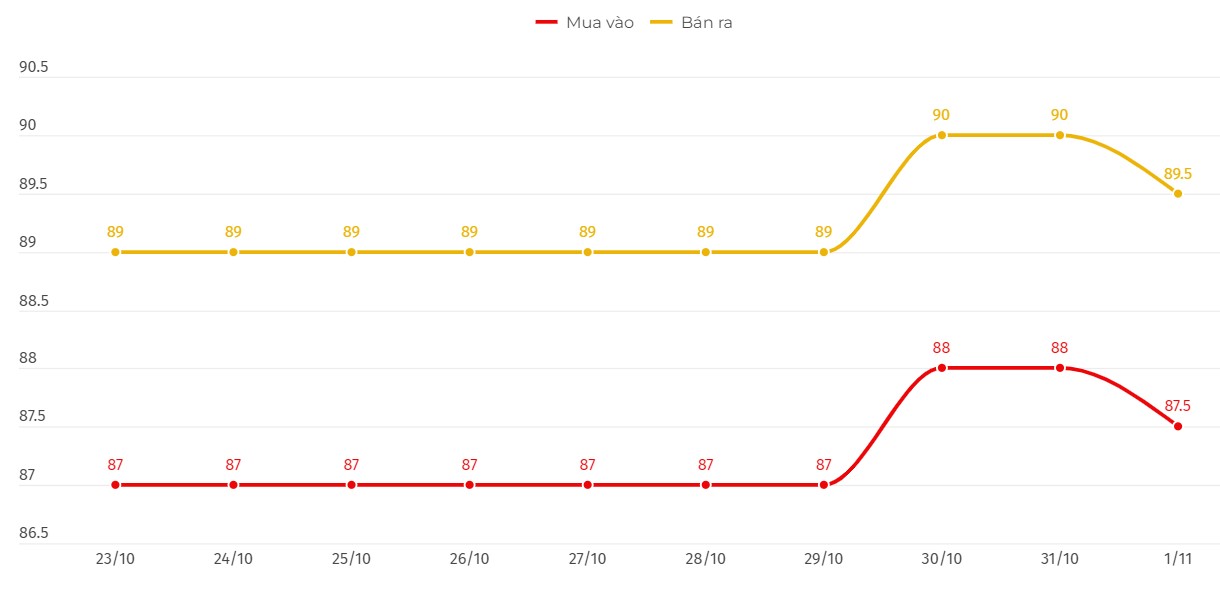

Update SJC gold price

As of 5:00 p.m., the price of SJC gold bars was listed by DOJI Group at 87.5-89.5 million VND/tael (buy - sell).

Compared to the close of the previous trading session, gold price at DOJI decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Meanwhile, Saigon Jewelry Company SJC listed the price of SJC gold at 87.5-89.5 million VND/tael (buy - sell).

Compared to the closing price of the previous trading session, the gold price at Saigon Jewelry Company SJC decreased by 500,000 VND/tael for both buying and selling.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Currently, the difference between the buying and selling price of gold is listed at around 2 million VND/tael. Experts say that this difference is very high, causing investors to face the risk of losing money when investing in the short term.

