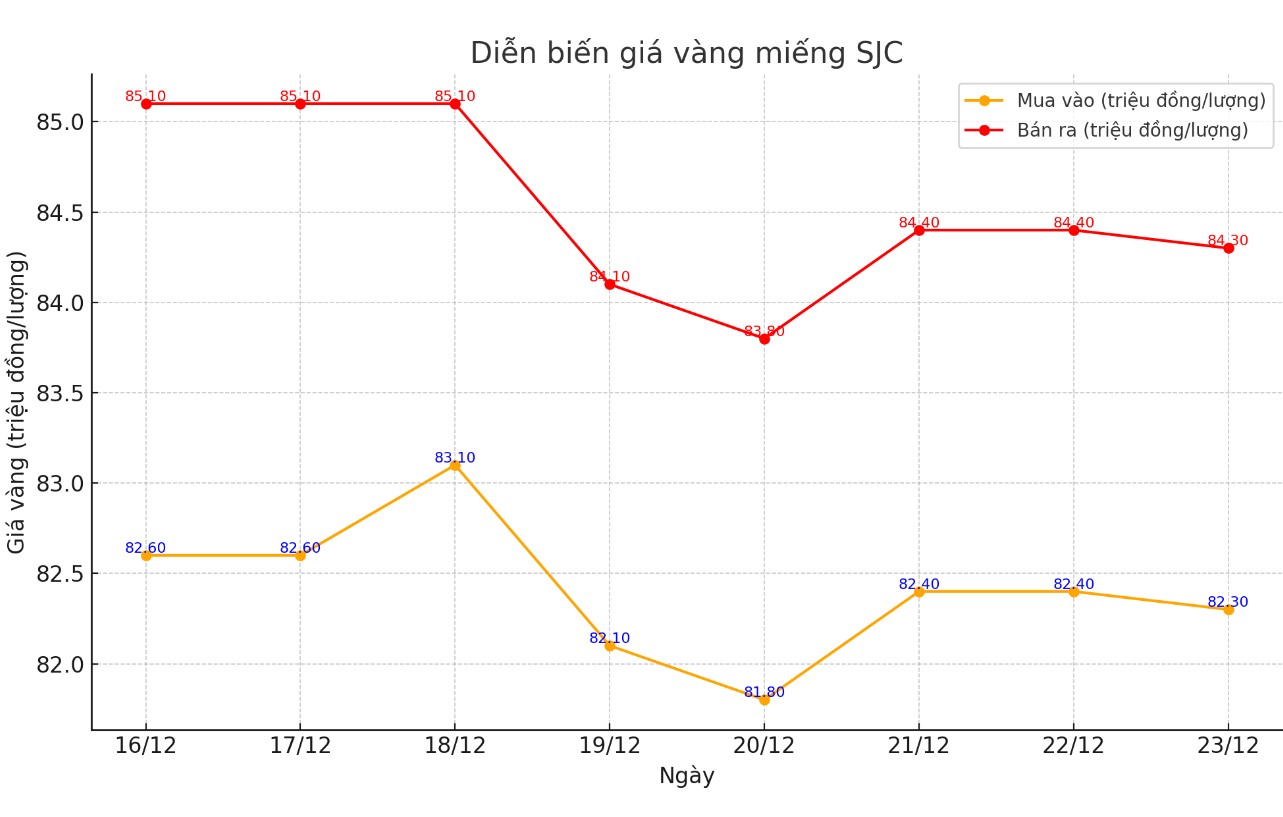

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND82.3-84.3 million/tael (buy - sell); an increase of VND500,000/tael in both directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, the price of SJC gold bars listed by DOJI Group is at 82.3-84.3 million VND/tael (buy - sell); down 100,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 82.3-84.3 million VND/tael (buy - sell); down 100,000 VND/tael in both directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around VND2 million/tael. Experts say this difference is still very high. The difference between buying and selling prices is a factor that investors need to consider when participating in the gold market because it directly affects the ability to make a profit, especially in the short term.

