After a period of downward adjustment, UBS Bank - the largest bank in Switzerland and among the world's top - said that the decline in gold prices was only temporary.

According to the research report published on November 3, UBS forecasts that gold prices are still on track towards the 4,200 USD/ounce mark in the first quarter of 2026, and in case of escalating geopolitical or financial risks, the highest price could be up to 4,700 USD/ounce.

According to UBS, the World Gold Council (WGC) in its Q3/2025 report confirmed a strong and increasingly accelerated gold buying trend from both central banks and private investors.

Global central banks have purchased 634 tonnes of gold since the beginning of the year, although slower than in 2024, but are accelerating in the fourth quarter - in line with UBS's forecast of 900-950 tonnes in 2025.

Gold ETFs recorded capital flows at 222 tons, while demand for gold bars and coins surpassed 300 tons for the fourth consecutive quarter - a testament to increased investment attraction.

Meanwhile, jewelry demand is not as weak as expected, UBS added.

Mr. Sagar Khandelwal - strategist of UBS Global Wealth Management - said that real interest rates falling, the weak USD, the US public debt increasing and geopolitical instability are factors that can push gold prices to the mark of 4,700 USD/ounce in the first quarter of 2026.

Although he acknowledged that strong growth could lead to short-term volatility, he emphasized: Gold is an essential element in a sustainable investment strategy.

Mr.handelwal warned that real US interest rates could fall to negative levels, as the Federal Reserve (Fed) is forced to cut interest rates while inflation remains persistent. This will reduce the attractiveness of the US dollar and boost cash flow into gold, he said.

According to the WGC, global gold ETFs recorded their largest inflows since the statistics - $17 billion in September, bringing the total increase in the third quarter to $26 billion, a record high.

UBS forecasts that total global gold demand in 2025 could reach about 4,850 tons, the highest since 2011. If private investors also start shifting capital from US Treasury bonds to gold - as the trend of many central banks, spot gold prices could be pushed even higher.

UBS believes that in the context of prolonged global economic, political and policy uncertainty, cash flow will continue to seek gold as a safe haven, helping the precious metal increase to the 4,700 USD/ounce zone.

With a low correlation between gold and stocks or bonds, especially during times of market stress, we continue to recommend an average gold ratio in a diverse portfolio, UBS concluded.

Investors can also consider stocks of gold mining companies, as their cash flow could increase faster than gold prices in the next 6 months, according to Mr. Khandelwal's recommendation.

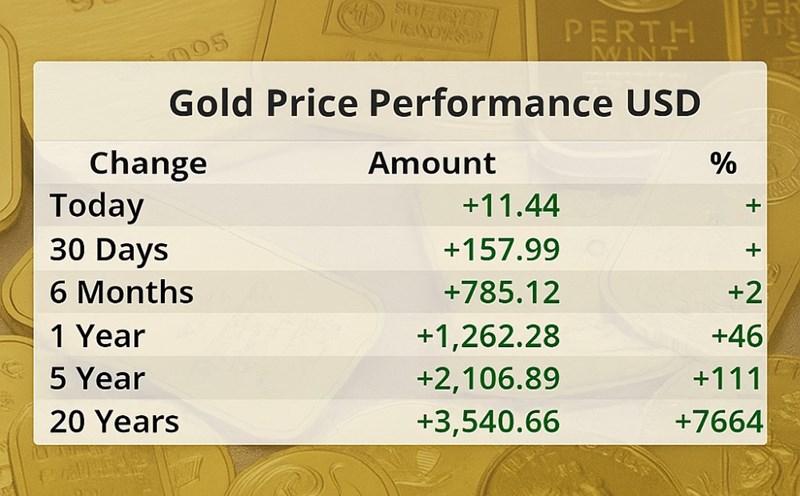

The world gold price at 10:00 a.m. on November 4, Vietnam time, was trading at 3,987.53 USD/ounce, down 15.40 USD, equivalent to a decrease of 0.38%.

Regarding domestic gold prices, as of 9:55 a.m. on November 4, SJC gold bar prices were trading around 147.2 - 148.2 million VND/tael (buy - sell).

The price of 9999 Bao Tin Minh Chau gold rings is listed at 145.7 - 148.7 million VND/tael (buy - sell).