Gold prices recovered slightly thanks to safe-haven demand reappearing as the global stock market is still fluctuating, amid concerns that US stocks are overvaluable and there are AI stocks.

December gold contract increased by 12.7 USD, to 3,972.9 USD/ounce. December delivery silver price decreased by 0.011 USD, to 47.285 USD/ounce.

The global stock market last night had mixed developments to weaken. US stock indexes are expected to open slightly down in the New York trading session.

The US government is currently in its longest shutdown in history, and as there are no signs of being resolved soon, its economic impact is getting worse.

It has now reached the 36th day that the closure has surpassed the previous record set in early 2019 during the first term of US President Donald Trump.

Each week that has passed has caused the economy to suffer losses ranging from 10 billion to 30 billion USD, according to analysts' estimates, many forecasts are around 15 billion USD. Depending on the length of the closure, the closure could reduce US economic growth in the fourth quarter by up to 2 percentage points, according to the Congressional Budget Office (CBO). If the stalemate continues into Thanksgiving, the $14 billion damages will not be recovered, the CBO said, according to Bloomberg.

The ADP's employment report was the focus of attention today. ADP Research's private sector employment report, released before the US market opened today, may have a greater impact than usual due to limited access to the labor market amid a record-long government shutdown. The expected figures show a slight increase in October after two consecutive months of decline, according to Bloomberg.

With the currency market pricing in about a 70% chance that the Federal Reserve will cut interest rates in December to support the labor market, a surprising result could change this expectation.

If the ADP report shows a sharp decline, discussions about the Fed cutting interest rates will increase, which could support the stock market, said UniCredit SpA strategist Christian Stocker, according to Bloomberg.

Technically, the next bullish target for December gold futures is to close above a solid resistance level at $4,100/ounce. The nearest downside target for the sellers is to push prices below the strong support zone at $3,800.00.

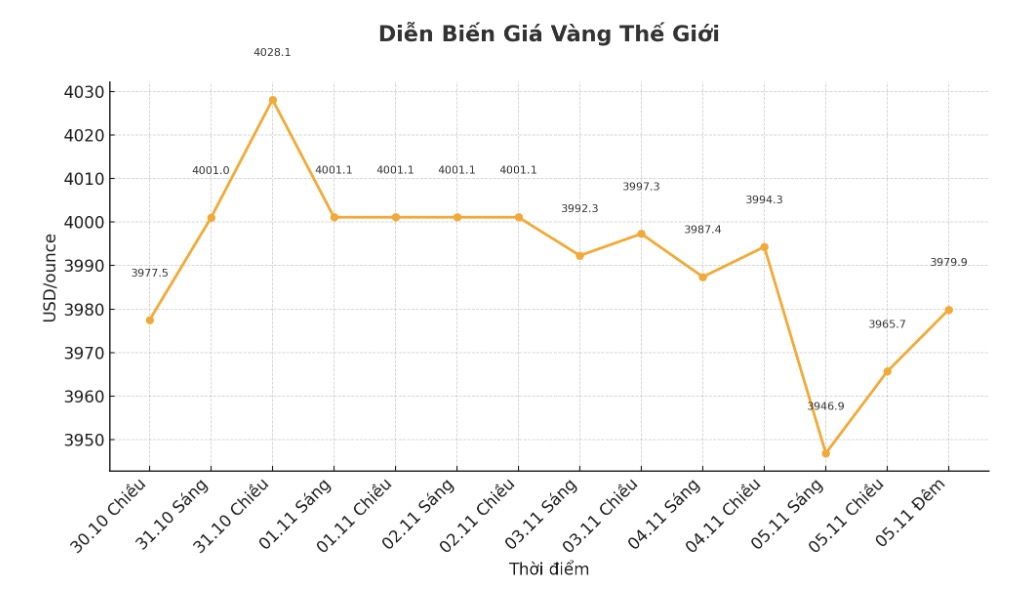

The first resistance level was recorded at 4,000 USD/ounce, then the highest level of the week at 4,043.1 USD/ounce. First support was at last night's lowest level - $3,935.7/ounce, followed by $3,900/ounce.

Overseas markets saw the US dollar index slightly decline today. Crude oil prices are weaker, trading around 60.25 USD/barrel. The yield on the 10-year US government bond is currently at 4.08%.

The world gold market operates through two main valuation mechanisms. The first is the spot delivery market, where prices are for immediate purchase and delivery. Second is the term market, which determines the price for future delivery.

Due to year-end liquidity and position balance, December gold futures are currently the most actively traded on the CME floor.