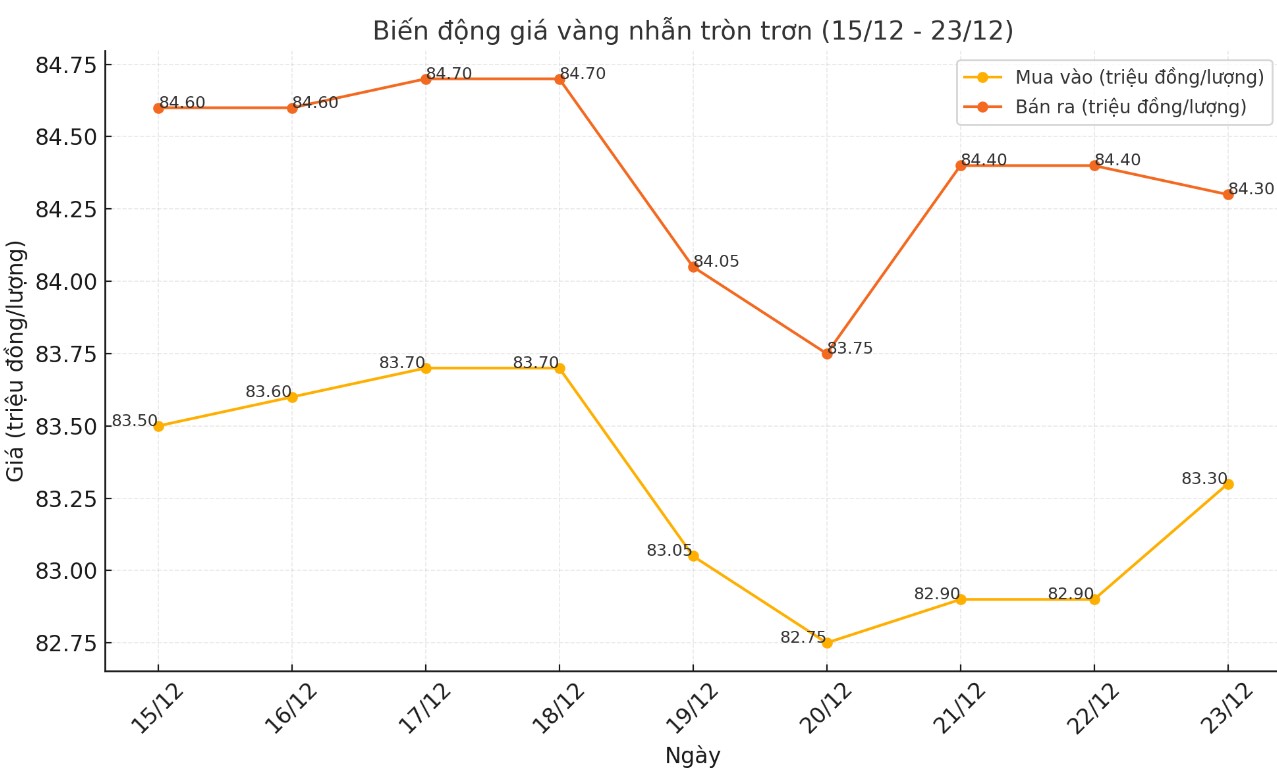

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 83.30-84.30 million VND/tael (buy - sell); an increase of 400,000 VND/tael for buying and a decrease of 100,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 82.98-84.28 million VND/tael (buy - sell), an increase of 280,000 VND/tael for buying and a decrease of 120,000 VND/tael for selling compared to early this morning.

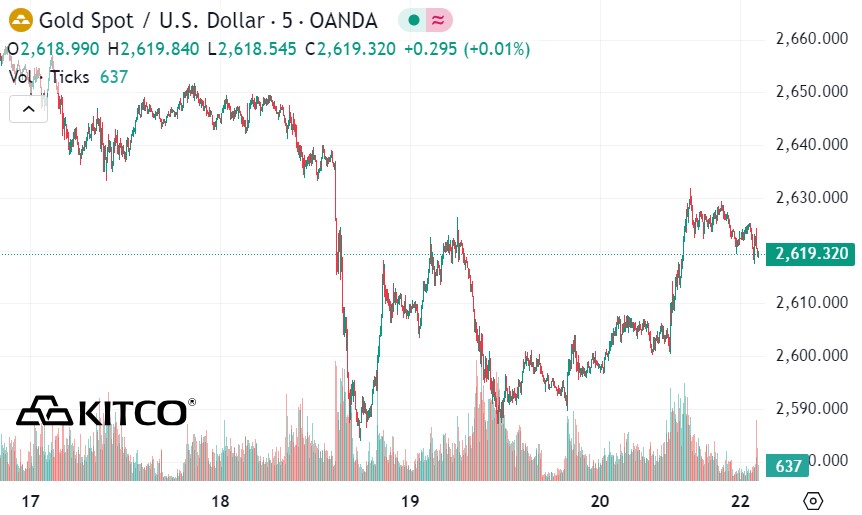

World gold price

As of 8:15 a.m., the world gold price listed on Kitco was at 2,619.3 USD/ounce, down 4.3 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell slightly as the USD increased. Recorded at 8:15 a.m. on December 23, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 107.570 points (up 0.2%).

The market was cautious after the US Federal Reserve (FED) announced its decision to cut interest rates. At the same time, the FED also signaled that it would slow down the pace of interest rate cuts in the future, thereby supporting the appreciation of the USD and pushing up US government bond yields.

According to Tom Bruce - an expert at Tanglewood, in the context of low interest rates, demand for gold from central banks is expected to increase.

The People's Bank of China (PBOC) resumed gold purchases in November after a six-month hiatus. As the world's second-largest economy, China is likely to continue to stockpile gold bars to counter the impact of trade tensions involving President-elect Donald Trump. Central bank demand is expected to play a key role in the gold market next year.

Meanwhile, US President Joe Biden signed a bill to avoid a government shutdown after it was passed by both houses of Congress. In 2023, the US federal government spent nearly $6.2 trillion, pushing the total public debt above $36 trillion. Amid economic and geopolitical uncertainty, gold continues to be seen as a safe haven asset.

According to John LaForge - Head of Real Asset Strategy at Wells Fargo, the Fed may only make one interest rate cut in 2025. He also said that demand for gold from central banks in emerging markets will continue to increase strongly, as these countries seek to diversify their reserves away from the US dollar.

In its 2025 outlook report, consulting firm State Street forecasts that gold prices will have a 50% chance of fluctuating between $2,600 and $2,900 per ounce, a 30% chance of being between $2,900 and $3,100 per ounce, and only a 20% chance of falling below $2,600 per ounce.

See more news related to gold prices HERE...