Bank of America (BofA - one of the largest banks in the US and the world) - recently issued a gold price forecast.

The bank said gold and silver are still in a strong uptrend, with a forecast that gold prices could reach $5,000/ounce and silver could reach $65/ounce next year.

Meanwhile, the World Gold Council (WGC) said that gold demand has set a new record and the outlook is still optimistic in the coming time.

Data released by the WGC shows that global gold demand in the third quarter reached 1,313 tons, equivalent to 146 billion USD, the highest level ever recorded in a quarter.

The World Bank (WB) has also just released its October commodity market forecast and said that gold is entering a historic price increase cycle.

The World Bank forecasts that the average gold price in 2025 could reach about 3,250 USD/ounce, up to 40% compared to 2024.

In 2026, gold prices will continue to increase by about 5%, reaching an average of 3,575 USD/ounce, and may even reach 4,300-5,000 USD/ounce if geopolitical tensions have not cooled down and demand for shelter remains high.

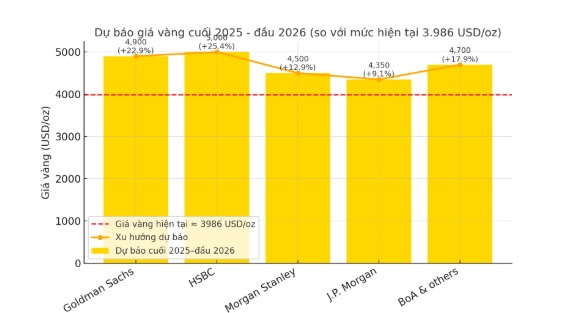

HSBC Bank also issued a very optimistic forecast, with the possibility of gold prices reaching 5,000/ounce in the first half of 2026.

Meanwhile, Goldman Sachs - a multinational investment bank and a US financial services company - raised its forecast for gold prices to reach 4,900/ounce by 2026 thanks to the central bank's additional purchasing capabilities.

Forecasts all show that gold prices range from $4,500-5,000/ounce, with an average of about $4,700/ounce, reflecting a strong uptrend compared to the current level.

The reason international financial institutions predict that gold prices will continue to increase in the late 2025 - early 2026 period is due to the expectation that the FED and many central banks will lower interest rates, causing the opportunity cost of holding gold to decrease. While the US dollar weakened and US bond yields fell.

Strong buying from central banks and exchange-traded funds (ETFs) is also becoming an important driving force, as they seek safe haven and reserve channels amid global economic uncertainty. Geopolitical factors, trade conflicts, and the risk of declining growth continue to strengthen the psychology of "safe priority" in the market.

According to experts, when the above factors converge - falling interest rates, weak USD, increased safe-haven cash flow and expanding central bank savings demand - gold prices are likely to increase, even setting a new price level in 2026.

Updated gold price today:

In the domestic market, gold bar prices fell sharply compared to yesterday; gold ring prices in some brands continued to stay at a very high level, with some brands trading higher than gold bar prices.

As of 6:30 p.m., DOJI Group listed the price of SJC gold bars at 146.2-148.2 million VND/tael (buy in - sell out), down 800,000 VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

The price of SJC gold bars was listed by Bao Tin Minh Chau at 147.2-148.2 million VND/tael (buy - sell), down 300,000 VND/tael for buying and down 800,000 VND/tael for selling. The difference between buying and selling prices is at 1 million VND/tael.

Plain round gold rings are traded by enterprises at 145.7 million VND/tael for buying and 148.7 million VND/tael for selling (down 800,000 VND/tael compared to yesterday in both directions).

On the world market, on November 4, the spot gold price was at 3,986.2 USD/ounce.