Update SJC gold price

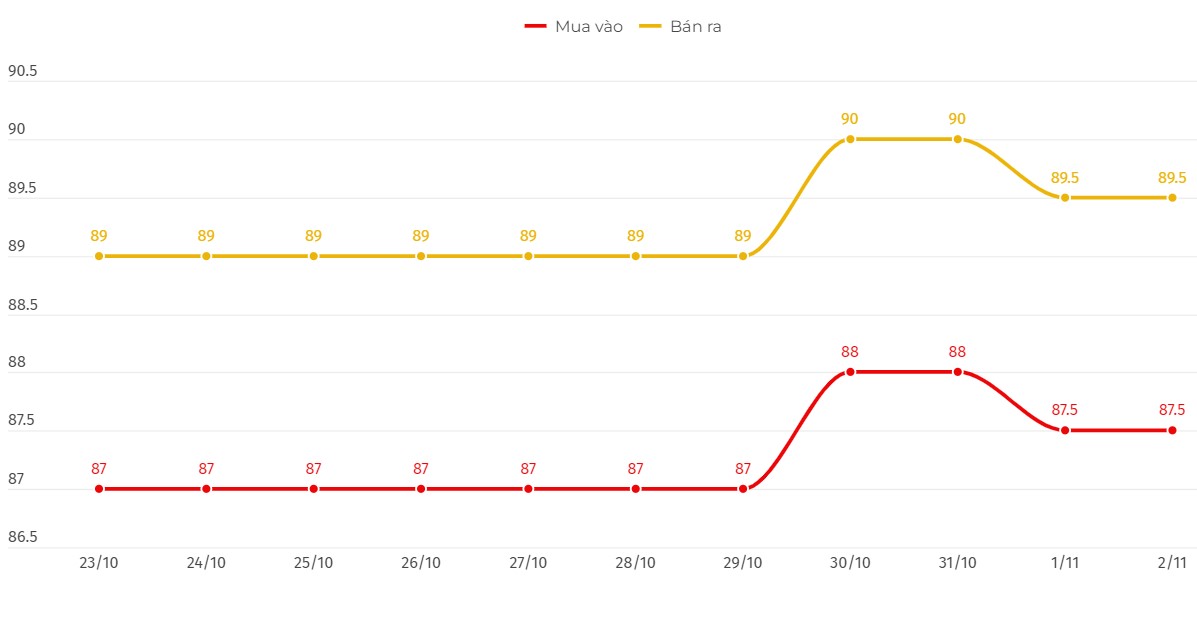

As of 9:00 a.m., the price of SJC gold bars was listed by DOJI Group at 88-90 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at DOJI remained unchanged in both buying and selling directions.

The difference between buying and selling prices of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 87.5-89.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, the gold price at Saigon Jewelry Company SJC remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 87.5-89.5 million VND/tael (buy - sell).

Compared to the beginning of the previous trading session, gold prices at Bao Tin Minh Chau remained unchanged in both buying and selling directions.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Currently, the difference between buying and selling gold prices is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

