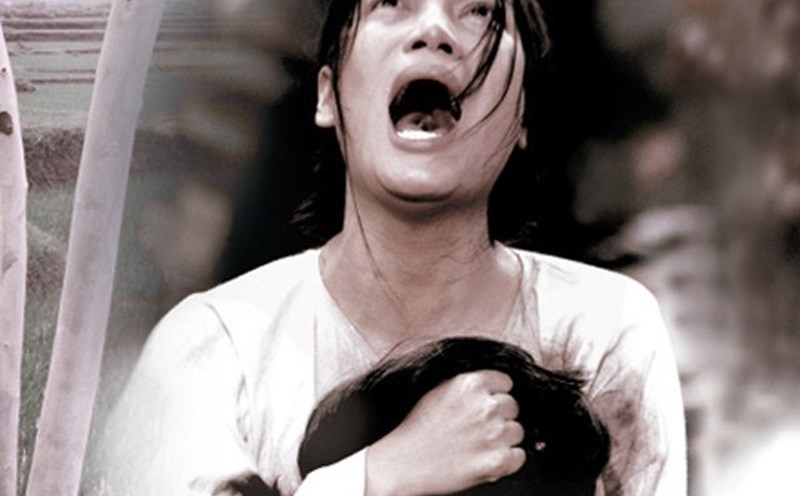

SJC gold bar price

As of 6:00 a.m., DOJI Group listed the price of SJC gold bars at 146.4-148.4 million VND/tael (buy in - sell out), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 146.9-148.4 million VND/tael (buy - sell), an increase of 400,000 VND/tael for buying and an increase of 600,000 VND/tael for selling. The difference between buying and selling prices is at 1.5 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 145.9-148.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

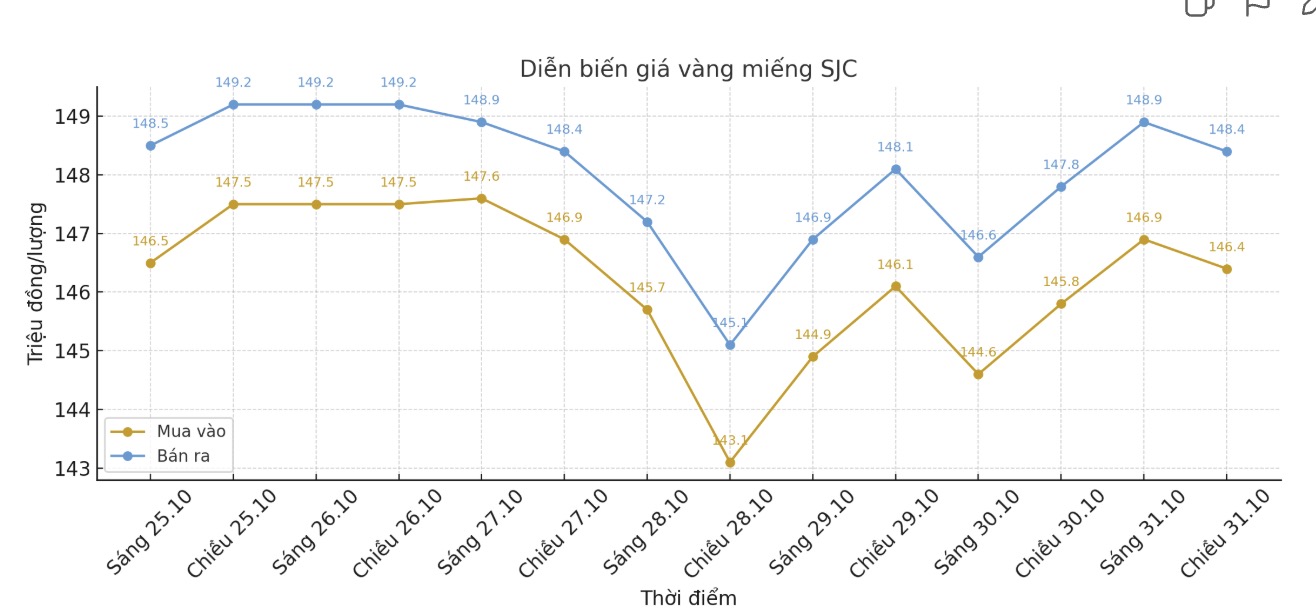

9999 gold ring price

As of 6:00 a.m., DOJI Group listed the price of gold rings at 145.3-148.3 million VND/tael (buy - sell), an increase of 600,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 146.2-149.2 million VND/tael (buy - sell), an increase of 300,000 VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 145.4-148.4 million VND/tael (buy - sell), an increase of 600,000 VND/tael for both buying and selling. The difference between buying and selling is 3 million VND/tael.

