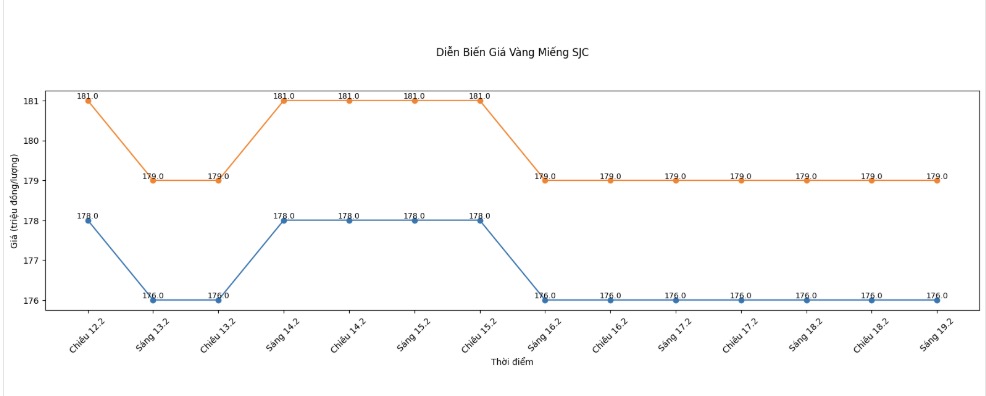

SJC gold bar price

As of 9:00 AM, SJC gold bar prices were listed by DOJI Group at 176-179 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

SJC gold bar price is listed by Bao Tin Minh Chau at 178-181 million VND/tael (buying - selling), unchanged. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Jewelry Group listed SJC gold bar prices at 176-179 million VND/tael (buying - selling), unchanged in both directions. The difference between buying and selling prices is at 3 million VND/tael.

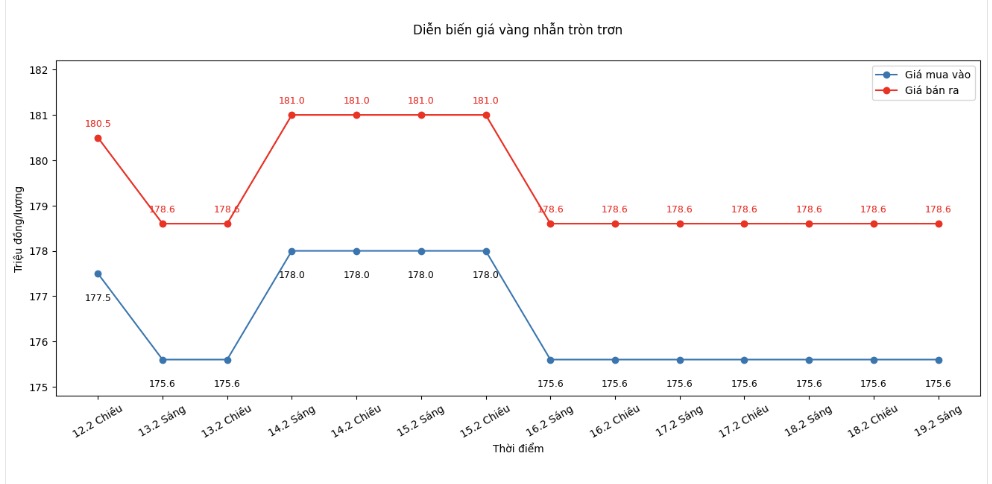

9999 gold ring price

As of 9:00 AM, DOJI Group listed the price of gold rings at 175.6-178.6 million VND/tael (buying - selling), unchanged in both directions compared to the previous day. The buying - selling difference is at 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 178-181 million VND/tael (buying - selling), unchanged in both buying and selling directions. The difference between buying and selling prices is at 3 million VND/tael.

Phu Quy Gold and Gems Group listed the price of gold rings at the threshold of 175.7-178.7 million VND/tael (buying - selling), unchanged in both directions. The buying - selling difference is at 3 million VND/tael.

