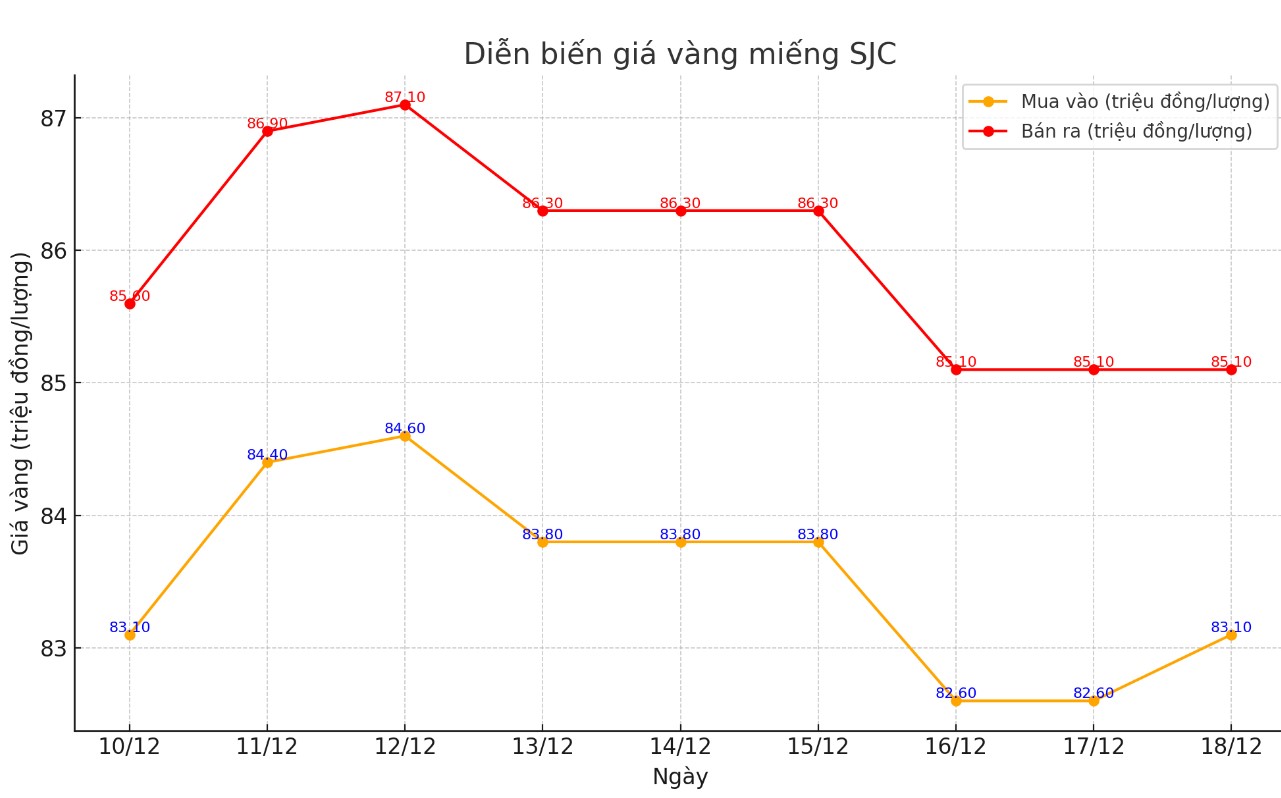

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND83.1-85.1 million/tael (buy - sell); increased by VND500,000/tael for buying and remained unchanged for selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 82.6-85.1 million VND/tael (buy - sell); unchanged in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.6-85.1 million VND/tael (buy - sell), unchanged in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2.5 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2.5 million VND/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market. It directly affects the ability to make a profit, especially in the short term.