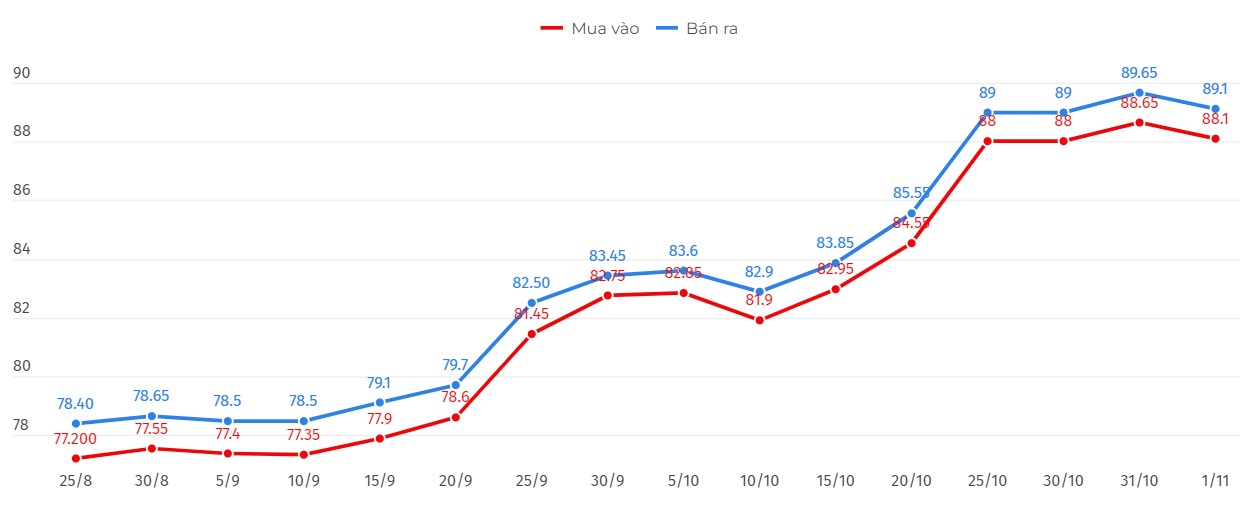

Price of round gold ring 9999

As of 5:00 p.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 88.1-89.1 million VND/tael (buy - sell); down 550,000 VND/tael in both directions compared to the close of the previous trading session.

Bao Tin Minh Chau listed the price of gold rings at 88.18-89.18 million VND/tael (buy - sell); down 450,000 VND/tael for both buying and selling compared to the close of the previous trading session.

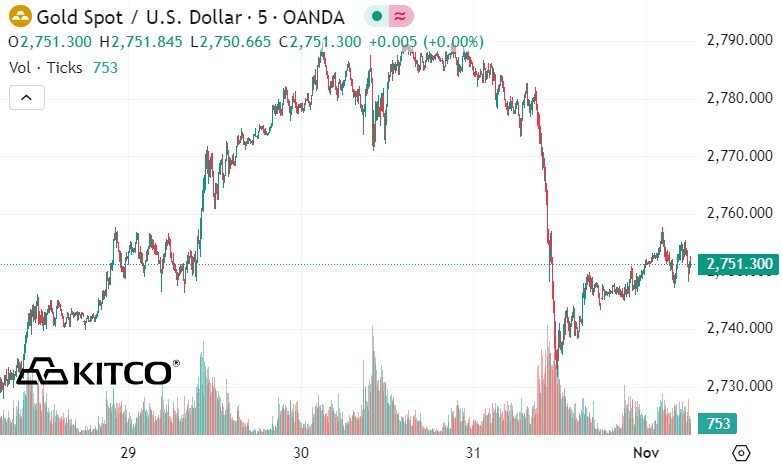

World gold price

As of 5:00 p.m., the world gold price listed on Kitco was at 2,751.3 USD/ounce, down 27.7 USD/ounce compared to the close of the previous trading session.

Gold Price Forecast

World gold prices fell sharply as the USD index increased. Recorded at 5:00 p.m. on November 1, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 104.044 points (up 0.16%).

Although gold prices are down from yesterday's close, they are showing signs of recovery. According to Edward Meir, an analyst at Marex, the "buy on dip" mentality is still dominating investors. This mentality may continue until the end of the US election, or even longer due to the unpredictable fluctuations ahead.

Gold prices plunged yesterday, but the decline may soon end as investors buy at deep price drops, according to Kitco.

In October 2024, gold prices increased thanks to money flowing to safe investment channels amid Middle East tensions and information surrounding the US presidential election.

The market is now paying attention to the US non-farm payrolls report, scheduled to be released at 7:30 p.m.today, November 1 (Vietnam time), to look for clues about the health of the world's largest economy.

Private payrolls data showed strong U.S. job gains last month. The Labor Department said Thursday that initial state unemployment claims fell to a seasonally adjusted 216,000 in the week ended Oct. 26.

Claims fell 12,000 from the previous week's estimate of 228,000.The data beat expectations, with the consensus estimate showing claims of 229,000.Traders see a 95% chance of the Federal Reserve cutting interest rates by 25 basis points next week.

With no signs of a recession and inflation falling, the economy looks pretty good, said Edward Meir.The key question now is how quickly the Fed will cut rates.Gold, a non-yielding asset, typically benefits in a low-interest-rate environment.

In other precious metals, spot silver rose 0.3% to $32.75 an ounce and platinum was little changed at $988.08 an ounce. Both precious metals were on track for weekly gains. Palladium rose 0.2% to $1,108.36 an ounce, after hitting a one-week low earlier in the session.