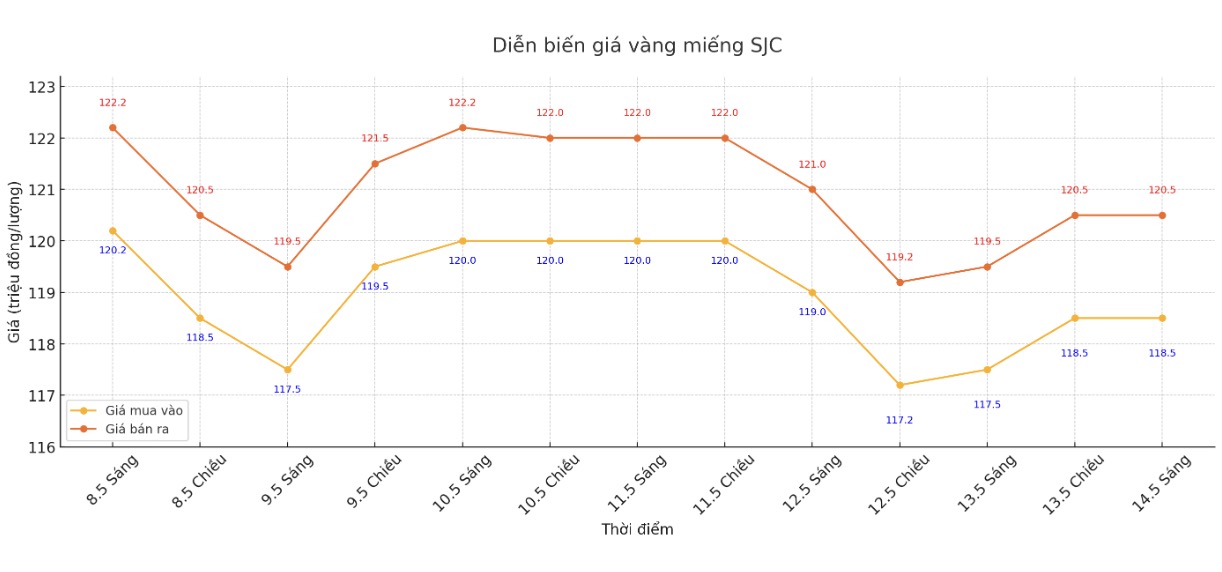

Updated SJC gold price

As of 9:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at VND 118.5-120.5 million/tael (buy in - sell out), an increase of VND 1 million/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

At the same time, the price of SJC gold bars was listed by DOJI Group at 118.5-120.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Meanwhile, Bao Tin Minh Chau listed the price of SJC gold bars at 118.5-120.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 2 million VND/tael.

Phu Quy Jewelry Group listed the price of SJC gold bars at 117.5-120.5 million VND/tael (buy in - sell out), an increase of 1 million VND/tael in both directions. The difference between buying and selling prices is at 3 million VND/tael.

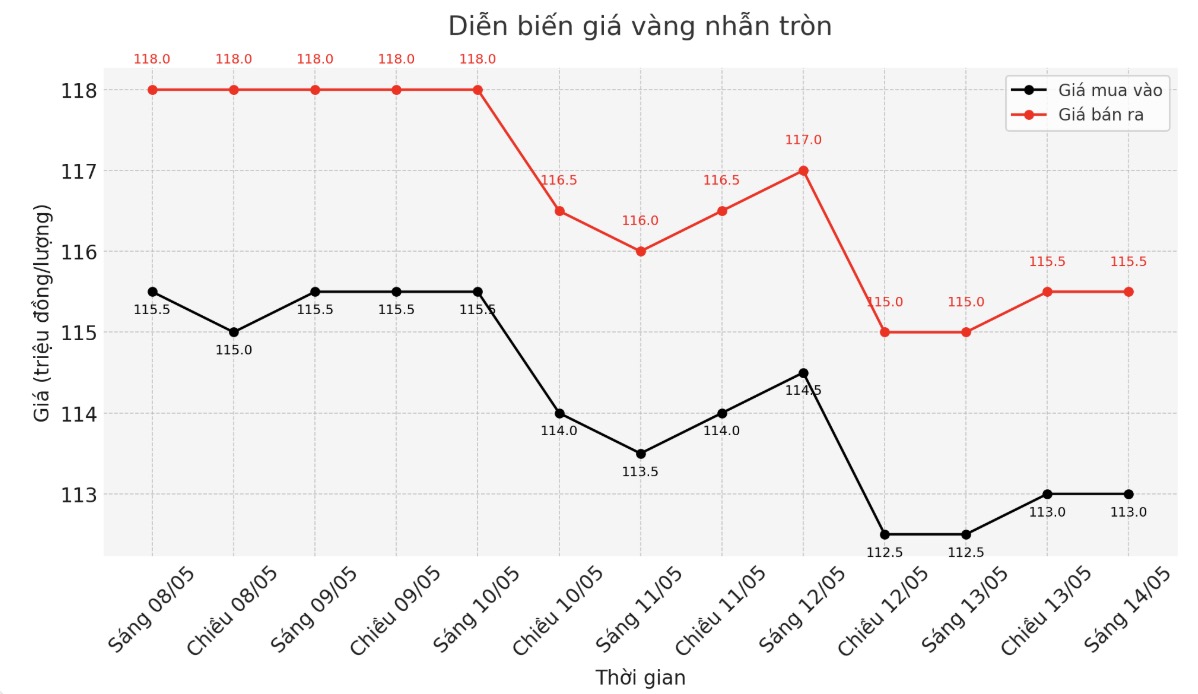

9999 round gold ring price

As of 9:00 a.m., the price of Hung Thinh Vuong 9999 round gold rings at DOJI was listed at 113-125.5 million VND/tael (buy in - sell out), an increase of 500,000 VND/tael in both directions. The difference between buying and selling prices is at 2.5 million VND/tael.