The high buying and selling distance increases the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

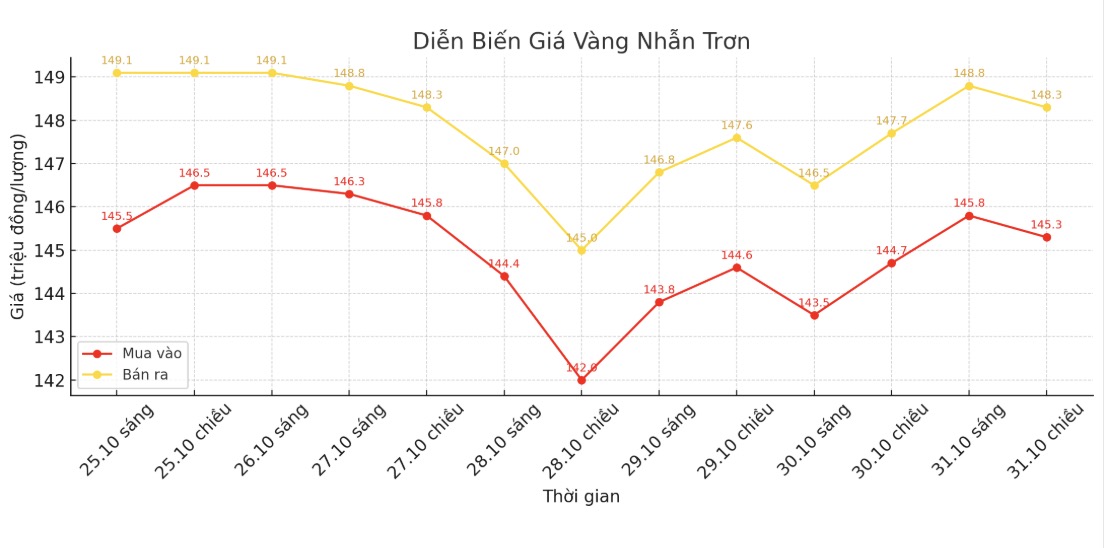

World gold price

The world gold price was listed at 6:00 a.m. at 4,001.1 USD/ounce, down 24.9 USD/ounce.

Gold price forecast

Gold prices are under pressure as the USD strengthens amid concerns about the prospect of the next interest rate cut by the US Federal Reserve (FED). However, the precious metal is still heading for its third consecutive month of increase.

The Federal Open Market Committee (FOMC) lowered the federal interest rate target range by 0.25% on Wednesday, in line with market expectations, with disagreements in both directions.

However, Mr. Powell warned investors not to expect too much about the possibility of a rate cut in December, emphasizing the growing division within the Fed in terms of employment prospects and inflation. He said: "continuing to cut interest rates at the December meeting is not certain - it is far away to say so."

Mr. Powell's tough tone has caused US Treasury bond prices to fall (increase yields), leaving the possibility of the Fed cutting interest rates in December at only average.

In the international market, global stock exchanges last night had mixed to moderate positive movements, while US stock indexes are expected to open up firmly in the New York session.

In the remarkable international developments, Chinese President Xi Jinping emphasized the importance of maintaining a stable and smooth global supply chain, calling on countries to cooperate more closely to strengthen the trade and production system.

Speaking at the APEC Summit in Gyeongju (South Korea), he said that it is necessary to strengthen the spirit of cooperation and multilateralism to promote sustainable growth in the region.

Also on the same day, according to Bloomberg, defense ministers of some major economies had their first face-to-face meeting in Kuala Lumpur, in a move seen as contributing to strengthening international dialogue and cooperation in the context of the global move towards more stability and balance.

In China, manufacturing activity continued to weaken, with the Official Manufacturing PMI in October falling to 49 points the lowest level in six months and marking the longest downward trend in more than nine years. A level below 50 points shows that the manufacturing sector is in a narrowing phase, raising expectations that Beijing will launch new economic stimulus measures.

Technically, experts say buyers are aiming to close above the strong resistance level of 4,100 USD/ounce, while sellers are aiming to pull prices below the support zone of 3,800 USD/ounce.

The immediate resistance level was at 4,059.9 USD/ounce and then 4,100 USD/ounce, while the most recent support was at 4,000 USD/ounce, followed by 3,950 USD/ounce.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...