Gold prices fell as three officials of the Federal Reserve (FED) did not clearly support continuing to cut interest rates next month, in the context of the USD index trading near its highest level in many months.

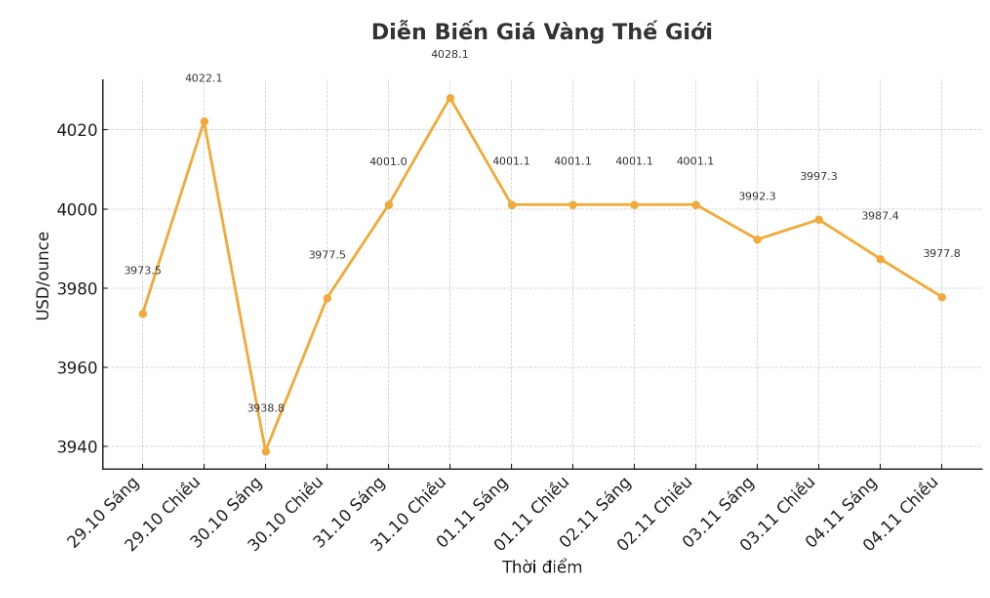

Spot gold prices fell to nearly $3,980 an ounce, after fluctuating between ups and downs in the first session of the week.

Fed Governor Lisa Cook said she sees the risk of further weakening the labor market is greater than the risk of rising inflation again, but did not commit to the possibility of the Fed continuing to cut interest rates at its December meeting. These statements reflect similar views from two colleagues, Mary Daly and Austan Goolsbee.

The precious metal rose to record levels in the middle of last month, before falling due to concerns that the increase in this commodity was taking place too quickly. Traders are now looking to assess whether the uptrend will return, with the outlook partly dependent on the Fed's policy, as the US's loose monetary policy makes aker-yielding assets gold more attractive. After two recent interest rate cuts, the Fed's policymakers will meet next month for the final regular meeting of the year.

There is a possibility that the Fed will try to reduce market expectations of a rate cut, said Kyle Rodda, an analyst at Capital.com Inc. This could increase yields and the US dollar, thereby putting pressure on gold prices.

At the end of last month, FED Chairman Jerome Powell also warned investors not to believe that the US central bank will continue to cut interest rates in December, in a speech that appeared to curb market expectations.

Spot gold prices fell 0.5% to $3,981.86/ounce at 9:27 a.m. in Singapore. The Bloomberg Dollar spot Index rose slightly, after finishing the first session of the week at its highest level since July.

Silver and palladium prices fell, while platinum prices remained almost flat.

Gold prices remained largely unchanged in the first session of the week, after China announced on Saturday that some retailers will no longer be fully covered by value-added tax (VAT) on input when selling certain items. This move raises concerns about the outlook for gold demand, as it is still unclear how the new regulation will be implemented in practice.