Currently, the buying - selling price difference of gold is at a very high level, around 3 million VND/tael, posing a risk of losses for investors.

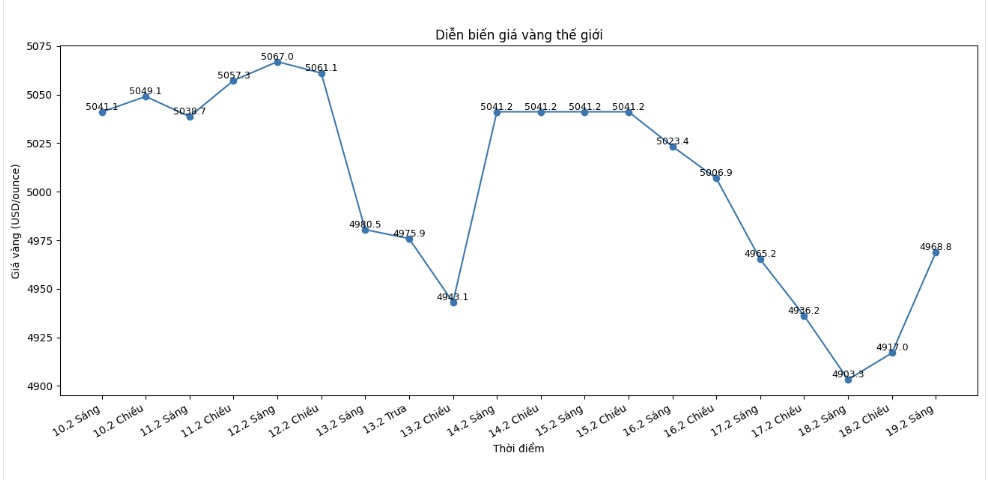

World gold price

At 9:00 AM, world gold prices were listed around 4,968.8 USD/ounce, up 65.5 USD compared to the previous day.

Gold price forecast

After a strong adjustment at the beginning of the week, the precious metal market witnessed a notable reversal session. Gold prices rebounded, while silver continued to show outstanding momentum.

This development is seen by analysts as a technical rebound, and also reflects the investor's psychology of balancing positions before the announcement of the minutes of the policy meeting of the US Federal Reserve (Fed).

At the January meeting, the Fed decided to keep interest rates unchanged, but what the market is most concerned about is the orientation signals for the coming months. Expectations for monetary policy easing – if strengthened – often provide support for gold, an asset that does not generate yields.

Recent statements by Fed Governor Michael Barr showed caution when saying that interest rates need to remain stable until more evidence of inflation approaching the 2% target. Conversely, Chicago Fed Chairman Austan Goolsbee left open the possibility of reducing interest rates this year if the price trend continues to cool down.

Along with the monetary factor, the geopolitical picture continues to intertwine impacts. Information about US-Iran contacts is assessed to have made initial progress, although not enough to completely eliminate shelter demand. The market therefore fluctuates in a narrow range but is sensitive to news.

From a technical perspective, resistance - support levels are playing a role in shaping the short-term trend. For gold futures for April delivery, the 5,000 USD/ounce area is considered a nearby barrier, while the 4,800 - 4,854 USD/ounce area is an important buffer below. For silver for March delivery, the 80 USD/ounce mark continues to be a test for the current upward momentum.

Notably, Mr. Jigar Trivedi - senior analyst at IndusInd Securities, said that the fluctuation range of gold this year may be around 4,700 - 5,100 USD/ounce. This view reflects the expectation that gold is still supported by the prospect of gradually decreasing interest rates, but adjustments are inevitable as risk psychology changes.

In the long term, many international financial institutions believe that the gold accumulation trend of central banks and protectionist demand in the face of macroeconomic instability are still the support for the price base. However, investors are advised to be cautious in the face of short-term fluctuations, especially when the market enters the "signal review" phase from the Fed and US inflation data.

Gold price data is compared to the previous day.

See more news related to gold prices HERE...