Bao Tin Minh Chau listed the price of gold rings at 116-119 million VND/tael (buy - sell), an increase of 1 million VND/tael in both directions. The difference between buying and selling is 3 million VND/tael.

Phu Quy Gold and Stone Group listed the price of gold rings at 114-117 million VND/tael (buy - sell), an increase of 500,000 VND/tael in both directions.

In the context of strong fluctuations in domestic gold prices, the buying-selling gap is pushed too high, increasing the risk for individual investors. Personal investors, especially those with a "surfing" mentality, need to consider carefully before putting money down.

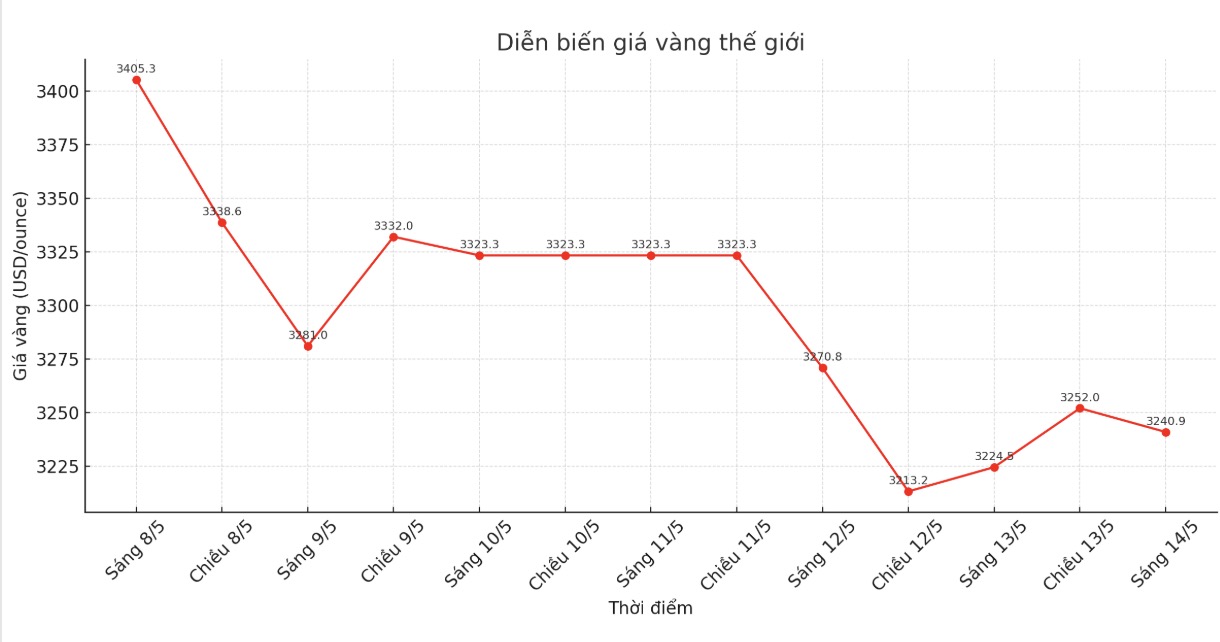

World gold price

At 8:55 a.m., the world gold price listed on Kitco was around 3,240.9 USD/ounce, up 16.4 USD/ounce.

Gold price forecast

Gold prices remain above the key support zone after US President Donald Trump's tax announcement. Initially, he applied a high tax rate on imported goods, but later switched to a unified tax rate of 10%.

Recently, the US government continued to adjust its trade policy when announcing a tax reduction on goods imported from China to 30%.

Although gold prices fell 3% in the first session of the week due to the signal of cooling down in US-China relations, analysts at TD Securities still believe that this precious metal will be well supported in the context of continued global instability.

TD Securities assessed that investment demand for gold remains high, as Western financial institutions adjust their asset allocation strategies, promoting capital flows into gold ETFs. At the same time, demand from ETFs in Asia continues to play a leading role.

Jeffrey Roach - Chief Economist at LPL Financial - commented: "Although market sentiment has improved, uncertain factors still cover global financial markets. Temporary trade deals make it difficult for the Fed to issue policy orientations, especially when the risk of economic recession has not been ruled out.

Bart Melek - Head of Commodity Strategy at TD Securities - also said that the current tax rate is still putting pressure on growth, although gold adjusted strongly after the news of reaching a trade deal.

Carlo Alberto De Casa - an analyst at Swissquote - warned that tax policy instability is still a big risk for the market. After the boost from tax reduction information, the stock market is temporarily closed, while the USD continues to fluctuate.

Note: Gold price data is compared to a day earlier.

See more news related to gold prices HERE...