Precious metal prices continue to repeat the familiar pattern: slow increase but rapid decrease. Gold outperforms silver and platinum metals (PGMs), reflecting the level of deeper commitment of organizations to this metal.

However, according to Mr. Ross Norman - CEO of Metals Daily, the entire precious metal market is still heavily influenced by speculative capital flows rather than fundamental factors.

In a recent analysis, Mr. Norman said that precious metal prices once again followed the scenario of "climbing the stairs, descending the escalator" - gradually increasing step by step and then sharply decreasing in a short time.

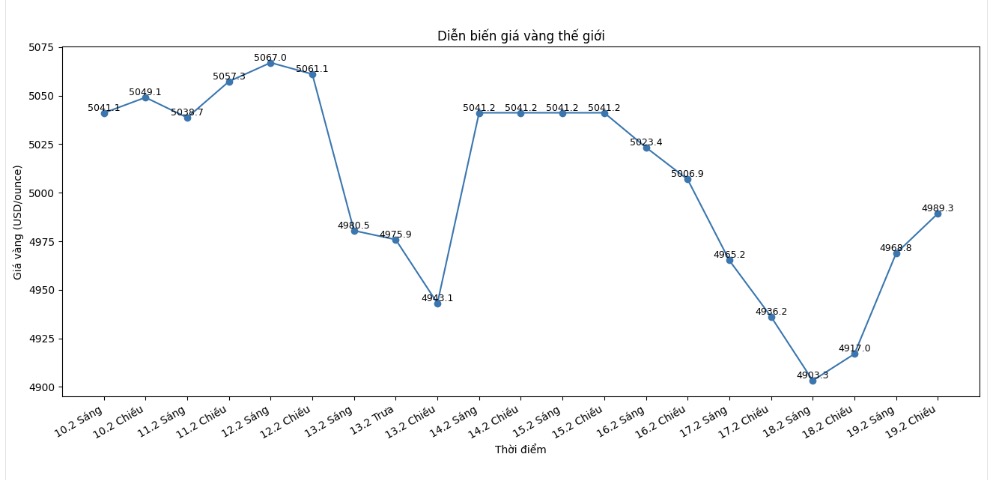

January recorded dramatic price increases and set new peaks across the market. But in February, prices plummeted, partially recovered, lost momentum and continued to fluctuate sharply, causing the market to fall into a vague accumulation state," he said.

According to Mr. Norman, derivative trading activities in China are having a superior impact on price movements, with many fluctuations going against the supply-demand foundation.

In the volatile environment like today, small investors are prone to losses, large organizations stand aside, industrial customers increase replacement of materials, central banks temporarily stop buying, and speculators fall into a spiral of mutual trading - a zero-sum game" - he said.

From a technical perspective, Norman believes that after a sharp drop, the market needs to recover about 50% to confirm the continued upward trend. However, most metals have only recovered weakly and soon reached the resistance level.

This creates a "yellow light" state: buyers have a basis for expectations thanks to rapid recovery, despite macroeconomic disadvantages such as positive US economic data, stronger USD and expectations that the Fed will postpone interest rate cuts. But sellers are also not grounded enough to confirm that the market has peaked" - he analyzed.

Gold maintains its position

Norman believes that structural supporting factors are still sustainable, including: the accumulation trend of central banks, the dedollarization process and public debt concerns.

Material demand continues to be strong. Gold showrooms in the UK, Europe and Asia recorded a sudden increase in customers. Insurance premiums in India remain near the highest level in a decade, although prices are already high. Seasonal demand in China shows signs of slight slowdown," he said.

Silver weakens the most

Conversely, silver shows a clear weakness, currently about 38% lower than the historical peak set in January.

The nearly 60% increase in January was mainly due to speculation, far exceeding the basic foundation, making silver vulnerable when the market reduces leverage" - Norman commented.

Although the silver market has experienced a 6-year supply deficit and industrial demand is still increasing, the current price movement is separate from these factors.

Mr. Norman also noted the potential for increasing silver demand from solid-state batteries. If this technology accounts for about 10% of the electric vehicle market and each vehicle needs about 1kg of silver, additional demand could reach 6,000 - 8,000 tons by 2035, equivalent to 1/4 of global production.

However, extreme price fluctuations are causing concern for industrial consumers. Typically, jewelry brand Pandora is switching to platinum-plated products to reduce dependence on silver.

Platinum metal group under pressure

Platinum increased by nearly 50% in January but then wiped out the entire increase and continued to decrease.

“Basic factors are still positive such as tight supply, backwarding and high metal lease rates. However, macro pressure and technical sell-offs are dominating," Norman said.

Palladium also increased sharply at the beginning of the year but quickly reversed direction. Currently, the price is almost flat compared to the beginning of the year.

Speculation still leads

The main message from Ross Norman's analysis is: the precious metal market is being led by speculation, margin adjustment and technical fluctuations, rather than real supply and demand.

For long-term investors, the basic picture has not changed. But for short-term investors, it is necessary to get used to the reality that technically correct but financially wrong" - he concluded.

Norman predicts that the upcoming US inflation data will be a key factor in orienting the market in the coming time.