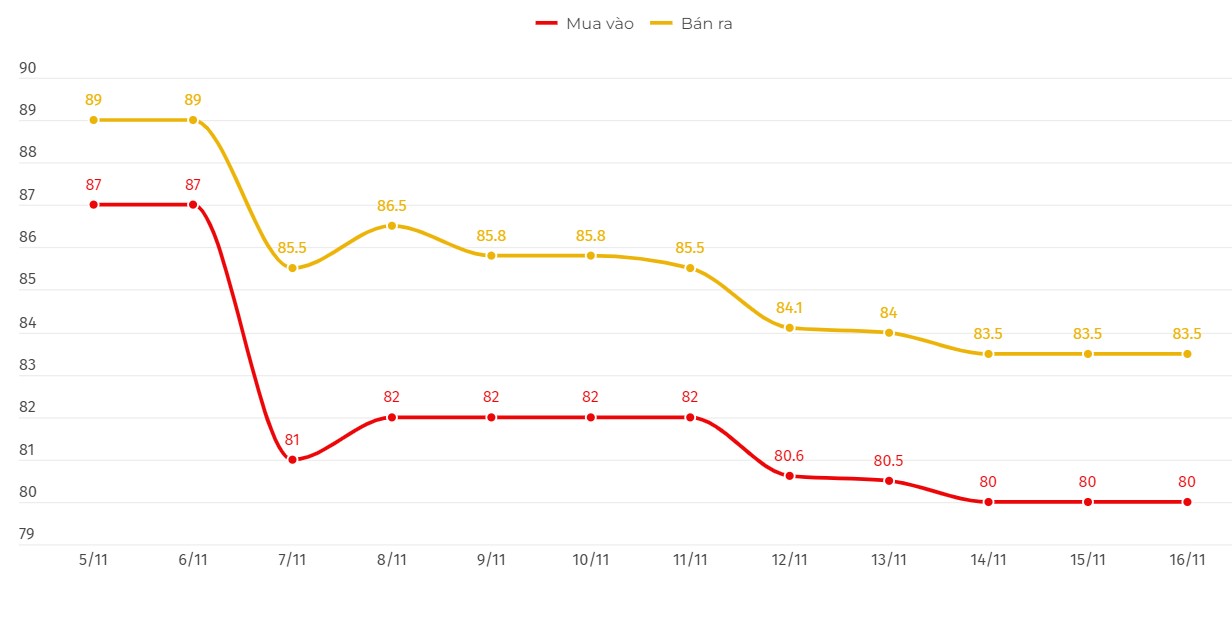

Update SJC gold price

As of 9:30 a.m., the price of SJC gold bars was listed by DOJI Group at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at DOJI Group is at 3.5 million VND/tael.

Meanwhile, Saigon Jewelry Company listed the price of SJC gold at 80-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 3.5 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 80.3-83.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 3.2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