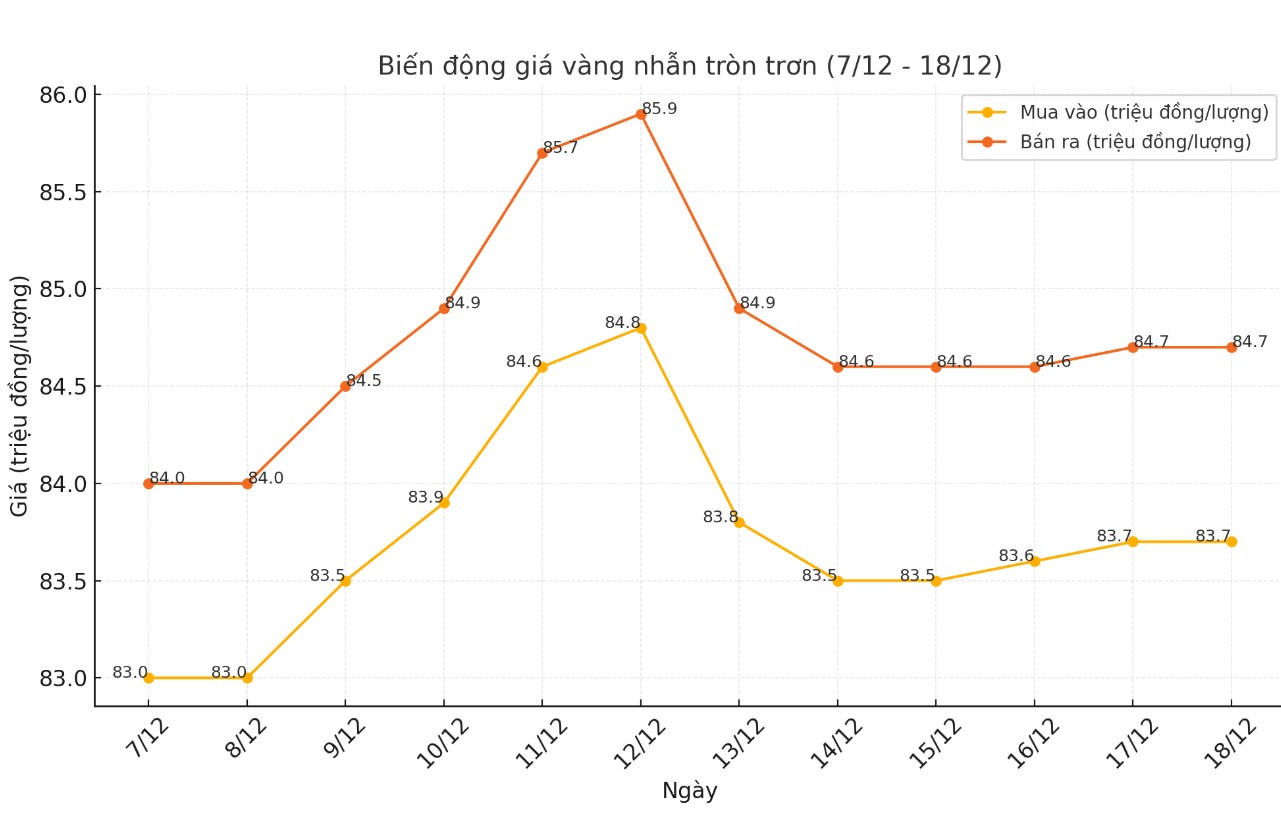

Price of round gold ring 9999

As of 9:45 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.7-84.7 million VND/tael (buy - sell); an increase of 200,000 VND/tael for buying and an increase of 100,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 83.73-85.03 million VND/tael (buy - sell), an increase of 100,000 VND/tael for buying and a decrease of 50,000 VND/tael for selling compared to early this morning.

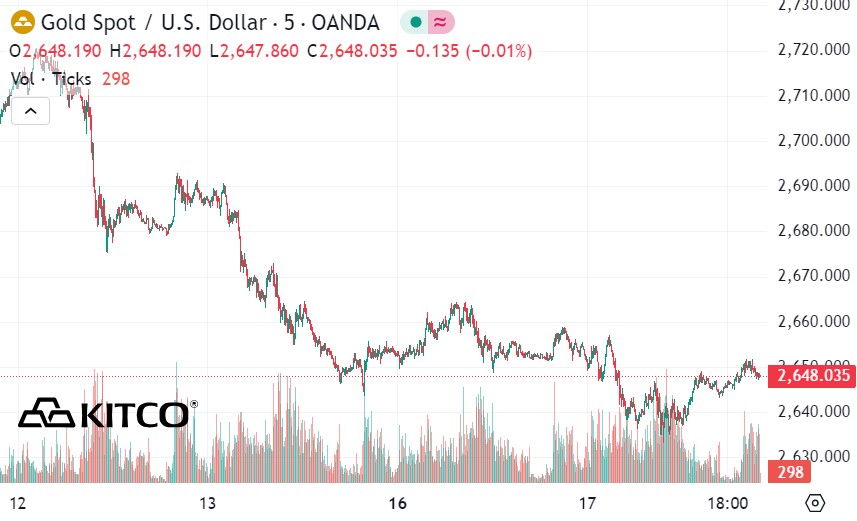

World gold price

As of 9:55 a.m., the world gold price listed on Kitco was at 2,648 USD/ounce, down 7.2 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell as the USD rose. Recorded at 10:00 a.m. on December 18, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 106,640 points.

Pressure from the rising value of the US dollar and bond yields continued to put pressure on the gold market in the early morning trading session of December 18. Investors are currently focusing on the US Federal Reserve's (FED) final policy meeting of the year, with the expectation that the pace of interest rate cuts in 2025 will be slower than previously predicted.

Market attention is now focused on new economic forecasts from the Fed and the dot plot, which could reshape the path of interest rates in 2025-2026.

U.S. retail sales rose 0.7% in November, beating expectations, thanks to strong vehicle sales and online transactions. Annual retail sales rose 3.8%, beating the 0.5% forecast. However, excluding gasoline and autos, spending rose just 0.2%, below the 0.3% expected. Treasury yields reflected the cautious mood, with the 2-year yield at 4.245% and the 10-year yield falling to 4.383%.

The key question is whether the Fed will be more hawkish or more dovish than the market expects, according to Fawad Razaqzada, an analyst at Forex.com. Investors are betting that the Fed will be cautious about easing monetary policy, especially as Donald Trump’s policies are seen as potentially inflationary.

Based on the CME FedWatch tool, the probability of the Fed cutting interest rates by 25 basis points this week is as high as 95%, but the possibility of making a similar move in January is only at 18%.

Mr. Zain Vawda - market analyst of OANDA - commented that gold is under downward pressure as the market awaits the decision from the FED.

Investors are also closely watching key US GDP and inflation data, due later in the week, for further clarity.

Exinity Group expert Han Tan said that gold prices are currently fluctuating slightly, while gold traders are waiting for policy signals from the FED. Mr. Tan predicted that if the FED adopts a tough stance, gold prices could fall to $2,600/ounce.

See more news related to gold prices HERE...