Update SJC gold price

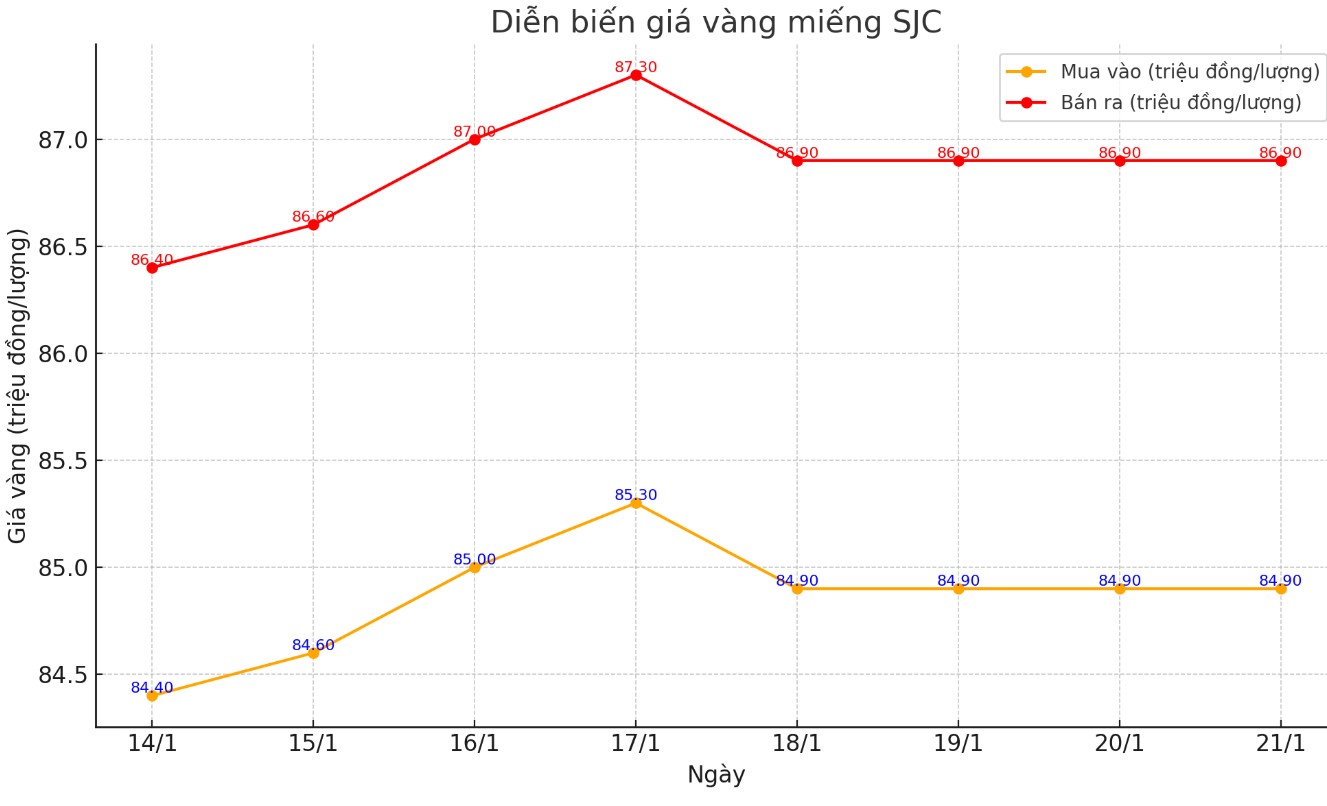

As of 6:00 a.m., the price of SJC gold bars was listed by Saigon Jewelry Company at 84.9-86.9 million VND/tael (buy - sell); both buying and selling prices remained unchanged.

The difference between buying and selling price of SJC gold at Saigon Jewelry Company is at 2 million VND/tael.

Meanwhile, DOJI Group listed the price of SJC gold at 84.9-86.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at DOJI Group is at 2 million VND/tael.

Bao Tin Minh Chau listed SJC gold price at 84.9-86.9 million VND/tael (buy - sell); keeping both buying and selling prices unchanged.

The difference between buying and selling price of SJC gold at Bao Tin Minh Chau is at 2 million VND/tael.