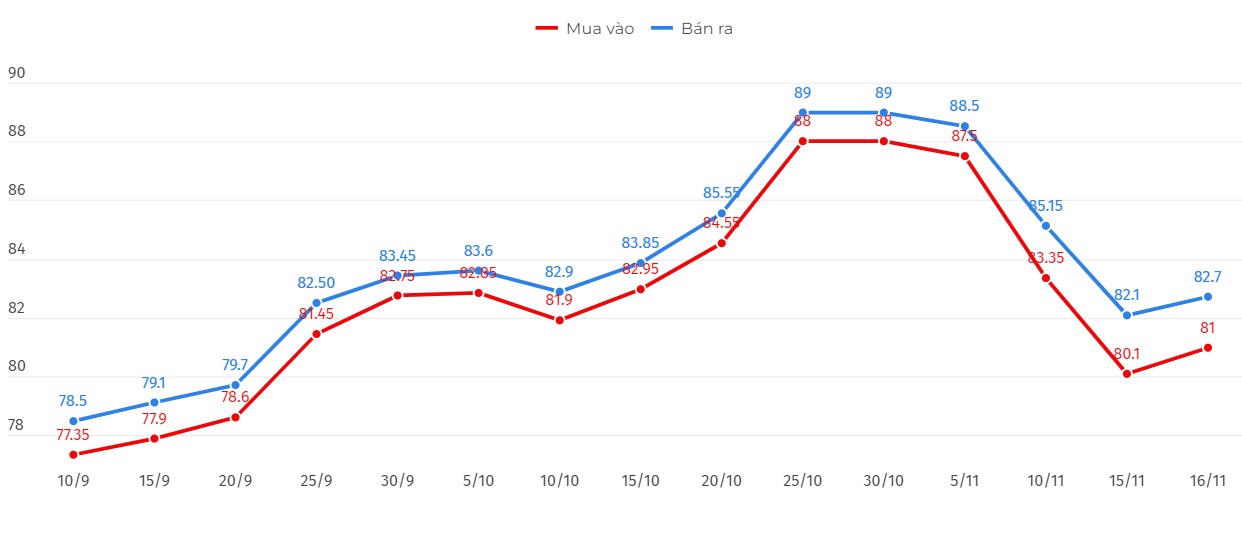

Price of round gold ring 9999

As of 9:30 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 81-82.7 million VND/tael (buy - sell); an increase of 900,000 VND/tael for buying and an increase of 600,000 VND/tael for selling compared to early this morning.

Bao Tin Minh Chau listed the price of gold rings at 80.78-82.68 million VND/tael (buy - sell), an increase of 660,000 VND/tael for buying and 460,000 VND/tael for selling compared to early this morning.

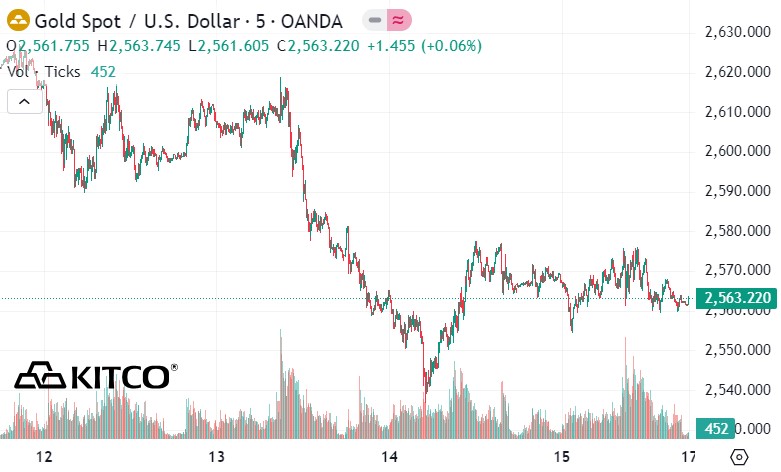

World gold price

As of 9:25 a.m., the world gold price listed on Kitco was at 2,563.2 USD/ounce, down 4.6 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell due to pressure from the strong increase of the USD. Recorded at 9:30 a.m. on November 16, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 106.620 points (up 0.02%).

Kelvin Wong, senior market analyst at Oanda, said the stronger USD and rising 10-year Treasury yields have impacted gold prices.

Following the US presidential election results, the “Trump Trade” policy triggered a significant rally in the USD against major and emerging currencies. The USD Index surged, breaking through the key resistance zone of 106.37. The USD is up 7% from its low on September 27.

Gold is on track for its biggest weekly decline since 2021, down nearly 5% for the week, according to Kitco. Gold prices were weaker after a stronger-than-expected U.S. retail sales report.

U.S. economic data showed retail sales rose 0.4 percent in October from the previous month, slightly above traders' expectations for a 0.3 percent increase. The hotter CPI data followed U.S. consumer and producer price index reports this week that showed steady inflation.

US Federal Reserve Chairman Jerome Powell delivered a speech on Thursday afternoon that was somewhat tough on US monetary policy.

“Mr Powell spooked markets in his speech and Q&A session on Thursday, saying the US economy was giving no indication that the central bank should rush to cut interest rates,” said David Morrison, senior market analyst at Trade Nation.

His comments led to a pullback in stocks and a rise in bond yields. The comments also led to a sharp reversal in interest-rate cut expectations as measured by the CME FedWatch Tool.

The probability of a 25 basis point rate cut at the Fed's FOMC meeting next month was 82% on Thursday morning. That number dropped to 62% after Powell's comments. Meanwhile, the Boston Fed said Thursday that a December rate cut by the Fed is "certainly on the table but not a done deal."

Meanwhile, Allegiance Gold CEO Alex Ebkarian said that all the uncertainties, especially the short-term ones, have disappeared. Now, only the fundamentals remain, and that is having a strong impact on gold.

Fawad Razaqzada, a market analyst at Forex, said the fall in gold prices reflected expectations of tighter US monetary policy in 2025 under Donald Trump. Higher interest rates increase the opportunity cost of holding gold.

See more news related to gold prices HERE...