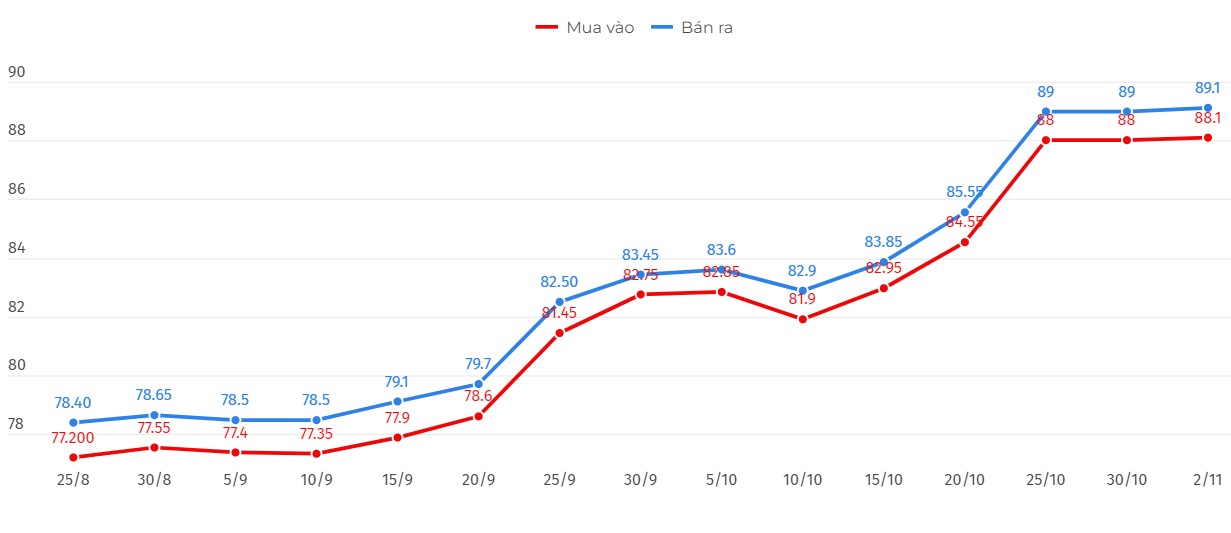

Price of round gold ring 9999

As of 9am today, the price of 9999 Hung Thinh Vuong round gold ring at DOJI is listed at 88-89 million VND/tael (buy - sell); down 250,000 VND/tael in both directions.

Bao Tin Minh Chau listed the price of gold rings at 88.18-89.18 million VND/tael (buy - sell); down 50,000 VND/tael in both directions.

World gold price

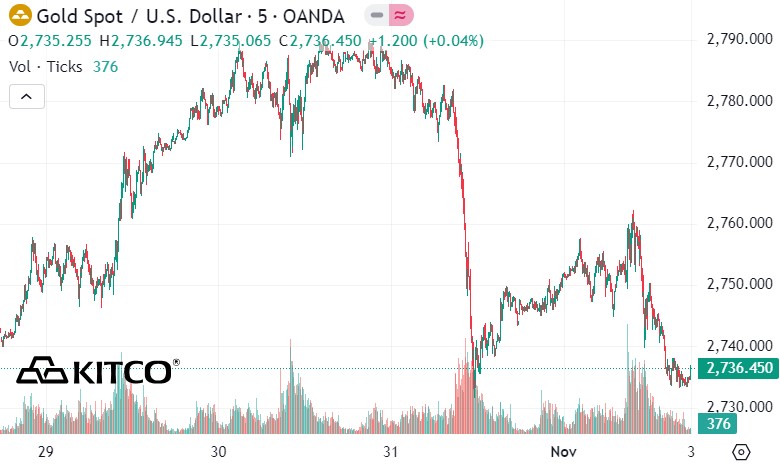

As of 8:38 a.m., the world gold price listed on Kitco was at 2,736.4 USD/ounce, down 14.2 USD/ounce compared to the beginning of the previous trading session.

Gold Price Forecast

World gold prices fell as the USD index rose. Recorded at 8:38 a.m. on November 2, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 104.239 points (up 0.35%).

Despite the continuous decline, experts say that this precious metal is on track to reach $3,000/ounce in the next 6 months in the context of the deteriorating US labor market and increasing demand from exchange-traded funds.

Global gold exchange-traded funds, which have seen Vietnamese sausagey outflows for three consecutive years amid high interest rates, saw Vietnamese sausagey inflows in September for the fifth consecutive month.

On the physical front, high prices continue to weigh on physical gold demand in major Asian regions. In China, gold consumption fell 11% in the first nine months of 2024. In India, the share of gold coins and bars in sales is rising as buyers are reluctant to pay the extra cost of jewelry making.

Jesse Colombo, an independent precious metals analyst, noted that while gold appears slightly overbought, it remains in a solid uptrend as prices stabilize between $2,700 and $2,800 an ounce.

David Brady, another independent analyst, noted that with the current rally, gold prices are likely to test resistance at $3,000 an ounce before a major sell-off occurs.

Economic data to watch next week

Monday: Reserve Bank of Australia monetary policy decision

Tuesday: Institute for Supply Management (ISM) Purchasing Managers' Index (PMI), US Presidential and Congressional Elections

Thursday: Bank of England monetary policy decision, US weekly jobless claims, US Federal Reserve monetary policy decision.

Friday: University of Michigan Consumer Psychology Preliminary.

See more news related to gold prices HERE...