Price of round gold ring 9999

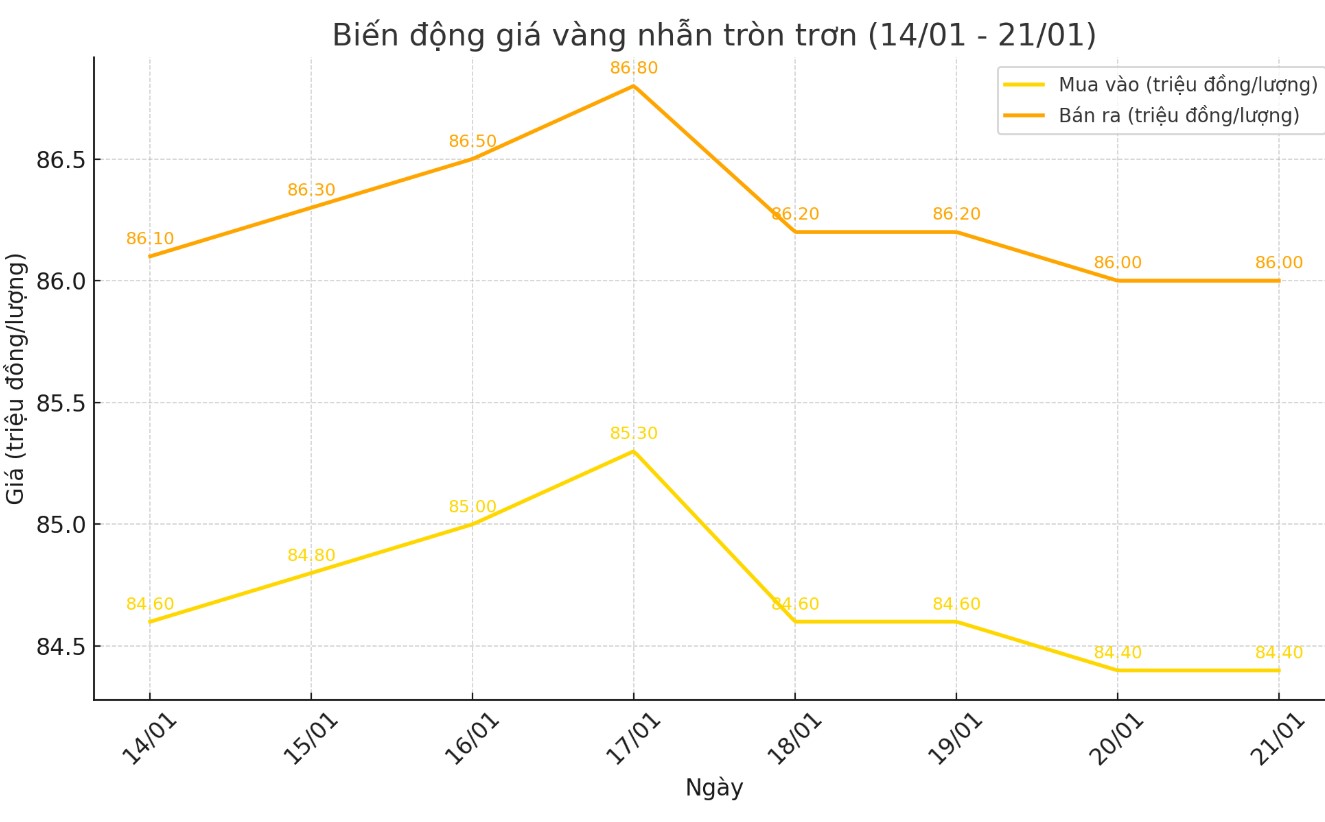

As of 6:00 a.m. today, the price of 9999 Hung Thinh Vuong round gold rings at DOJI is listed at 84-86 million VND/tael (buy - sell); down 200,000 VND/tael for both buying and selling compared to the beginning of the trading session yesterday morning.

Bao Tin Minh Chau listed the price of gold rings at 84.6-86.85 million VND/tael (buy - sell), down 300,000 VND/tael for buying and unchanged for selling compared to early this morning.

World gold price

As of 0:30 on January 21, the world gold price listed on Kitco was at 2,707.5 USD/ounce, up 4.4 USD/ounce compared to early this morning.

Gold Price Forecast

World gold prices are receiving support amid a sharp decline in the USD index. Recorded at 0:30 on January 21, the US Dollar Index, which measures the greenback's fluctuations against six major currencies, was at 108.250 points (down 0.87%).

Gold prices rebounded overnight as Donald Trump may delay imposing tariffs. According to the Wall Street Journal, Trump issued a presidential memorandum directing federal agencies to investigate trade deficits and address unfair trade and currency policies from other countries. However, the directive does not include imposing new tariffs on the first day of his presidency, which many countries have feared.

Concerns about tariffs and a global trade war have had a significant impact on the precious metals market. Last week, gold prices surged above $2,700 an ounce, while silver prices returned above $30 an ounce, reflecting the urgency in the market.

Some analysts have attributed the rise in gold and silver prices to disruptions in the global supply chain as the precious metals are moved from London to New York. Donald Trump’s tariff threats have created huge volatility in the futures and physical asset swaps market, as banks have moved large amounts of metals to the US to avoid the risk of potential tariffs.

In an interview with Kitco News, Dr. Nomi Prins - geo-economic expert, author of the book "Permanent Distortion: How Financial Markets Abandoned the Real Economy Forever" - gave an optimistic assessment of the gold trend.

Prins believes that gold prices are likely to rise sharply in 2025, with an expected peak of up to $4,000 an ounce. According to her, demand for gold from central banks around the world is one of the main factors driving the increase.

“Gold is a physical asset and is outside the control of any financial or monetary system established by humans. You cannot print or create it,” she stressed.

As the global economy faces many uncertainties, central banks have increased their gold purchases to protect assets against risks such as inflation and rising public debt.

In addition to its role as a hedge against inflation, gold is also seen as a safe haven during economic and geopolitical turmoil. Prins noted that while global inflation has shown signs of cooling, consumers are still under pressure from rising prices for essential goods such as food, housing and healthcare.

See more news related to gold prices HERE...