. After testing the support zone around 4,400 USD/ounce, gold has now found a balanced state around the 5,000 USD/ounce threshold.

The investment company from Sweden believes that in an upward price market, investors should get used to fluctuations of 20% to 30%.

These are often adjustments that are'arrangement' when the market becomes too hot. Large short selling positions are used to pull prices down, causing speculators to be eliminated from the game and weak investors to start selling. Buyers afterwards are often the ones who started the decline - that is, "strong players" looking for attractive entry points for the next uptrend" - the analysis group said.

Despite short-term fluctuations, AuAg Funds sees structural drivers supporting the upward trend. According to them, global debt continues to expand, currently approaching 350 trillion USD.

At the same time, global debt monetarization is seen as only a matter of time, as central banks, led by the US Federal Reserve (Fed), may both cut interest rates and implement new quantitative easing (QE) programs to curb long-term yields.

Analysts also believe that gold is increasingly attractive as a global alternative currency, in the context of gradually decreasing confidence in the USD and the ongoing trend of "monetary dilution".

In an environment of both fiscal stimulus and strong monetary easing, when the bond market becomes unpredictable, AuAg believes that capital flows are increasing into gold thanks to high profit potential, low correlation with stocks and the absence of partner risk.

In the long term, gold reacts to the number of legal monetary units generated exceeding real economic growth" - the report stated. "It should be emphasized that real growth does not mean reported GDP, because modern GDP includes many inefficient expenditures but is still considered growth. Countries are generating more money but generating less real output per unit of debt. This dynamic is what keeps gold prices increasing at an increasingly rapid pace.

Meanwhile, AuAg Funds believes that silver still has more room to increase, as prices may double in the current context. The company said that in addition to its role as a currency, silver is also strongly supported by industrial demand.

After many years of the market lacking supply compared to demand, the supply-demand balance is moving towards a state that can strongly impact the price formation process. A material shortage can cause the price of silver to double in a very short time.

Silver demand is also low elasticity - high prices are difficult to significantly reduce usage. This stems from the fact that the properties of silver are almost irreplaceable, and silver usually accounts for only a small proportion of the total cost of the final product" - analysts said.

In addition to holding physical metals, AuAg also appreciates the potential of mining stocks.

Gold mining stocks have grown strongly in 2025, as expected by us. However, the valuation is still lower than before last year's big increase.

If gold prices remain at the current level or continue to rise, the current stock price still does not fully reflect the higher price assumption. This opens up the possibility of explosive growth of mining stocks, even far exceeding the increase of gold. Silver is still undervalued compared to gold, leading to the fact that silver mining stocks are also undervalued compared to gold mining enterprises" - the report said.